XPeng (XPEV) has released the pricing details for its global offering that would see its stock double-listed in Hong Kong, as well as in the U.S.

It has priced the offering at HK$165 per share and expects to raise more than HK$14 billion in gross proceeds before deducting offering costs and underwriting fees. But it could raise more than that as it could issue an additional 12.75 million shares to cover over-allotment. The underwriters have until July 30 to use the over-allotment allocation.

The Chinese electric vehicle company plans to use the money from the offering on a variety of programs. It outlined expanding its product portfolio, upgrading manufacturing facilities and increasing capacity, and speeding up business expansion through enhanced brand recognition and bigger sales touchpoints. It could also use the offering proceeds for working capital.

XPeng’s Hong Kong-listed shares are expected to begin trading on July 7. The offering will be based on the ratio of one NYSE-listed XPeng share being equivalent to two Hong Kong-listed shares. (See XPeng stock chart on TipRanks).

Citigroup analyst Jeff Chung recently reiterated a Buy rating on XPeng stock and raised the price target to $50.30 from $50. Chung’s new price target suggests 13.24% upside potential. The analyst cited XPeng’s terminal value as being greater than that of NIO in maintaining his bullish view.

“Terminal value suggests XP > NIO: We estimate the terminal value on XPeng with the following conclusion – Ultimate XPeng market cap is equivalent to US$32.2bn vehicle market cap + US$43bn software earnings market cap (total at US$75.3bn, 87% higher than market cap calculated based on our P/S driven TP),” commented Chung.

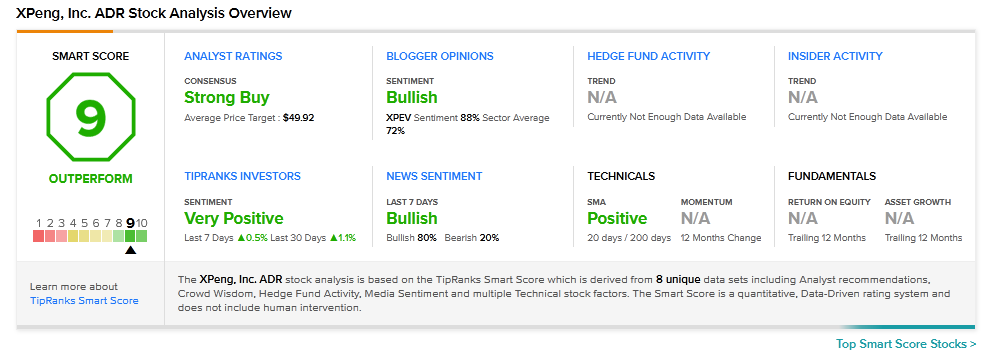

Consensus among analysts is a Strong Buy based on 5 Buys. The average XPeng price target of $49.92 implies 12.38% upside potential to current levels.

XPEV scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

ExxonMobil Selling Santoprene Business for $1.15B

Micron Reports Strong Q3 Earnings, Sells Utah Factory

Bed Bath & Beyond Reports Better-Than-Expected Revenue, Misses Earnings; Shares Soar 11%