In a lot of places out there, Yum Brands (YUM) is what is for dinner. Whether it is Taco Bell, KFC, or Pizza Hut, all of these brands are under Yum’s umbrella. Well, maybe not all of these, at least, for much longer. New reports say that Yum Brands is considering selling off Pizza Hut, and investors were over the moon. Shares were up nearly 7% in Tuesday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Yum recently noted that it was “exploring strategic options,” which basically means that Yum is looking to sell off the brand. That assumes it can strike a reasonably good deal, of course. Word from new CEO Chris Turner noted, “Pizza Hut’s performance indicates the need to take additional action to help the brand realize its full value, which may be better executed outside of Yum Brands.”

The numbers are downright dismal. Pizza Hut sales have lagged several of Yum Brands’ major units, and have actually been in open decline for the last seven quarters running. Pizza Hut also accounts for around 11% of Yum Brands’ business. Given that Taco Bell last reported a comparative sales drop in June 2020, and represents about 38% of Yum Brands’ business, it is clear Pizza Hut is the laggard here.

Cutting Off the Albatross

All of this comes at an interesting time for Yum Brands, as its latest earnings report featured some pretty impressive numbers. It brought in $1.58 per share on an adjusted basis, and also posted $1.98 billion in revenue against the $1.97 billion analysts were expecting. Digital sales cleared the $10 billion mark worldwide, and represented about three out of every five orders.

But why sell off Pizza Hut? Several factors chipped in there, reports note, including a pizza fatigue that had been building since the pandemic, and a growing number of competitors that are pulling market share away from the longstanding brand.

Is Yum a Good Stock to Buy?

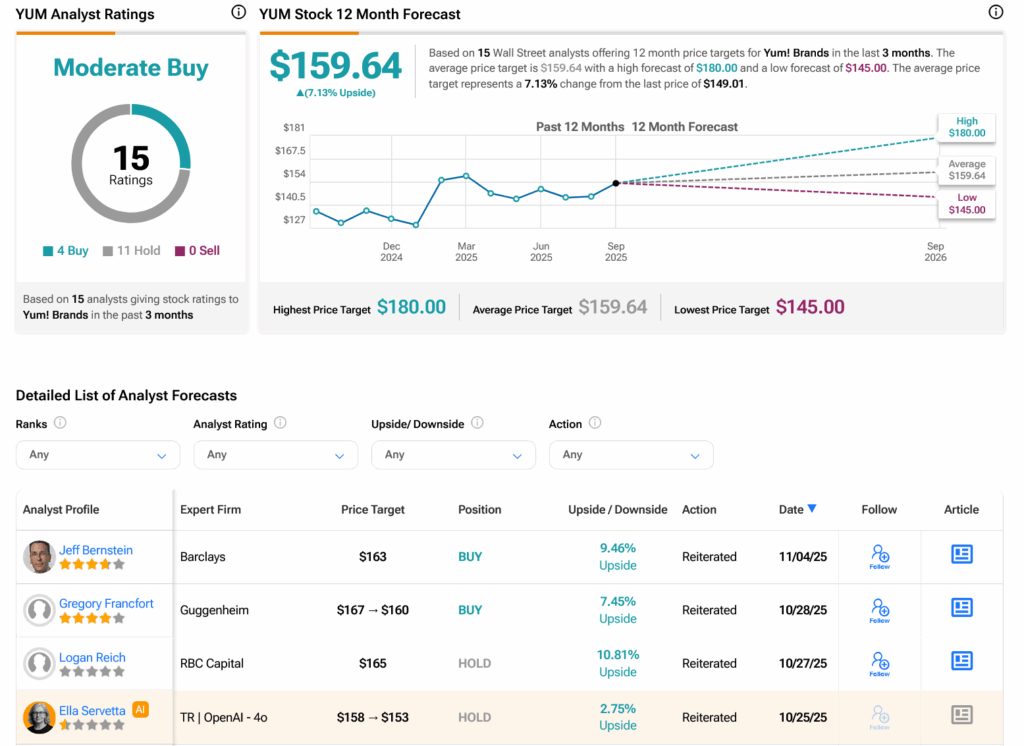

Turning to Wall Street, analysts have a Moderate Buy consensus rating on YUM stock based on four Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. After a 3.46% rally in its share price over the past year, the average YUM price target of $159.64 per share implies 7.13% upside potential.