Hovering near its 52-week low price, shares of ride-hailing corporation Lyft, Inc. (NASDAQ: LYFT) has remained in murky waters so far this year. It lost 62.5% in value, including yesterday’s sell-off, which pushed the stock down by 17.3% at the close.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

To tackle the crisis and raise investor optimism, management takes a cautious approach toward spending and hiring. It plans to slow down recruitment, cut the budgets of some of its divisions, and award eligible employees with new stock options.

Following the news, shares of one of the largest transportation networks in the United States and Canada gained 1.08% in the extended trading session on Tuesday.

Official Comments

President John Zimmer wrote in a memo to employees, “It’s clear from our discussions with other business leaders that every company is taking a hard look at how they respond to concerns about an economic slowdown and the dramatic change in investor sentiment.”

“Given the slower than expected recovery and need to accelerate leverage in the business, we’ve made the difficult but important decision to significantly slow hiring in the US,” Zimmer added. Yet, no layoffs have been planned.

Factors Pushing Shares Down

The stock is struggling amid the broad sell-off in the tech sector. The tech companies that bolstered the U.S. economy during the pandemic are bearing the brunt of reversal trends and interest rate hikes. Inflation, supply-chain issues, and labor shortages remain other challenges.

For the past year, ride-hailing companies have been experiencing driver shortages. In turn, they have resorted to high fares resulting in fewer riders and lower ride volumes. Though Lyft posted upbeat first-quarter 2022 results, management comments about increased investments in drivers and marketing for the June quarter sent the stock tumbling.

Like others, Lyft spent huge amounts to gain market share that wiped off its profits to some extent. Therefore, Zimmer said on Tuesday, “As we’ve seen and discussed, public market investors have continued to sharply shift their focus onto a potential recession and a company’s ability to deliver near-term profits. Our near-term action plan will be focused on accelerating profits—whether we like it or not, that’s the ticket of entry in today’s market.”

Meta Platforms (FB), Peloton Interactive (PTON), and Uber Technologies (UBER) are among the other tech companies that have recently resorted to slow hiring and re-evaluation of headcount to trim costs.

Wall Street’s Take

Recently, Bernstein analyst Nikhil Devnani assumed coverage of Lyft with a Hold rating and a price target of $22 (31.58% upside potential), down from $30.

Devnani believes shares “will remain in the penalty box” until the company succeeds in retaining drivers on lower incentives.

Furthermore, the analyst is skeptical about the long-term growth of Lyft. He noted that the company is focused on the U.S. markets, where already rideshare seems to reach mid-cycle.

The rest of the Street is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on 16 Buys and 10 Holds. The average Lyft price target of $41.08 implies 145.69% upside potential.

Hedge Funds

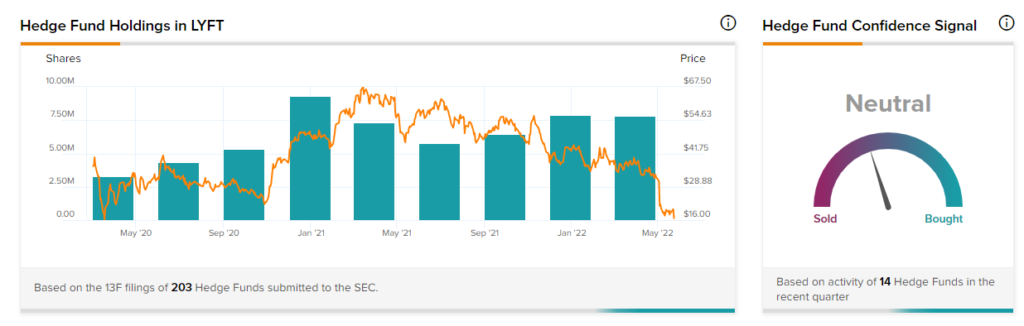

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Lyft is currently Neutral, as the cumulative change in holdings across all 14 hedge funds that were active in the last quarter was a decrease of 72,200 shares.

Bottom-Line

Amid the current market scenario, a cautious approach to equities like Lyft appears to be a safe bet.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure

Related News:

ZIM Ships Encouraging Outlook on Record Quarterly Results

WalkMe Posts Strong Quarterly Revenues; Website Visits Hinted at it

Snap Nosedives on Weak Outlook Amid Uncertain Economy