Copper, aluminum, and other industrial metals are all surging amid rebounding manufacturing activity and supply constraints, and the iShares MSCI Global Metals & Mining Producers ETF (BATS:PICK) is an attractive way for investors to gain exposure to all of these surging commodities. I’m bullish on PICK based on the diversified exposure it gives investors to metals and mining stocks (at a time when metals prices are surging) and its attractive 4.2% dividend yield.

What Is the PICK ETF’s Strategy?

The aptly-named PICK ETF is a $1.2 billion ETF from BlackRock’s (NYSE:BLK) iShares. According to iShares, PICK “seeks to track the investment results of an index composed of global equities of companies primarily engaged in mining, extraction or production of diversified metals, excluding gold and silver.”

PICK gives investors “exposure to companies that are involved in the extraction and production of diversified metals, aluminum, steel, and precious metals and minerals.”

The Metals Train Is Taking Off

I like gold and feel that it is worth a place in investor portfolios, but PICK essentially eschews gold, which is primarily used as a store of value and for ornamental purposes, in favor of metals used for industrial purposes. This seems like an attractive sector to gain exposure to in a world where manufacturing activity is suddenly picking up.

During the first quarter, manufacturing activity in China, the world’s largest manufacturer, increased by a healthy 6.1% from a year ago.

China’s purchasing manufacturer’s index increased for the first time in six months, and had its highest reading in over a year in March. Much of this rebound is attributed to high-tech manufacturing, with manufacturing in areas like 3D printing, electric vehicles (EVs), charging stations for electric vehicles, electronic components, solar panels, and batteries surging. This jump in manufacturing activity propelled China’s GDP to grow by 5.3% year-over-year.

And it’s not just China; the Institute for Supply Management’s manufacturing survey for March expanded for the first time since all the way back in September 2022.

This resurgent manufacturing activity is good news for the types of industrial metals that PICK gives investors exposure to, especially copper.

Copper prices have been surging in 2024, and on Friday, April 26, the commodity hit a new two-year high, breaching $10,000 per ton. Copper briefly traded for below $8,000 per ton towards the end of 2023, making this a stunning and significant comeback.

Copper is used in all kinds of end markets, including hot sectors like electric vehicles, renewable energy, and even wiring for data centers, which will benefit from the growth of AI. These areas are all poised to continue to grow, and many analysts believe there will be supply constraints as the world’s current mines won’t be able to keep up with this demand, meaning that copper prices could keep heading higher.

Analysts from Citigroup (NYSE:C) say that we could be in the early innings of a new copper bull market “driven by booming decarbonization-related demand growth” and that there could be “explosive price upside,” going forward.

Beyond copper, other industrial metals, including lead, tin, and aluminum, all hit multi-month highs in April.

PICK’s Top Holdings

PICK offers investors ample diversification within the metals and mining space. It holds 257 stocks, and its top 10 holdings make up just under half of its assets. Below, you can check out a list of PICK’s top 10 holdings using TipRanks’ holdings tool.

Not only does PICK allow investors to diversify by investing in a large number of stocks, but it also allows them to diversify by subsector. Diversified metals and mining have a weighting of 46.8% within the portfolio, followed by steel with a 35% weighting, copper at 12.3%, aluminum at 4.5%, and precious metals and minerals with a small 1.1% weighting.

Furthermore, PICK provides investors with significant geographic diversification — the fund’s highest exposure is to Australia, which has a 23% weighting. This is followed by the United States, which has a weighting of 19.5%, and the United Kingdom, accounting for 17.3%. No other market accounts for a double-digit weighting, but the fund also invests in companies from Canada, India, Japan, Brazil, and beyond.

Notably, Freeport-McMoRan (NYSE:FCX) and Rio Tinto (NYSE:RIO), both being top 10 holdings, have ‘Perfect 10’ Smart Scores. Additionally, other stocks like BHP Group (NYSE:BHP) and Glencore (OTC:GLNCF) have Outperform-rated Smart Scores.

The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating.

PICK Has an Attractive Dividend

Top holdings like BHP, Rio Tinto, and Glencore are all well-known as dividend stocks, so it’s unsurprising that PICK features an attractive 4.2% dividend yield. This is far more yield than investors can get from the S&P 500 (SPX), which currently yields an underwhelming 1.4%. This is also significantly higher than the yield offered by PICK’s top competitor, the SPDR S&P Metals & Mining ETF (NYSEARCA:XME), which yields just 0.9%.

How High Is PICK’s Expense Ratio?

PICK’s expense ratio of 0.39% is reasonable enough. It means that an individual investing $10,000 into the fund will pay $39 in fees annually. This puts PICK slightly above the most popular metals and mining ETF, XME, which charges 0.35%, but not by a significant margin.

Is PICK Stock a Buy, According to Analysts?

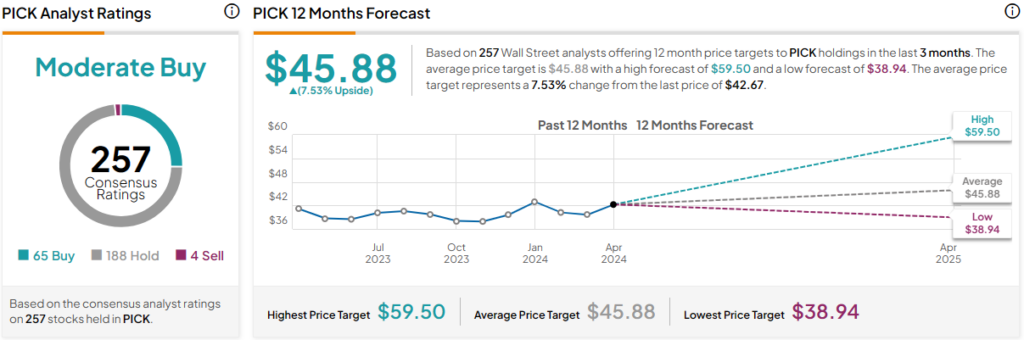

Turning to Wall Street, PICK earns a Moderate Buy consensus rating based on 65 Buys, 188 Holds, and four Sell ratings assigned in the past three months. The average PICK stock price target of $45.88 implies 7.5% upside potential.

The Takeaway

I’m bullish on PICK based on its diversified exposure to copper and other red-hot industrial metals at a time when the prices for these metals are soaring due to rebounding manufacturing activity and supply constraints. Beyond today’s pricing, I also believe PICK has a lot of long-term potential as long-term supply deficits come into play. Plus, PICK’s attractive 4.2% dividend yield is another nice benefit of owning this ETF.