As America’s oil majors prepare to release their third-quarter 2025 results later this month or in early November, top investment bank Barclays (BCS) has cut its price targets for their stocks, wary of their market performance during the period.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The downgrades come as crude oil producers have turned to cost-saving measures such as job cuts to stay above board as the price of oil struggles to rise above $70 a barrel.

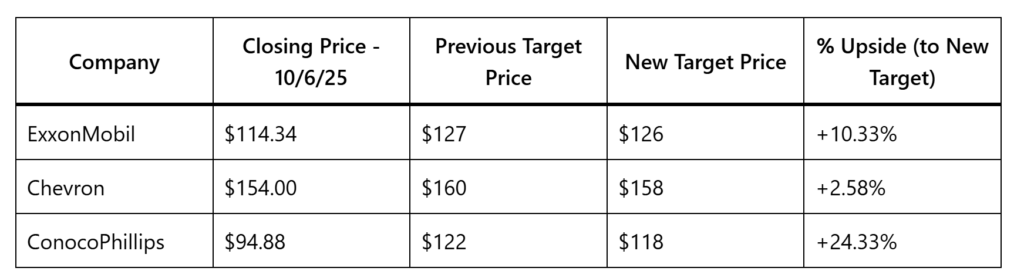

On Monday, Barclays analyst Betty Jiang, after previewing the incoming Q3 reports of various companies in the sector, trimmed her price targets for ExxonMobil (XOM), Chevron (CVX), and ConocoPhillips (COP), as the table below shows. Despite her sullen outlook, the new prices represent an upside for each stock, when compared to their closing prices at the end of regular trading on Monday.

Chevron, which suffered a fire explosion at its Los Angeles refinery last week, holds the lowest upswing possibility. XOM, CVX, and COP shares all rose marginally on Tuesday, as of 7:41 a.m. EDT.

How Did the Oil Majors Perform in Q3?

According to Jiang, ExxonMobil will report lower earnings from its upstream activities–which includes exploration and production of crude oil and natural gas–for the third-quarter. However, better-than-expected revenue from the Texas-based firm’s refining and chemical segments are expected to help cushion this weaker earnings.

For Chevron and ConocoPhillips, Jiang said her price cuts were to reflect each oil producer’s current market value and conditions, in addition to her team’s outlook from its early glimpse into the third-quarter results of companies in the sector.

However, the Barclays analyst maintains her Equal Weight and Overweight ratings for Chevron and ConocoPhillips, respectively, while also sticking with Overweight for ExxonMobil.

What Oil Stocks Are the Best to Invest in?

During Q2 2025, ExxonMobil hit its highest second quarter production since the merger of Exxon and Mobil over 25 years ago. Chevron also saw a quarterly production record both in the U.S. and globally. Similarly, ConocoPhillips also produced 2,391,000 barrels of oil equivalent per day in the quarter, surpassing the high end of its production guidance.

Despite the stock upsides and record productions, oil producers remain exposed to volatile oil supply chain–ConocoPhillips called the oil market “choppy” during its Q2 results reveal–even as the continued push for a shift to renewable energy and general economic uncertainty have together dampened the demand for fossil fuel.

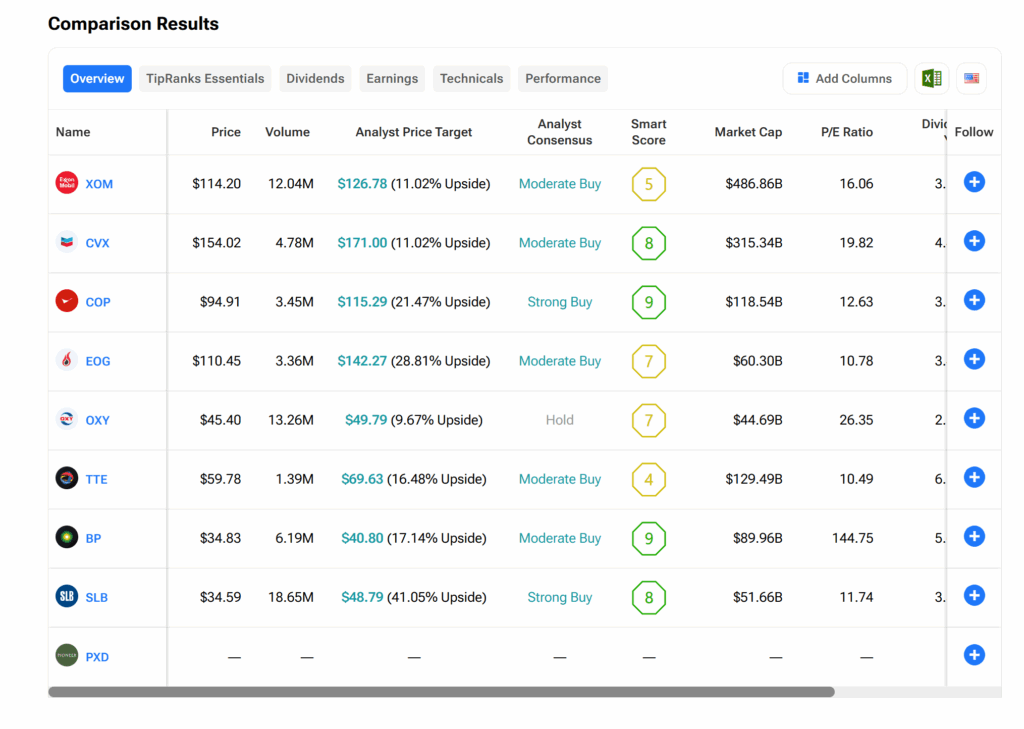

The TipRanks Stock Comparison tool provides insight into which oil stocks are still worth buying at this moment. Kindly refer to the graphics below.

Read more about these oil stocks here.