Ford Motor (NYSE:F) is recalling over 518,000 SUVs in the U.S. on account of some fire incidents in two of its sport utility vehicle (SUV) models. Given the challenging macroeconomic environment, intense competition, and declining demand for its SUVs, the recall will probably be a setback for the company. Also, the news might put pressure on Ford stock, which is down more than 35% year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Reportedly, the faulty fuel injector is said to cause the accumulation of fuel or fuel vapor near hot surfaces, leading to an under-hood fire. The affected vehicles include Bronco Sport SUVs from the 2021 and 2023 model years, along with Escape models from the 2020 through 2023 model years.

The automaker has asked the customers to get an engine control software update from dealers. This update is expected to help detect the crack and caution drivers during a drop in pressure in the fuel rail.

Earlier in November, the company had reported a decline in its vehicle sales for the month of October. Particularly, a 14.1% drop was witnessed in SUV sales, with retail SUV sales falling 18.2% year-over-year.

Should You Buy Ford Stock?

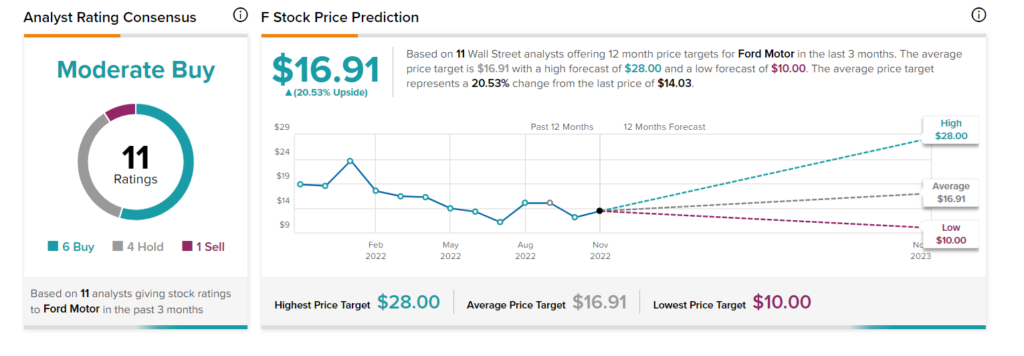

Wall Street is cautiously optimistic about F stock. Overall, the stock has a Moderate Buy consensus rating based on six Buys, four Holds, and one Sell. Ford’s average price target of $16.91 implies 20.53% upside potential from current levels.

Interestingly, Ford stock has a very positive signal from hedge funds. Our data shows that hedge funds bought 40.4M shares of F last quarter. Overall, the stock scores a 7 out of 10 on TipRanks’ Smart Score rating system, which indicates that the stock is likely to perform in line with market averages.