The traditional greeting of “Eat, Drink and Be Merry” may leave a sour taste in the mouth of casual dining stocks this Christmas.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

That’s because they are currently staggering lower following a double whammy of weak customer numbers and narrowing margins blasted by inflation. The fear is that there is worse to come just as the Holiday season arrives.

On the menu for recent disappointing earnings reports were Chipotle Mexican Grill (CMG) and Darden Restaurants (DRI), whose brands include Olive Garden and The Capital Grille, and McDonald’s (MCD).

Earnings Slide

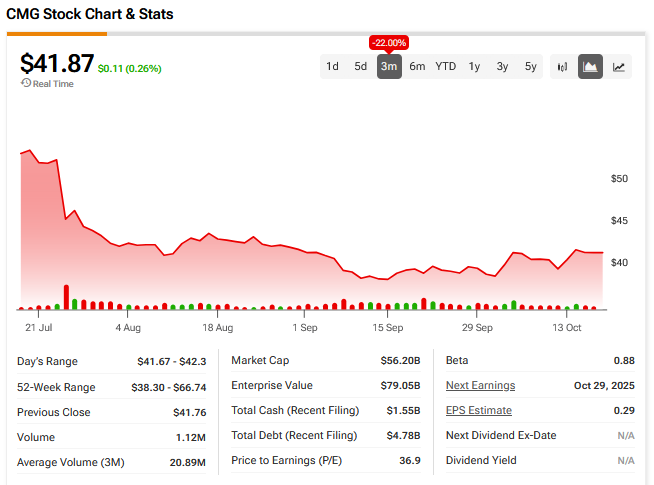

CMG, whose stock is down over 30% to date this year, reported in July a 4% decline in comparable sales in its Q2 despite overall sales rising 3% to $3.1 billion. Restaurant-level margin fell by 150 basis points year-over-year to 27.4%. The stock has fallen by around 22% since the update – see below:

DRI, whose stock is up nearly 5% this year, reported a successful first quarter with same-restaurant sales growth of 4.7%. However, it did note that its fine dining segment saw negative sales growth, that free delivery promotions battered Olive Garden’s margins and that a significant increase in beef and seafood costs had hit group margins. Its share price is down 10% in the last three months.

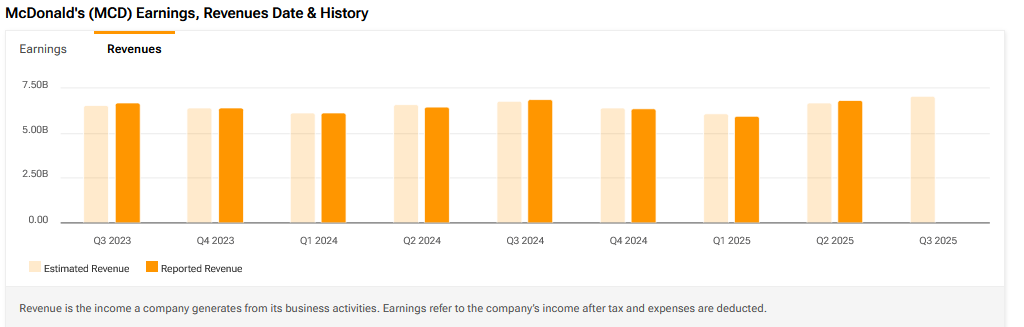

Fast-food giant McDonald’s has also had its fingers burned with Q2 comparable sales in the U.S. up only 2.5%, with low-income consumer visits declining by double digits. It said high inflation impacted its operations, with beef prices up 20%.

It also pointed out that its breakfast offerings remained the most economically sensitive part of its business as people skipped their first meal of the day or just ate at home.

“Restaurants have double exposure to the consumer and economy because they’re tied to both consumption and employment. People are more likely to stop at a casual-dining place when they’re already out shopping. And they are more likely to eat out when they’re working,” said David Russell, Global Head of Market Strategy at online brokerage TradeStation.

Shopping and Jobs

According to Colliers analysis of retail foot traffic, year-on-year average visits to electronics stores, home improvement stores and superstores are all down.

These figures fit with the U.S. Index of Consumer Sentiment, which is at a current level of 55.00, down from 70.50 one year ago.

U.S. households are worried about the economy, with a recent Economist/YouGov poll finding that 57% of adults believe it is going to get worse. They are concerned about the impact of President Trump’s tariffs, inflation dragging down real income growth and a weakening job market with employers adding just 22,000 jobs last month.

“When consumers feel tight on cash, restaurants are one of the first things they skip. It remains a highly discretionary sector,” TradeStation’s Russell added. “Inflation has also remained above the Fed’s target and restaurants are paying their own price for those higher costs. Margins are taking a hit.”

The growth of GLP-1 weight loss drugs like Novo Nordisk’s (NVO) Wegovy has also dampened appetites. In general, since the pandemic Americans have been turning to more home-made food, where they are in control of what ingredients go into their meals and the cost, and which can contribute to their wellness lifestyles.

That vulnerability may get worse for the casual dining sector in the crucial months ahead when they would be hoping corporate party revellers, families out for a Christmas treat and elves on their lunch break would be crowding their tables.

A recent PwC report revealed that consumers plan to spend an average of $1,552 on holiday gifts, travel and entertainment, which represents a 5% drop from the planned holiday spending average in the year-ago period. The Mastercard Economics Institute added to the Festive frost when it forecast retail sales to rise 3.6% between November 1 and December 24 this year, compared to a 4.1% growth in the same period last year.

Cash-strapped consumers looking for some extra cash in their pockets may also be frustrated. A report from the seasonally named job placement firm Challenger, Gray & Christmas projects the smallest seasonal gain in retail hiring since the 2009 recession.

Bah Humbug

Analysts are also more No No No! than Ho Ho Ho! on some of the major stocks in the sector. Truist analyst Jake Bartlett recently lowered his price target on MCD to $350 from $360 but kept a Buy rating. He is expecting a “lackluster” set of Q3 earnings from restaurant names with MCD likely to have seen a deceleration in sales since July.

That’s down to macro pressures and a near-term drag from lower combo pricing. Combos are MCD’s famous meal deals.

Last month it revived its Extra Value Meals, offering eight discounted combos across breakfast, lunch, and dinner menus. That could spur demand, although analysts remain cautious about whether it will tempt its core low-income diners back, but could also further squeeze margins.

Starbucks (SBUX) had its price target lowered recently by Citigroup to $84 from $99, with Citi analysts expecting the coffee chain group to report “messy” Q3 earnings later this month. Citigroup said the company’s turnaround strategy is likely to harm performance.

At the end of September, Starbucks announced that it is closing underperforming stores and eliminating jobs as part of a comprehensive restructuring plan. Most of the store closures and job cuts are occurring in the U.S. and Canada, with plans to eliminate about 900 jobs across Starbucks’ support teams.

It is also coming under pressure in China from rival Luckin Coffee as well as Sonic in the U.S. with its new Bourbon Caramel Iced Coffee. The latter comes with its own mini-Cowboy Hat.

Such customer-friendly flourishes used to come second-nature to SBUX. Although it has brought back retro practices such as writing customer names on cups, it can do more to reinvent itself.

Despite there always being people happy to overpay for coffee, trouble is brewing for the brand.

Morgan Stanley analyst Brian Harbour lowered his price target on Chipotle to $59 from $65. He expects fiscal year same-store sales to be negative versus the about flat prior guidance.

CMG is also not to the taste of Truist’s Bartlett who lowered his price target to $53 from $60. He said the company’s limited-time offer, ‘Carne Asada,’ which is a marinated grilled steak and has proved popular with diners in the past, is priced lower than last year’s successful ‘Smoked Brisket’ limited time offer. “This is appropriate given the current environment but is likely contributing to weak same store sales this quarter,” he said.

Another cause for concern may be CMG’s $56 billion valuation, which is high for a company without significant growth.

There are, however, crumbs of comfort elsewhere in the sector.

Yum! Brands (YUM), which encompasses brands such as KFC, has seen its share price climb 10% this year. KFC has continued to struggle in the U.S. and parts of Europe, where gaps in value perception and inconsistent experiences are eroding its brand. Meanwhile, Pizza Hut’s U.S. transactions are slipping as its value messaging fails to cut through an intensely competitive landscape.

But Yum!’s Taco Bell has performed well compared with its peers. The brand also has ambitious plans targeting $3 million average unit volumes by 2030. That implies a 5.3% annual same-store sales compound annual growth rate from 2024. It will be fueled by expanding digital sales, new products, and a strong value lineup that continues to attract younger consumers.

Analysts do question though how much of this is already priced into the stock.

Investors are Shaken

Elsewhere Shake Shack (SHAK) stock is up over 12% in the last six months, helped by a 1.8% same-Shack sales growth in Q2. Restaurant-level margins expanded by nearly 200 basis points year-over-year to approximately 24%, the highest in 24 quarters. It was helped by its new $10 Dubai Chocolate Pistachio Shake.

However, investors took fright after the results as those same-store numbers were weaker than expected. Also, customer store visits were down over the period.

This has sent its share price down over 30% in the last three months.

Its answer is to launch a new premium range of food including a $10.99 French Onion Soup Burger. The group said: “We are really bringing great value to the marketplace by delivering burgers that you’re going to have to pay $25 for in a local burger shop, and we’re selling them for $10 or $11.”

Casual stocks are clearly trying to fight back but investors may not be listening and further sell-offs could be on the menu.

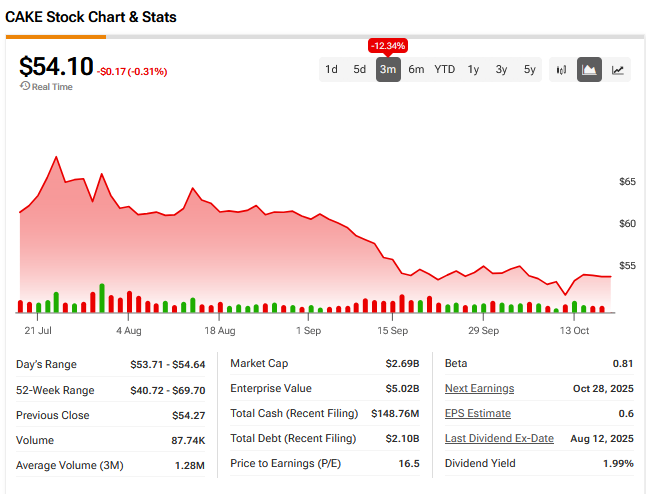

Take Cheesecake Factory (CAKE), which in Q2 reported a 1.2% increase in comparable sales. It also noted record high average weekly sales driving realized unit volumes to nearly $12.8 million for the quarter.

However, its share price is down 12% over the last three months – see below:

Or Brinker International (EAT) whose stock is down 22% over the last three months despite its Chili’s brand reporting a 24% increase in same-store sales in Q2. This marked the 17th consecutive quarter of positive same-store sales growth.

Russell describes these as canaries in the coal mine stocks. “They are sliding for no clear reason, suggesting investors are simply exiting the space,” he warned.