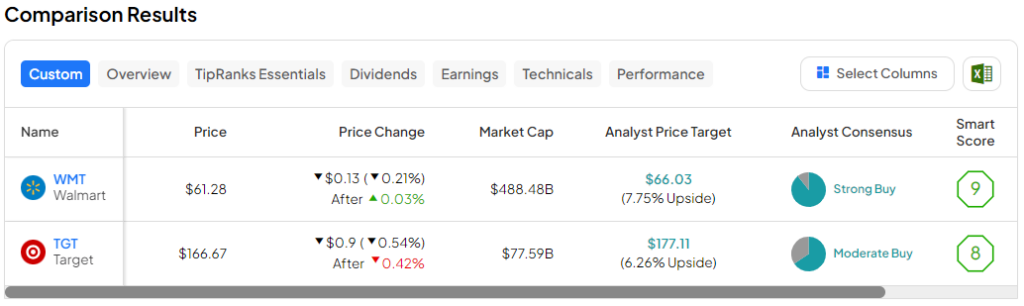

In this piece, I evaluated two big-box retailer stocks, Walmart (NYSE:WMT) and Target (NYSE:TGT), using TipRanks’ comparison tool to see which is better. A closer look suggests a neutral view for Walmart and a bullish view for Target.

Walmart owns both retail stores under the Walmart brand and wholesale stores under the Sam’s Club name. It offers a wide array of items at everyday low prices at its brick-and-mortar stores and online. Target is a competitor and offers a similar range of curated items at its brick-and-mortar Target stores and online.

Shares of Walmart are up 16.6% year-to-date and up 35% over the last year, while Target stock has gained 18% year-to-date but is up only 8.8% over the last year.

With Walmart rising so much more than Target over the last year, it’s no surprise that Walmart is trading at a much higher valuation. Since both retailers are profitable, we’ll use their price-to-earnings (P/E) ratios to gauge their valuations against each other and against that of their industry.

For comparison, the big-box segment of the retail industry is trading at a P/E of 34.3, in line with its three-year average.

Walmart (NYSE:WMT)

At a P/E of 31.7, Walmart is trading just below the current valuation of big-box retailers as a whole but in line with its mean P/E over the last five years. The stock has actually soared to new record highs, so it comes as little surprise that insiders have been dumping their shares. Thus, a neutral view seems appropriate, pending a more attractive valuation.

First, the fact that Walmart is trading in line with its five-year mean P/E suggests further upside might be limited in the near term. In fact, insiders have unloaded $6.3 billion worth of Walmart shares in Informative Sell transactions over the last three months.

Additionally, that doesn’t count all the Auto Sell transactions that have occurred over that timeframe. Auto Sell parameters are established in insiders’ preset trading plans and may include prices at which to automatically sell shares.

With Walmart stock soaring to record highs on robust sales numbers, it makes sense that insiders would be selling into that strength. The big-box retailer’s overall sales rose 5.7% year-over-year in the last quarter, including a 23% increase in Global Online sales, a 17.6% increase in International net sales, and a 33% increase in Global Ad sales.

Finally, Walmart does pay a dividend yield of 1.25% with a payout ratio of 34.16% of its net income. It’s nothing to write home about, but if or when the shares pull back, it could make the stock worth holding onto, especially considering its long-term gains.

Walmart stock is up 43% over the last three years, 100% over the last five, and 200% over the last decade. Thus, investors may want to monitor for a better entry price.

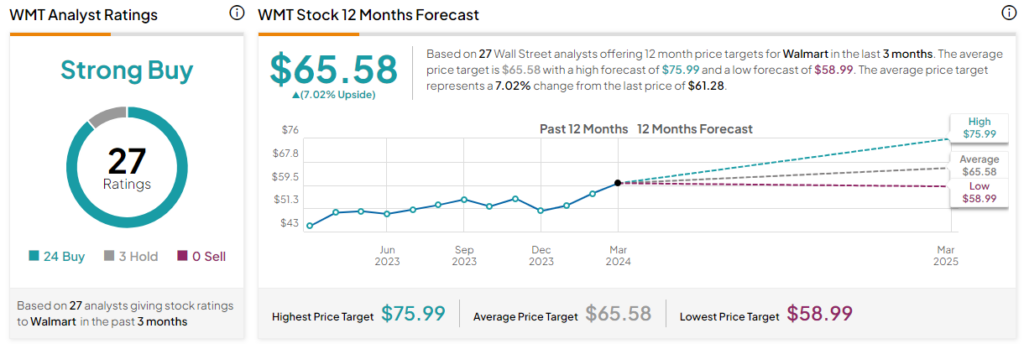

What Is the Price Target for WMT Stock?

Walmart has a Strong Buy consensus rating based on 24 Buys, three Holds, and zero Sell ratings assigned over the last three months. At $65.58, the average Walmart stock price target implies upside potential of 7%.

Target (NYSE:TGT)

At a P/E of 18.6, Target is trading at a sizable discount to its industry and Walmart and slightly lower than its five-year mean P/E of 19.6. With Target trading well below its record high of around $260 set in August 2021 and displaying signs of a return to growth, a bullish view seems appropriate, especially considering its long-term share-price growth.

Unlike with Walmart, Target insiders have been generally holding onto their shares, notching only $4.6 million in Informative Sells over the last three months. However, this trend bears watching, given the $3.6 million non-open-market sale about a week ago.

Nonetheless, multiple analysts have boosted their price targets for Target stock over the last week or so following the latest earnings report. The big-box retailer had a challenging year in 2023 with declining comparable-store sales growth, including a 4.4% decline in the holiday quarter.

However, management stated in the earnings release that the declines in Target’s foot traffic improved in the fourth quarter. Meanwhile, overall sales rose 1.7% year-over-year to $31.9 billion, edging out the consensus estimate of $31.89 billion.

Additionally, Target’s GAAP (generally accepted accounting principles) and adjusted earnings per share rose 57.6% year over year to $2.98, significantly higher than the guidance of between $1.90 and $2.60 per share and the consensus of $2.43 per share. For the first quarter, Target is expecting comparable sales to be flat to up 2% for Fiscal 2024, suggesting a turnaround is imminent.

Although Target stock has been flat over the last three years, it’s up 145% over the last five and 274% over the last decade. Therefore, it looks like an attractive buy-and-hold position for the long term. Finally, Target pays a 2.58% dividend with a payout ratio of 49.05% of net income, which also makes it worth buying and holding for the long term.

What Is the Price Target for TGT Stock?

Target has a Moderate Buy consensus rating based on 19 Buys, 10 Holds, and zero Sell ratings assigned over the last three months. At $177.11, the average Target stock price target implies upside potential of 6.3%.

Conclusion: Neutral on WMT, Bullish on TGT

Walmart and Target have long been seen as two sides of the same coin, although their sales and share-price performances have differed widely over the last 12 months. Now, with Walmart shares at record highs and insiders unloading their shares, there could be limited upside left there.

However, it looks like Target has some room to run, given the turnaround that appears to be on tap in 2024. Thus, while both big-box retailers are likely worth buying and holding for the long term, especially to collect their dividend payments, Target looks like the clear winner with the potential for greater upside in the near term.