XRP (XRP-USD), Dogecoin (DOGE-USD) and other major tokens climbed this week even as U.S. political gridlock and Japan’s bond market turbulence unsettled traditional markets. Traders say the macro uncertainty may actually create a friendlier backdrop for digital assets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

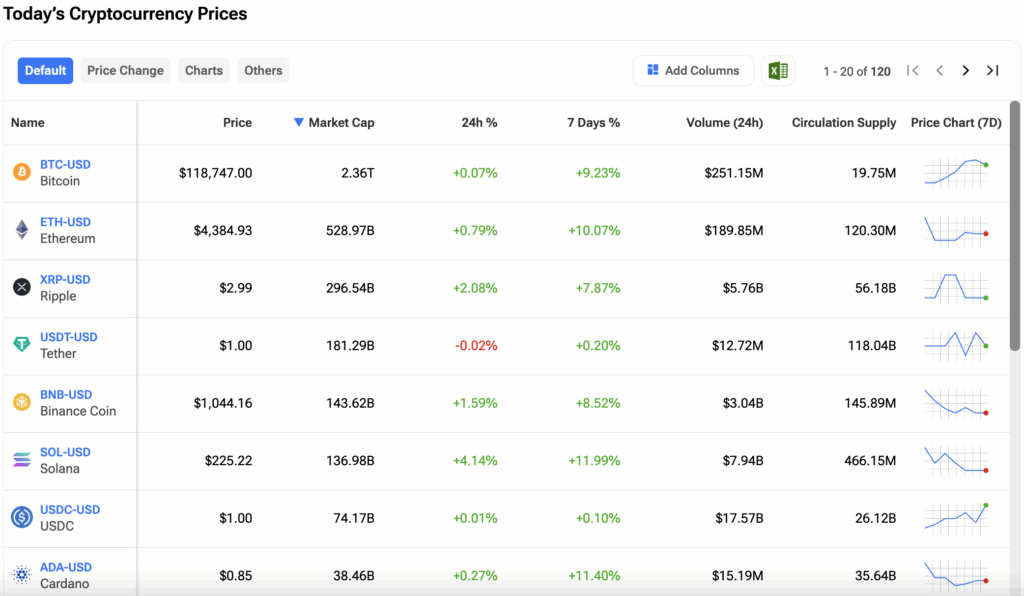

Bitcoin held firm near $118,700, rising over 3% in the past 24 hours. Ether jumped 5.6% to $4,374, while Solana added 7% to $223. Dogecoin outperformed with a nearly 9% surge to $0.25. XRP steadied at $2.97, extending a volatile week around the $3.00 level. The rally lifted total crypto market capitalization above $2.37 trillion.

U.S. Shutdown Creates Case for Liquidity

The latest U.S. government shutdown has raised concerns over delayed economic data and Fiscal visibility. For risk assets, however, the disruption may have an upside.

“The U.S. government shutdown and weak employment numbers from ADP have impacted markets this past week. Traders believe these catalysts could be making a case for the Fed to further stimulate the economy and cut rates through the rest of the year, which could boost stocks and cryptocurrencies,” said Jeff Mei, COO at BTSE.

Shutdowns that slow reporting often force policymakers into a cautious stance. For investors, that means higher odds of rate cuts and easier liquidity conditions, a scenario that historically benefits Bitcoin and its peers.

Japan Bond Turbulence Adds to the Mix

Japan’s government bond yields climbed to their highest levels since 2008, signaling that the Bank of Japan may be preparing to shift its ultra-loose policy. Rising yields in Tokyo ripple into global funding markets, tightening liquidity in some areas while prompting speculation of counter-easing elsewhere.

For crypto traders, the result has been a surge in speculation that institutions may rotate back into digital assets as macro hedges. Combined with U.S. political uncertainty, the Japanese backdrop is viewed as another reason to expect volatility, and potentially new inflows.

Volatility Metrics Point to Steadier Market

Despite macro stress, implied volatility across equities, rates, FX and Bitcoin has declined. Analysts attribute this to more accommodative central bank stances and easing geopolitical frictions.

“The major theme this quarter is with lower implied volatilities, evident across equities, rates, FX, and even BTC,” said Augustine Fan, Head of Insights at SignalPlus. “This has been driven by a collapse in realized volatilities thanks to an accommodative Fed, stabilizing global GDP, lack of significant tariff passthroughs on CPI readings, and a flattening of geopolitics and tariff surprises.”

This mix has allowed Bitcoin to consolidate just under $119,000 while altcoins like DOGE and XRP push higher.

The coming weeks may test whether the latest burst of inflows can sustain momentum. A continued U.S. shutdown or sharper moves in Japanese yields could either reinforce crypto’s decoupling or reintroduce macro pressure.

Investors should stay informed by tracking the prices of their favorite cryptos on the TipRanks Cryptocurrency Center.