The year 2023 was marred with the spectacle of elevated inflation, an ever-hawkish Fed, and concerns about consumers tightening their purse strings. Yet, the recent fourth-quarter performance from restaurant operator Shake Shack (NYSE:SHAK) has induced a pleasant bout of optimism for investors. The company delivered a 20% year-over-year jump in Q4 revenue and a nearly 80% growth in its adjusted EBITDA for 2023. SHAK’s results also boosted optimism around Wingstop (NASDAQ:WING), another restaurant operator. The company is slated to report its fourth-quarter results on Wednesday.

To be fair, investors in Wingstop are already sitting on investment gains of nearly 85% over the past year. It has outpaced analysts’ expectations for five consecutive quarters. Impressively, Wingstop has seen same-store sales grow for 19 consecutive years and was included in Entrepreneur Magazine’s Fastest-Growing franchises list for 2023.

On Wednesday, analysts expect Wingstop to deliver an EPS of $0.57 on revenue of $120 million for the quarter. In the comparable year-ago period, Wingstop’s EPS of $0.60 had smashed estimates by a wide margin of $0.19.

Is WING a Good Stock to Buy?

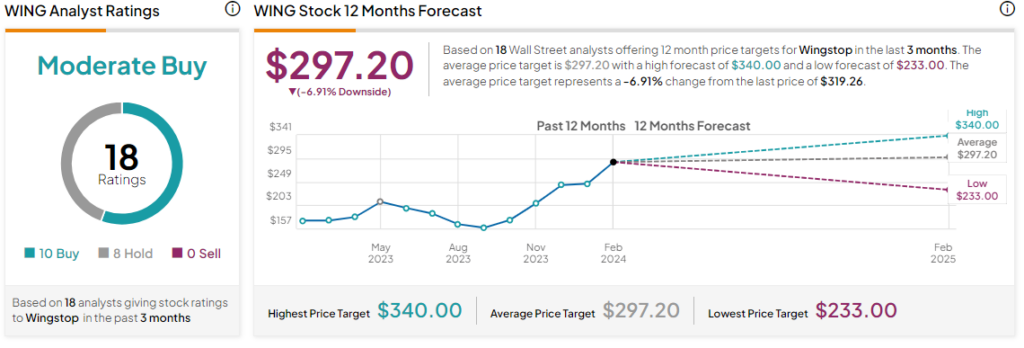

Shares of the company have run up by nearly 25% year-to-date. Overall, the Street has a Moderate Buy consensus rating on Wingstop alongside an average price target of $297.20.

Read full Disclosure