Grocery-delivery company Instacart generated solid results for the fourth quarter of 2022, with revenue rising over 50% year-over-year and gross profits jumping more than 80%, per the Wall Street Journal (WSJ). During a call with investors about Q4 results, executives stated the company was waiting for more “cooperative markets” to go ahead with its much-anticipated initial public offering (IPO).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As per a December 2022 report of The Information, Instacart cut its internal valuation by 20%, compared to October, to around $10 billion. Investors have been avoiding risky investments due to macro pressures and fears of an impending recession, which explains why Instacart is delaying its IPO. Moreover, pandemic-tailwinds for delivery companies ended following the reopening of the economy and they are facing higher competition from giants like Walmart (WMT), Amazon (AMZN), and Kroger (KR), who are taking greater control over their delivery networks.

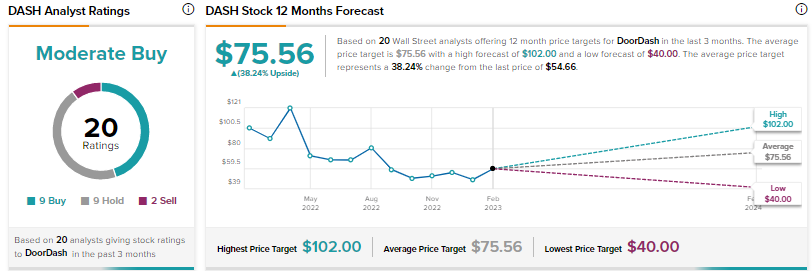

Rival DoorDash’s (NYSE:DASH) shares have plunged nearly 47% over the past 52-weeks, though the stock has advanced over 11% since the start of this year. Wall Street has a Moderate Buy consensus rating for DoorDash, with the average price target implying 28.2% upside potential.

Meanwhile, citing Instacart’s internal memo, WSJ noted that the company continues to take steps to boost its business, including the addition of more stores to its platform, introduction of food-stamp payments, and the expansion of the Instacart+ membership. Further, the company’s advertising products are gaining traction and helped in driving a 39% rise in full-year 2022 revenue to about $2.5 billion.

The memo also stated that Instacart is on track to deliver improved profitability and intends to focus on its core business while expanding into newer areas like Instacart Health. Instacart’s initiatives to boost its revenue and profits might make it more attractive to potential public investors whenever the company goes ahead with its IPO.