Hope springs eternal in the human breast, and it’s no different in the Chinese stock market. Especially so today for electric vehicle stocks. Three of the biggest names in Chinese electric vehicles, XPeng (NASDAQ:XPEV), Li Auto (NASDAQ:LI), and Nio (NASDAQ:NIO), gained at least somewhat in Friday afternoon’s trading on the hope that U.S.-China relations would start to normalize again, and fairly soon, too.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

If that sounds like a long shot, well, you’re not alone. But it wasn’t so long ago that the U.S. and China kicked off both an economic and a financial working group led by U.S. Treasury Secretary Janet Yellen and Vice Premier He Lifeng of China. The working groups in question are designed to help spur communications between the pair, currently the world’s two largest economies. With such groups in place, it’s possible that the two can patch things up and get everyone involved back to work.

Yet, that wasn’t the only thing that gave the Chinese EV sector a shot in the collective arm. Europe’s fascination with the electric car continues in earnest, with market share now clearing the 20% mark in August. This is the first time it’s reached that high, and it’s actually the second time that it’s been stronger than diesel-fueled cars’ market share.

Are Chinese Electric Vehicle Stocks a Good Buy Right Now?

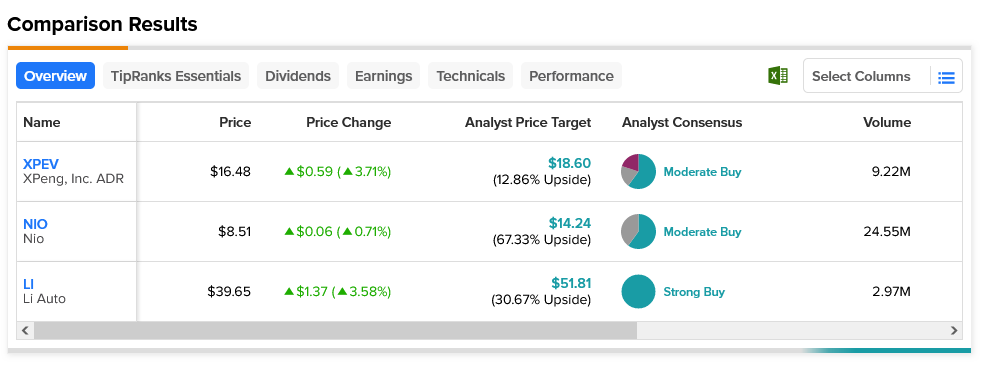

Among the Chinese big three, Nio, a Moderate Buy, offers the best upside potential at 67.33% on its average price target of $14.24. Meanwhile, the second-strongest upside potential goes to the only Strong Buy on the list – Li Auto, which offers 30.67% upside potential on its average price target of $51.81.