Normally, large-scale job cutting is a good reason for a stock to climb. For copier titan Xerox (NASDAQ:XRX), however, it proved just the opposite. Xerox stock is down nearly 10% in Wednesday morning’s trading, which is only slightly less than the percentage of its workforce it plans to fire in the new year.

Xerox plans to make its cuts quickly, with the pink slips set to go out during this quarter. It plans to drop around 3,000 out of the 20,500 employees it currently has, or 15% of its workforce. The cuts are intended to shift Xerox to a new business model and organizational structure, which will hopefully make Xerox leaner, meaner, and more profitable. The current plan calls for Xerox to dial back its work in printing and instead focus on digital services and other information technology operations.

The Cyberattacks Probably Didn’t Help

This news comes hot on the heels of what is likely to be another major expense for Xerox that could also reflect poorly on its plans to go all-in on IT and digital services: a cyberattack. More specifically, a ransomware assault from a group known as INC. What INC got from Xerox isn’t immediately clear, but reports suggest that some users’ personal information may have been stolen in the attack.

Though it wasn’t Xerox proper that was hit—it was actually a subsidiary known as XBS—the news is likely still sufficient to cast doubt on Xerox’s ability to manage documents safely when its own subsidiaries are being directly hit by ransomware gangs.

Is Xerox a Buy?

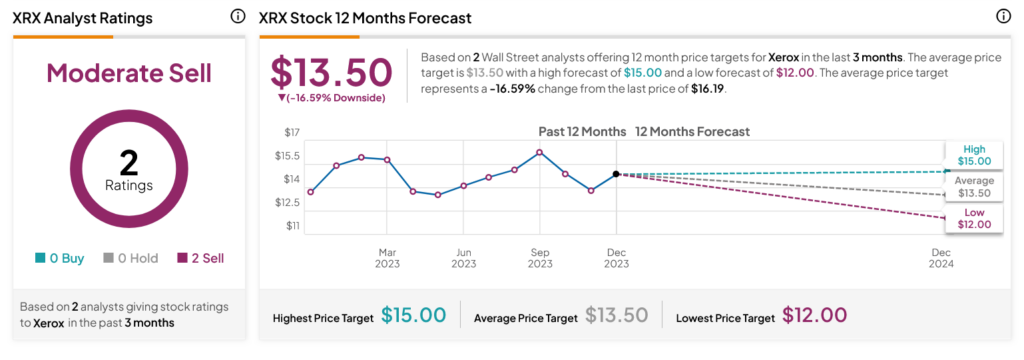

Turning to Wall Street, analysts have a Moderate Sell consensus rating on XRX stock based on two Sells assigned in the past three months, as indicated by the graphic below. After a 12.26% rally in its share price over the past year, the average XRX price target of $13.50 per share implies 16.59% downside risk.