Hyundai Motor Company (HYMLF)

OTHER OTC:HYMLF

HYMLF Stock Chart & Stats

Day’s Range― - ―

52-Week Range$88.50 - $89.00

Previous CloseN/A

Volume42.00

Average Volume (3M)0.00

Market Cap

$38.45B

Enterprise Value$143.05B

Total Cash (Recent Filing)$30.29T

Total Debt (Recent Filing)$10.00T>

Price to Earnings (P/E)2.8

Beta0.00

Next Earnings

Oct 23, 2025EPS EstimateN/A

Last Dividend Ex-Date

Aug 28, 2025Dividend Yield8.86%

Share Statistics

EPS (TTM)8.22

Shares Outstanding204,757,770

10 Day Avg. Volume0

30 Day Avg. Volume0

Financial Highlights & Ratios

PEG RatioN/A

Price to Book (P/B)0.00

Price to Sales (P/S)0.00

P/FCF Ratio0.00

Enterprise Value/Market Cap3.72

Enterprise Value/Revenue<0.01

Enterprise Value/Gross Profit<0.01

Enterprise Value/Ebitda<0.01

Forecast

1Y Price TargetN/A

Price Target UpsideN/A

Rating ConsensusN/A

Number of Analyst Covering0

Hyundai Motor Company News

HYMLF FAQ

What was Hyundai Motor Company’s price range in the past 12 months?

Hyundai Motor Company lowest stock price was $88.50 and its highest was $89.00 in the past 12 months.

What is Hyundai Motor Company’s market cap?

Hyundai Motor Company’s market cap is $38.45B.

When is Hyundai Motor Company’s upcoming earnings report date?

Hyundai Motor Company’s upcoming earnings report date is Oct 23, 2025 which is in 23 days.

How were Hyundai Motor Company’s earnings last quarter?

Hyundai Motor Company released its earnings results on Jul 24, 2025. The company reported $8.225 earnings per share for the quarter, beating the consensus estimate of N/A by $8.225.

Is Hyundai Motor Company overvalued?

According to Wall Street analysts Hyundai Motor Company’s price is currently Overvalued.

Does Hyundai Motor Company pay dividends?

Hyundai Motor Company pays a Quarterly dividend of $1.774 which represents an annual dividend yield of 8.86%. See more information on Hyundai Motor Company dividends here

What is Hyundai Motor Company’s EPS estimate?

Hyundai Motor Company’s EPS estimate for its next earnings report is not yet available.

How many shares outstanding does Hyundai Motor Company have?

Hyundai Motor Company has 204,757,770 shares outstanding.

What happened to Hyundai Motor Company’s price movement after its last earnings report?

Hyundai Motor Company reported an EPS of $8.225 in its last earnings report, beating expectations of N/A. Following the earnings report the stock price went same 0%.

Which hedge fund is a major shareholder of Hyundai Motor Company?

Currently, no hedge funds are holding shares in HYMLF

Company Description

Hyundai Motor Company

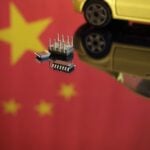

Hyundai Motor Co is engaged in the manufacturing and distribution of motor vehicles and parts. The business of the group is operated through a vehicle, finance, and other segments. Its vehicle segment is engaged in the manufacturing and sale of motor vehicles. The finance segment operates vehicle financing, credit card processing, and other financing activities. Others segment includes the research and development, train manufacturing and other activities. The company derives majority of the revenue from vehicle segment.

HYMLF Company Deck

HYMLF Earnings Call

Q2 2025

0:00 / 0:00

Earnings Call Sentiment|Neutral

The earnings call highlights several positive aspects such as record high sales of hybrid models, growth in eco-friendly vehicle sales, and revenue growth driven by favorable foreign exchange rates. However, significant challenges are apparent, particularly the decline in operating profit and net income due to U.S. tariffs and increased incentives. The company anticipates further impact from tariffs in the second half of the year, indicating ongoing challenges. Overall, while there are strong growth areas, the financial pressures from tariffs and operating profit declines weigh heavily.View all HYMLF earnings summariesTechnical Analysis

1 Day

3 Days

1 Week

1 Month

Ownership Overview

<0.01% Insiders

0.02% Other Institutional Investors

99.97% Public Companies and

Individual Investors

Options Prices

Currently, No data available

---