XPeng’s (NYSE:XPEV) Vice Chairman and Co-President, Brian Gu, stated at the Beijing Auto Show that he does not expect autonomous taxis to be a significant business for at least the next five years. Gu added that he believes full-scale commercial operations of robotaxis are more than five years away and, as such, it is not part of their current sales planning.

Currently, the Chinese EV major is focusing on expanding its XNGP, an Advanced Driver Assistance System (ADAS) implemented nationwide. In March, XNGP achieved a monthly active user penetration rate of 82%.

Meanwhile, other Chinese companies such as Baidu (NASDAQ:BIDU) and Pony.ai have obtained permission from Chinese authorities to charge for driverless taxi services in approved areas, such as suburbs in Beijing and parts of Wuhan.

Musk’s Dreams of a TSLA Robotaxi

Gu’s comments come against the backdrop of Tesla’s (NASDAQ:TSLA) much-discussed robotaxi initiative. During TSLA’s Q1 earnings call, CEO Elon Musk revealed that the company’s robotaxi service will be named CyberCab. Musk also outlined a future vision where Tesla’s autonomous vehicles form a driverless network, accessible through the Tesla app for hailing rides. Additionally, Musk suggested that Tesla should be valued as an AI company, emphasizing its plans to transform existing vehicles into autonomous ones.

Tesla reported dismal Q1 results, with sales declining by 8.5% year-over-year to $21.31 billion, missing analysts’ expectations of $22.23 billion. Even more concerning, Tesla reported a negative free cash flow of $2.53 billion, compared to $441 million in the same period last year. Negative free cash flow is worrying because it indicates that a company has insufficient cash remaining after covering operating expenses, capital needs, and non-cash expenses.

Is XPEV Stock a Good Buy?

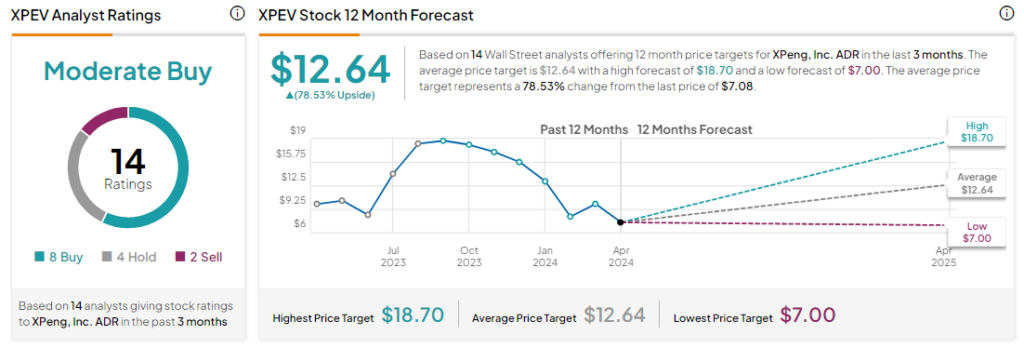

Analysts remain cautiously optimistic about XPEV stock, with a Moderate Buy consensus rating based on eight Buys, four Holds, and two Sells. Year-to-date, XPEV has declined by more than 45%, and the average XPEV price target of $12.64 implies an upside potential of 78.5% from current levels.