Gold prices soared to record highs this year, but the stocks of gold miners are yet to catch up. For example, the price of gold is up 16.3% over the past year, while the iShares MSCI Global Gold Miners ETF (NASDAQ:RING) is slightly down over the same time period. This disconnect creates an opportunity to invest in gold mining stocks as they catch up with the physical metal itself, and RING offers investors an effective way to do so.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m bullish on this $462.0 million ETF from BlackRock’s (NYSE:BLK) iShares based on the strength of gold and the attractive setup for gold miners. I also like the fact that it allows investors to gain exposure to gold miners through a basket approach, protecting them from some of the risks that can come with investing in individual gold mining stocks. RING is also appealing because it provides some geographic diversification, pays a dividend, and charges a relatively reasonable fee.

What Is the RING ETF’s Strategy?

According to iShares, RING “seeks to track the investment results of an index composed of global equities of companies primarily engaged in the business of gold mining.” Investing in RING gives investors “exposure to companies that derive the majority of their revenues from gold mining” and “targeted access to global gold mining stocks.”

Why Gold, and Why Gold Miners?

Gold is hitting record highs and continues to look attractive for a number of reasons. U.S. national debt is at a record level of over $34.6 trillion and growing, prompting people both in the U.S. and around the globe to try to lessen their exposure to the dollar by moving into other stores of value that they perceive to be safe-haven assets, like gold and Bitcoin (BTC-USD).

For example, the South China Morning Post reports that China imported a record 1,447 tons of gold for non-monetary purposes last year, finding that everyday middle-class and retail investors were allocating money into gold as a way to “seek wealth security” and “preserve their dwindling fortunes caused by the property market crisis and slumping stock market.”

Furthermore, central banks around the world are loading up on gold. Bloomberg reported that total gold demand hit a record last year, spurred in large part by central banks moving to acquire the asset. According to the World Gold Council, the People’s Bank of China was the largest purchaser of gold in 2023, and countries including Poland, India, Singapore, and many others were net buyers of gold.

So gold looks attractive from a macro perspective, and gold mining stocks also look compelling. As mentioned above, gold mining stocks haven’t kept up with gold’s rally, meaning they could have plenty of room to run if gold prices stay steady or continue to rise. Gold miners also have leverage to rising gold prices. For example, if their breakeven cost for mining an ounce of gold is $1,500 and gold rises from $2,000 to $2,500, they double their profits while the price of gold rises 25%.

The Benefits of a Basket Approach

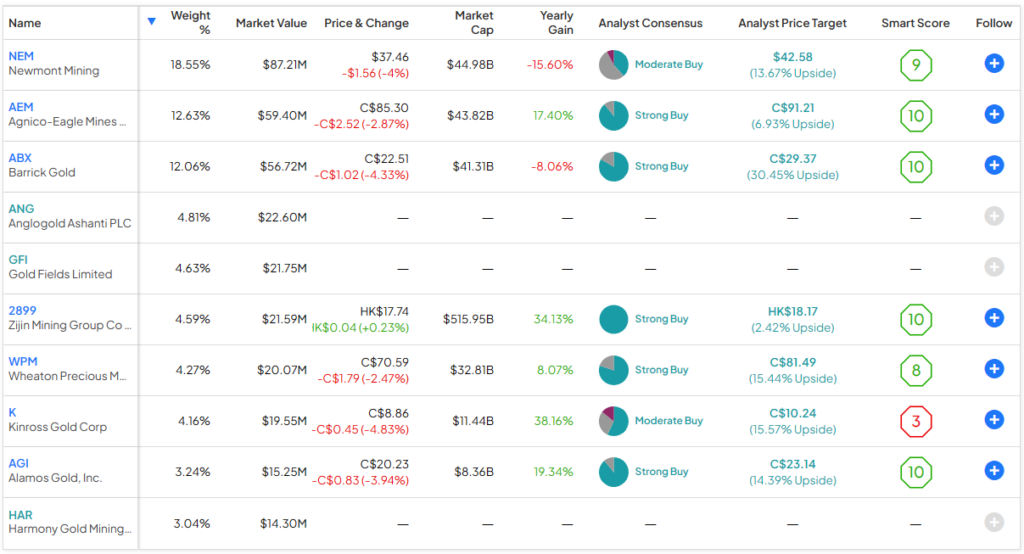

RING owns 36 stocks, and investors should be aware that its top 10 holdings account for a fairly high 72.0% of assets, making this a fairly concentrated fund. You’ll find an overview of RING’s top 10 holdings below.

Investors should note that RING comes with a lot of exposure to some of the major gold mining stocks, such as its top holding Newmont Mining (NYSE:NEM), which has a weighting of 18.6%. It also has lots of exposure to its second- and third-largest holdings, Agnico-Eagle Mines (NYSE:AEM) and Barrick Gold (NYSE:GOLD), which also feature double-digit weightings of 12.5% and 11.9%, respectively.

As a concentrated bet on gold miners, this isn’t necessarily a problem, but investors should know and understand the risk that the ETF comes with a lot of exposure to these stocks and could take a hit if one of these stocks has a significant decline.

I like investing in gold miners through an ETF like RING and taking a basket approach, as opposed to investing in individual miners, because mining for gold often comes with many operational and geopolitical risks. For example, countries where these miners operate are often dangerous or feature significant political instability. They also deal with the typical operational safety and enviornmental risks that come with the territory when running a gold mine.

Therefore, investing in an ETF like RING, which holds a group of these stocks, can be more advantageous than investing in a single gold miner stock. Owning just one stock can leave investors vulnerable if the underlying company faces operational issues or conflicts in its operating jurisdictions. By owning a basket of these stocks, you can weather the storm of this happening to a holding much better than if you own just a single stock.

RING also gives investors some geographic diversification and exposure to different markets. The fund has a 51.3% weighting towards Canada, which is by far its largest exposure. It also features a 20.0% weighting towards the United States and a 13.1% weighting towards South Africa, the only two other countries that have double-digit weightings. Additionally, the fund invests in stocks from China, Australia, the U.K., Peru, and other jurisdictions in smaller amounts.

RING’s Dividend

Another benefit of owning RING, particularly compared to holding physical gold or a physical gold ETF, is that it pays a dividend and currently yields 1.9%. While this isn’t a massive payout, it is more than investors will receive for holding physical gold or investing in a physical gold ETF.

RING’s Expense Ratio Is Reasonable

RING has an expense ratio of 0.39%. This means that RING charges $39 in fees annually on an investment of $10,000. While this isn’t necessarily a screaming bargain, it isn’t excessively expensive either. It’s worth noting that it’s lower than the average expense ratio for all ETFs (currently 0.57%), and it’s also cheaper than the expense ratio charged by the VanEck Gold Miners ETF (NYSEARCA:GDX), the largest pure-play gold miner ETF.

Is RING Stock a Buy, According to Analysts?

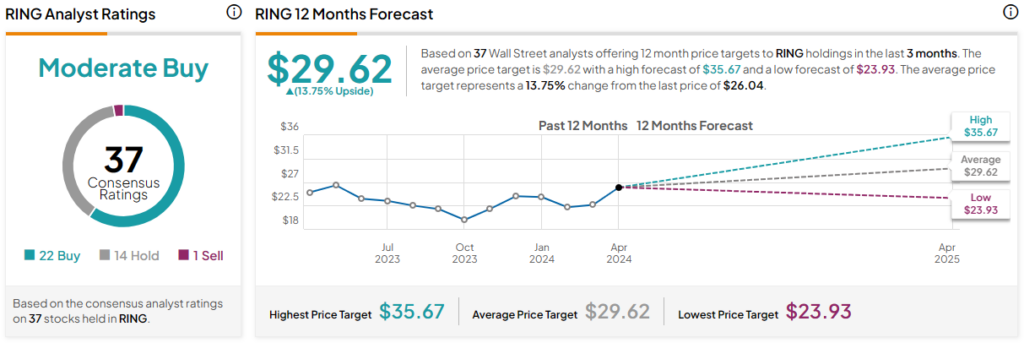

Turning to Wall Street, RING earns a Moderate Buy consensus rating based on 23 Buys, 13 Holds, and one Sell rating assigned in the past three months. The average RING stock price target of $29.62 implies 13.8% upside potential.

Looking Ahead

Gold continues to look attractive, and gold miners look even more appealing. The RING ETF is a sensible way to invest in a group of these stocks through a lower-risk basket approach.

I’m bullish on the RING ETF based on the strength of gold and the attractiveness of gold mining stocks. I also favor the lower-risk strategy of investing in the space with a basket approach by using an ETF like RING as opposed to exposing one’s self to the risks of owning one individual gold mining stock. As an added bonus, RING also pays a dividend, and it features a relatively reasonable expense ratio.