XRP (XRP-USD) is entering October with momentum after establishing a solid base near $2.80. Analysts at Alpha Crypto Signal said that “this compression is setting up for a decisive move,” pointing to a breakout pattern that could define the token’s trajectory for the rest of the year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

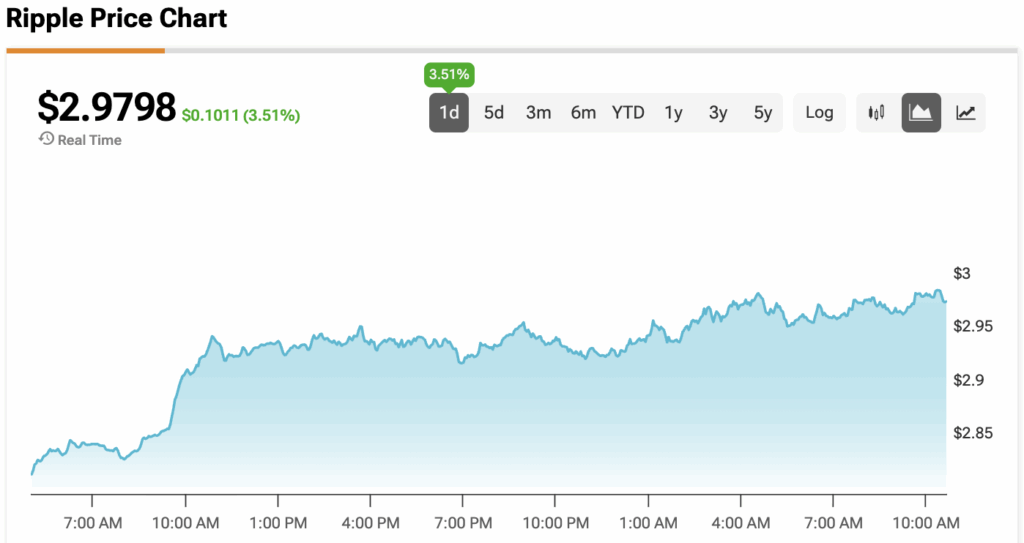

In the last 24 hours, XRP climbed 5% to $2.98. That rebound is 11% higher than its late-September low at $2.69. Traders are now looking at October as the stage for a bigger move, with technical signals and regulatory catalysts converging at once.

Analysts Highlight Critical Support

XRP’s record quarterly close landed just above a key support zone between $2.75 and $2.80. According to Cointelegraph, roughly 4.3 billion XRP were acquired in this price range, showcasing its importance.

“XRP is currently trading within a descending triangle pattern as buyers continue to defend the $2.8 support zone,” Alpha Crypto Signal noted. Clearing resistance at $3 could confirm a bullish breakout, setting the stage for moves toward $3.40, $3.66, and potentially $4.20.

SEC Deadlines Create October Tailwinds

The biggest external catalyst comes from the U.S. Securities and Exchange Commission. The agency is set to rule on six spot XRP ETF applications between Oct. 18 and Oct. 25. Grayscale’s filing leads the lineup, with 21Shares, Bitwise, and WisdomTree (WT) also waiting for decisions.

Approval could unlock billions in institutional inflows, echoing what happened when Bitcoin and Ethereum ETFs went live. Even a partial green light would boost sentiment, improve liquidity, and give XRP a stamp of regulatory legitimacy that traders say could drive the next leg higher.

Whale Accumulation Supports the Case

Beyond charts and regulations, whale wallets continue to quietly accumulate. Santiment data shows that large holders have steadily added to their positions over the last two weeks, buying into dips and defending support zones.

This pattern of accumulation often precedes strong upside moves. Analysts note that whales add confidence to technical setups by absorbing supply during corrections, reducing downside risk for smaller traders. Combined with ETF speculation, this buying activity strengthens the argument that October may not just test $3.50, but could also prepare the market for levels closer to $4 and beyond.

October Could Define XRP’s Next Chapter

The mix of technical compression, ETF rulings, and steady whale support makes October a defining month for XRP. A decisive breakout above $3 would confirm bullish momentum, while ETF approvals could accelerate inflows.

Analysts warn that rejection at $3 could keep XRP consolidating longer. But for now, the weight of on-chain evidence and regulatory anticipation suggests October could deliver the most bullish backdrop XRP has seen all year.

At the time of writing, XRP is sitting at $2.9798.