Yellow Corporation’s (YELLQ) bankruptcy resulted in a bidding war between other transportation providers over YELL’s network of 169 truck terminals. Recently, Old Dominion Freight Line (ODFL) offered to buy Yellow’s properties for $1.5 billion. This offer is up from Estes Express Lines’ proposal of $1.3 billion, which was announced earlier last week.

Additionally, as per the filing, ODFL has been revealed to be a stalking horse bidder. This means that ODFL has effectively set the floor price of $1.5 billion for Yellow’s assets. As a result, other potential bidders will need to submit higher offers to surpass ODFL’s bid.

It is important to note that about 100 parties are known to have formally shown interest in Yellow’s properties. Therefore, this recent development in ODFL’s bid is a key positive for Yellow, as it provides an opportunity to raise substantial funds to pay off its high debt burden.

Furthermore, Yellow has agreed to an offer from hedge funds Citadel and MFN Partners to jointly provide a $142 million bankruptcy loan. This loan will be used to support the company’s operations as it goes through the winding-down process.

Yellow’s Bankruptcy Aftermath

After operating for nearly 100 years, Yellow filed for bankruptcy protection on August 6 due to challenges with its unionized workers, substantial debt levels, and reduced volumes. It’s worth noting that the company was delisted from NASDAQ on August 17 but continues to trade over the counter under the ticker “YELLQ.”

After the bankruptcy filing, several insiders appeared to have lost confidence in the company’s future and decided to exit their positions. As per the TipRanks Insider Trading tool, before the stock was delisted, a number of corporate insiders, including CEO Darren Hawkins, President, and COO Harris Darrel, along with other Directors and top executives, sold their YELL stock holdings.

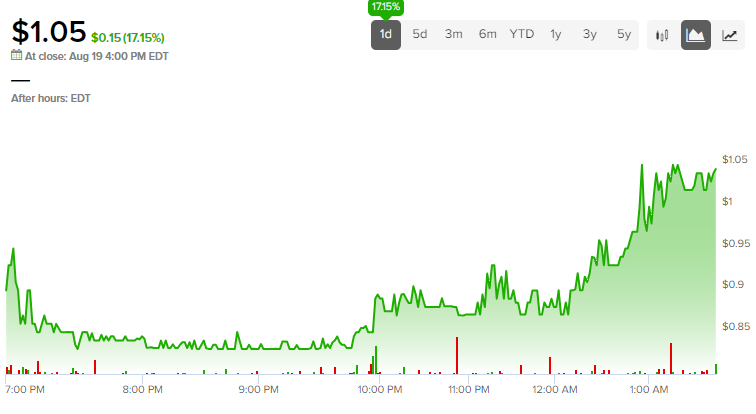

Despite this, the buzz generated by social media reports is providing support for the meme stock. YELLQ stock surged over 17% during Friday’s trading session.