Electric vehicle stock XPeng (NASDAQ:XPEV) made a big step forward recently by opening up an entirely new and somewhat unlikely market for its line of electric cars: Israel. In fact, XPeng recently shipped 750 vehicles for the Israeli market out of Guangzhou, and investors offered restrained cheers, sending XPeng up a little over 1% in Wednesday morning’s trading session.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

XPeng teamed up with local firm Freesbe in order to build up stock ahead of a new launch. The firm will have the XPENG P7 and the XPENG G9 in place for Israeli drivers to choose from, and the models in question were even modified for the Israeli market. Now, XPeng looks to set up a network of infrastructure—particularly sales and service—at several major locations throughout the country. Haifa, Jerusalem, and Tel Aviv are all slated to get XPeng sales and service operations.

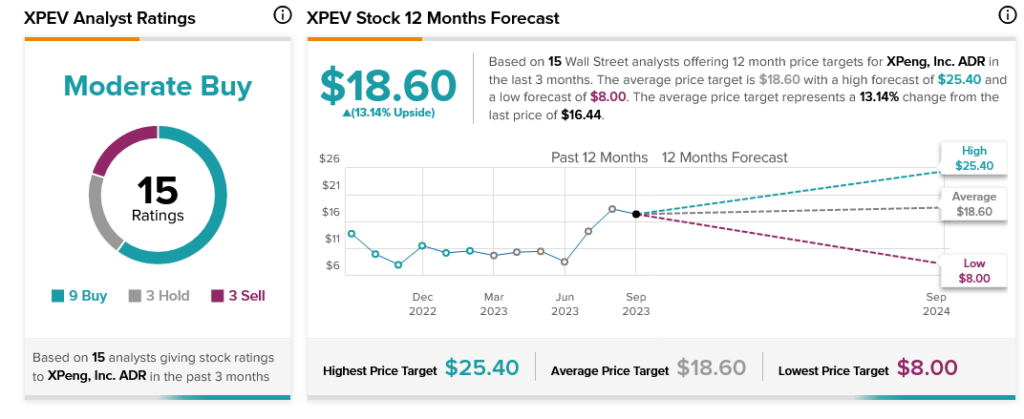

While some might question the impact of selling into a country with a smaller population than Belgium, as opposed to advancing its plans to break into the European market or making a play for North America, there’s reason enough for XPeng to target Israel. XPeng stock needs all the help it can get right now; it has one of the widest price target gaps among analysts there is. The shares could, over the next 12 months, shoot up to $196 in Hong Kong money or plummet to $18 in the same currency. And while XPeng faces its share of political challenges, branching out helps ensure it will ultimately survive.

Is It Good To Invest in XPeng?

Overall, XPeng stock is considered a Moderate Buy, supported by nine Buy ratings, three Holds, and three Sells. Further, with an average price target of $18.60 per share, XPeng stock offers investors 13.14% upside potential.