Tesla (NASDAQ:TSLA) shares have been mostly in a downtrend since the start of the year, having retreated by 28%. Considering that meaningful pullback, might it be time to start loading up on the EV leader’s shares again?

Not quite, asserts Bernstein analyst Toni Sacconaghi, suggesting that both the figures and valuation remain overly optimistic.

“Tesla’s stock price remains high on almost every valuation metric compared to both traditional and higher-growth auto OEMs, and also looks expensive relative to its reduced growth expectations when measured against tech comps,” the analyst said. “Despite the stock’s underperformance YTD, we struggle to see a catalyst for TSLA. We expect tepid growth in 2024, as well as 2025, bringing into question the company’s growth narrative.”

With the first quarter about to close, Tesla has witnessed both weak China/Europe demand and constrained US Model 3 production, and that, says Sacconaghi, requires some estimate-tweaking.

Sacconaghi now expects Q1 deliveries of 426,000 units (a 1% year-over-year increase), down from 490,000 beforehand, and for the full year, he sees deliveries reaching 1.98 million vs. the prior 2.12 million. In comparison, the consensus estimates stand at 468,000 units for Q1 and 2.06 million for the fiscal year 2024 .

Accordingly, the analyst has also reduced his FY24 GAAP EPS forecast from $2.31 to $2.06, now even further behind the Street’s expectation of $2.63. “We note that consensus FY24 earnings have now declined ~60% from ~$6.53 in Oct 22,” Sacconaghi went on to say.

Looking ahead to 2025, the picture Sacconaghi paints is not brighter in any way, anticipating Tesla will encounter “many of the same challenges.” In fact, by then its model lineup will be even more dated, and competition will likely only intensify. Furthermore, it appears Tesla probably won’t be able to scale the next-gen platform before 2026. As such, for FY25, Sacconaghi is calling for 2.18 million units and EPS of $2.22, both below consensus at 2.41 million units and EPS of $3.69.

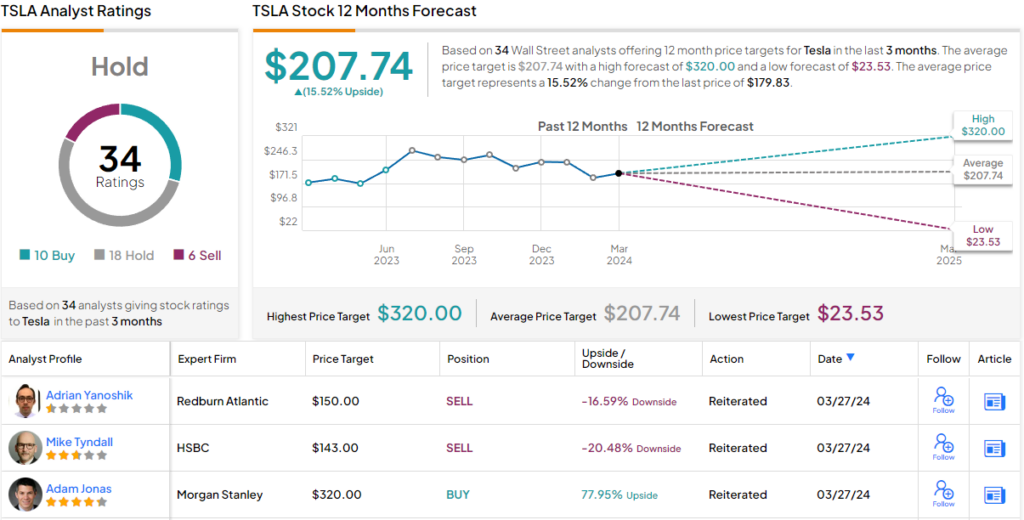

Bottom-line, Sacconaghi reiterated an Underperform (i.e., Sell) rating and lowered his price target from $150 to $120, suggesting the stock has downside of 33% from current levels. (To watch Sacconaghi’s track record, click here)

Amongst Sacconaghi’s colleagues there are 5 other bears recommending to Sell, while 10 suggest to Buy although the majority – 18, in total – say Hold, all coalescing to a Hold consensus rating. The average target clocks in at $207.74, implying the stock will post growth of 15.5% from current levels. (See Tesla stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.