Manufacturer of outdoor lifestyle products Winnebago Industries, Inc. (WGO) announced that it has entered into an agreement to acquire pontoon boat manufacturer Barletta Pontoon Boats for an initial consideration of $255 million in cash and newly issued Winnebago Industries shares. The deal is expected to close in the first quarter of Fiscal Year 2022.

Following the news, shares of the company jumped about 8% to close at $68.59 in Tuesday’s trading session.

With this buyout, Winnebago Industries fortifies its marine portfolio with access to Barletta’s products and services. Moreover, with expected 2021 revenues and EBITDA of $214.6 million and $26.4 million, respectively, for Barletta, the company expects the acquisition to be value accretive to its cash earnings per share and EBITDA margins.

CEO of Winnebago Industries Michael Happe said, “The acquisition of Barletta significantly expands Winnebago Industries’ presence in the strong and growing marine market by acquiring the fastest-growing brand within one of the most rapidly-growing boating segments. We look forward to leveraging our operational excellence, functional resources and proven expertise in nurturing and growing outdoor lifestyle brands to fuel the organic expansion of Barletta’s product line, market share and margins.” (See Winnebago Industries stock chart on TipRanks)

Last month, Robert W. Baird analyst Craig Kennison assigned a Buy rating to the stock with a price target of $85 (23.9% upside potential from current levels).

According to Kennison, the company’s solid third-quarter results and upbeat outlook are tailwinds. Further, the analyst believes that the company will have strong shipments through 2022.

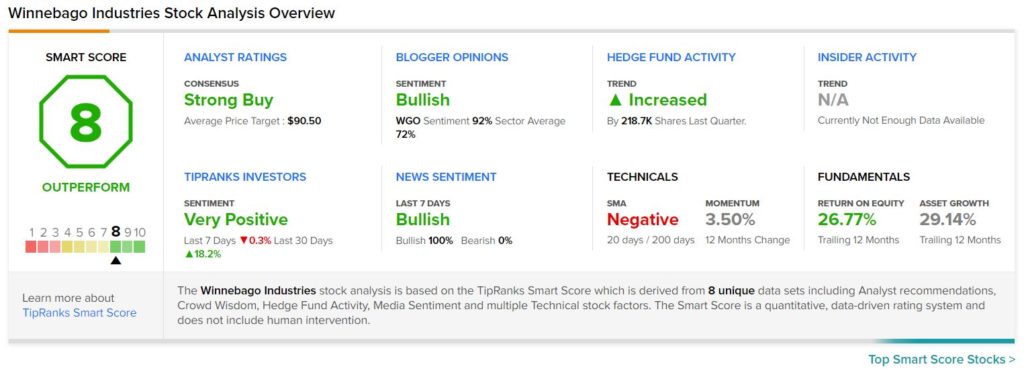

Consensus among analysts is a Strong Buy based on 6 Buys and 2 Holds. The average Winnebago Industries price target of $90.50 implies upside potential of 31.9% from current levels.

Winnebago Industries scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained about 6.8% over the past year.

Related News:

Uber Joins Hands with Albertsons to Expand Grocery Delivery Reach

Luminar Acquires OptoGration; Shares Fall

High Tide Acquires DankStop for $3.85M