Shares of semiconductor maker Wolfspeed (WOLF) are down nearly 30% after analysts across Wall Street either downgraded or abandoned the troubled stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

WOLF stock was down 27% in afternoon trading on May 9 following lackluster financial results that led analysts to cut their ratings or discontinue coverage entirely. William Blair analyst Jed Dorsheimer, who has a top five-star rating on TipRanks, suspended coverage of Wolfspeed, withdrawing his previous Hold-equivalent market perform tag.

Atif Malik, another top analyst who works at Citigroup (C), cut his target price on WOLF stock to $3 from $7 previously, and downgraded the shares to Sell. JPMorgan Chase (JPM) analysts Samik Chatterjee and Joseph Cardoso downgraded the stock to a Sell-equivalent underweight rating without putting a price target on the shares.

Debt Issue

While Wolfspeed’s latest financial results were in line with Wall Street’s expectations, the analysts say they remain concerned about the company’s debt. Wolfspeed is laboring under $6.58 billion in debt and has only about $1.40 billion of cash on hand. Management has said that Wolfspeed has a $575 million payment due to creditors next year.

Wolfspeed was promised $750 million in funding under former U.S. President Joe Biden’s Chips Act. However, it’s not clear whether the company will receive that money now that President Donald Trump is back in the White House. Wolfspeed is cutting its management team by 30%, but it’s not clear how much that will help with the debt issue.

WOLF stock has fallen 51% this year.

Is WOLF Stock a Buy?

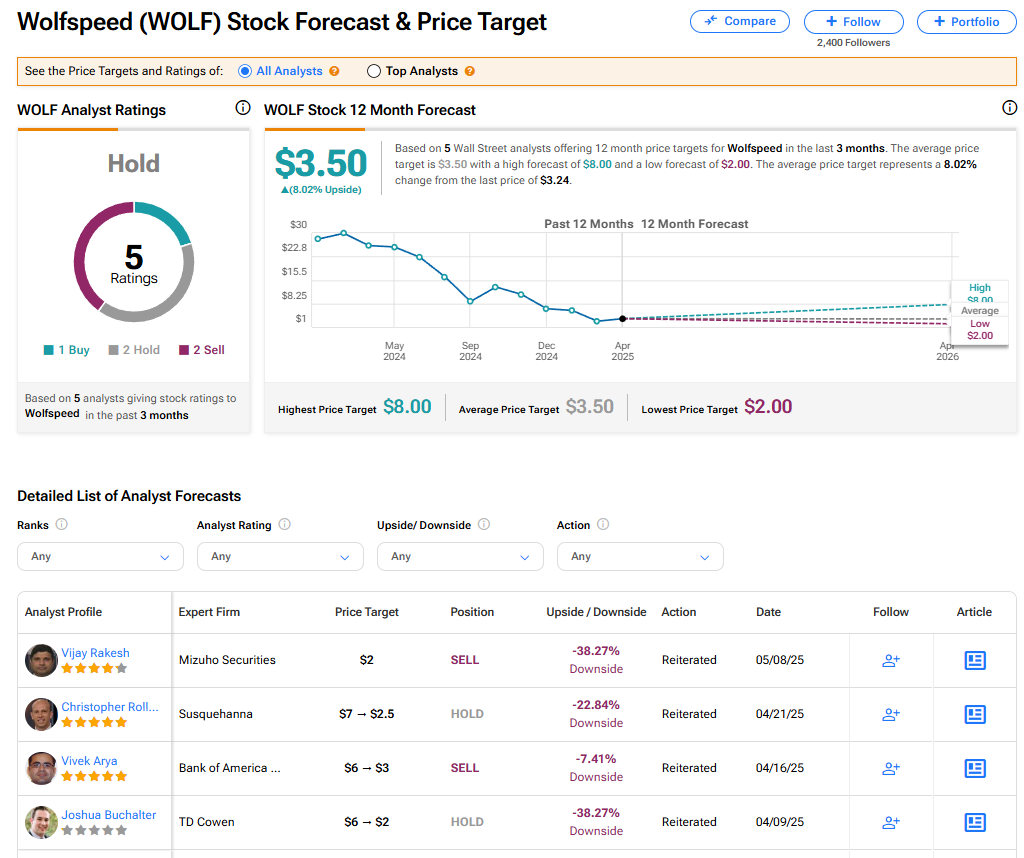

The stock of Wolfspeed has a consensus Hold rating among five Wall Street analysts. Those ratings are based on one Buy, two Hold, and two Sell recommendations issued in the last three months. The average WOLF price target of $3.50 implies 8% upside from current levels. These ratings are changing after the company’s financial results.