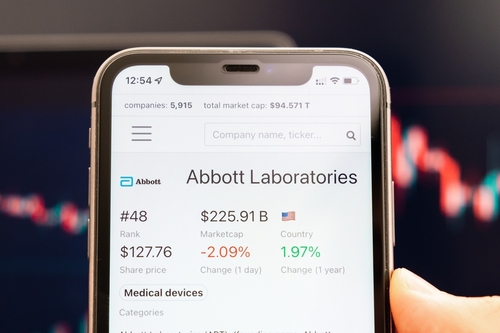

Abbott Laboratories (GB:0Q15)

LSE:0Q15

Holding GB:0Q15?

Track your performance easily

0Q15 Stock Chart & Stats

Day’s Range$0 - $0

52-Week Range$91.72 - $121.60

Previous Close$116.12

Volume45.81K

Average Volume (3M)24.04K

Market Cap

$202.04B

Enterprise Value$209.81B

Total Cash (Recent Filing)$7.22B

Total Debt (Recent Filing)$14.75B

Price to Earnings (P/E)35.3

Beta0.46

Next Earnings

Jan 22, 2025EPS Estimate

$1.34Last Dividend Ex-Date

Oct 15, 2024Dividend Yield1.85%

Share Statistics

EPS (TTM)3.29

Shares Outstanding1,739,897,004

10 Day Avg. Volume70

30 Day Avg. Volume24,037

Standard Deviation0.04

R-Squared0.01

Alpha0.03

Financial Highlights & Ratios

Price to Book (P/B)2.52

Price to Sales (P/S)5.00

Price to Cash Flow (P/CF)26.00

P/FCF Ratio33.00

Enterprise Value/Market CapN/A

Enterprise Value/Revenue5.15

Enterprise Value/Gross Profit9.48

Enterprise Value/Ebitda20.25

Forecast

1Y Price Target

$133.00Price Target Upside14.54% Upside

Rating ConsensusStrong Buy

Number of Analyst Covering21

Abbott Laboratories News

Bulls Say, Bears Say

Bulls Say

Financial PerformanceRevenue and EPS beat the Street's forecasts, with organic sales growth for the base business at 8.2% and Med Devices showing 13.3% growth.

Market PositionBroad strength across medtech, including pipeline products such as TAVR in Structural Heart, supports ABT's strong market position.

Stock BuybackAbbott Laboratories has a new $7B share repurchase authorization which may help push adjusted EPS higher.

Bears Say

Earnings OutlookThe current consensus estimates for 2025 look 'very aggressive', raising concerns about the company's ability to meet these expectations.

Financial PerformanceThe company fell short of the Street sales target for Nutrition, and international core lab performance was impacted by VBP, particularly in China.

Litigation RisksA jury in St. Louis ordered ABT to pay $495M in the company's first necrotizing-enterocolitis case, with the amount much more than Reckitt due to St Louis jurisdiction allowing for punitive damages.

---

Options Prices

Currently, No data available

---

Ownership Overview

0.47% Insiders

24.53% Mutual Funds

1.59% Other Institutional Investors

54.44% Public Companies and

Individual Investors

0Q15 FAQ

What was Abbott Laboratories’s price range in the past 12 months?

Abbott Laboratories lowest share price was $91.72 and its highest was $121.60 in the past 12 months.

What is Abbott Laboratories’s market cap?

Currently, no data Available

When is Abbott Laboratories’s upcoming earnings report date?

Abbott Laboratories’s upcoming earnings report date is Jan 22, 2025 which is in 91 days.

How were Abbott Laboratories’s earnings last quarter?

Abbott Laboratories released its earnings results on Oct 16, 2024. The company reported $1.21 earnings per share for the quarter, beating the consensus estimate of $1.202 by $0.008.

Is Abbott Laboratories overvalued?

According to Wall Street analysts Abbott Laboratories’s price is currently Undervalued.

Does Abbott Laboratories pay dividends?

Abbott Laboratories pays a Quarterly dividend of $0.55 which represents an annual dividend yield of 1.85%. See more information on Abbott Laboratories dividends here

What is Abbott Laboratories’s EPS estimate?

Abbott Laboratories’s EPS estimate is $1.34.

How many shares outstanding does Abbott Laboratories have?

Abbott Laboratories has 1,739,897,000 shares outstanding.

What happened to Abbott Laboratories’s price movement after its last earnings report?

Abbott Laboratories reported an EPS of $1.21 in its last earnings report, beating expectations of $1.202. Following the earnings report the stock price went up 1.672%.

Which hedge fund is a major shareholder of Abbott Laboratories?

Among the largest hedge funds holding Abbott Laboratories’s share is Fisher Asset Management LLC. It holds Abbott Laboratories’s shares valued at 1B.

---

Abbott Laboratories Stock Smart Score

Company Description

Abbott Laboratories

Abbott Laboratories offers a diversified line of healthcare products. It operates through four reportable segments: Established Pharmaceutical Products International (includes international sales of branded generic pharmaceutical products), Nutritional Products Diagnostic Products and Medical Devices. The company was founded by Wallace Calvin Abbott in 1888 and is headquartered in Abbott Park, IL.

---

0Q15 Company Deck

---

0Q15 Earnings Call

Q3 2024

0:00 / 0:00

---

0Q15 Net sales Breakdown

42.10% Medical Devices

24.90% Diagnostic Products

20.33% Nutritional Products

12.63% Established Pharmaceutical Products

0.03% Other

---

0Q15 Stock 12 Month Forecast

All Analysts

Top Analysts

Average Price Target

$133.00

▲(14.54% Upside)

Technical Analysis

1 Day

3 Days

1 Week

1 Month

Abbott Laboratories

―

Johnson & Johnson

―

Medtronic

―

Baxter International

―

Stryker

―

Best Analysts Covering 0Q15

1 Year

1 Year Success Rate

40/47 ratings generated profit

1 Year Average Return

+19.43%

reiterated a buy rating 10 days ago

Copying Jayson Bedford's trades and holding each position for 1 Year would result in 85.11% of your transactions generating a profit, with an average return of +19.43% per trade.

---