Since its initial unveiling as the 7E7 in early 2003, and then as the renamed 787, Boeing’s (NYSE:BA) widebody aircraft has a notable place in its history. Despite facing numerous challenges during its production, it stands out as a next-generation aircraft. The aircraft earned its moniker, the Dreamliner, due to its lower cabin altitude, improved humidity levels, cleaner air, and calmer ride, all of which were recognized as advantages for passengers looking to relax during longer-haul flights.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In recent years, the 787 Dreamliner has played a crucial role in solidifying Boeing’s dominance as it has become the preferred widebody aircraft, gaining a leading market share position over Airbus.

Yet, Stifel analyst Bert Subin believes the plane’s challenges since first taking to the air in 2011 along with negative MAX headlines have diverted attention from what the analyst believes will be a “growth engine” for Boeing. Looking ahead, the analyst thinks the 787 could be a “meaningful cash tailwind in 2024 and improving production and strong demand could help drive better future margins and cash generation as we look to 2025+.”

Over the past few years, investors have mainly focused on the 737 MAX, and even though Subin expects 737s will remain the “core driver” of future results, the 787 is starting to look like a “favorable supplement to the narrowbody recovery.”

From 2024 to 2026, the trajectory of the 787’s performance will be pivotal. Subin highlights the necessity of reducing inventory levels in 2024 and 2025 to facilitate the closure of shadow factories. Subsequently, production is expected to increase from the current rate of 5 per month to 7 in the second half of 2024 and first half of 2025, with further escalations to 10 or more by the second half of 2025 and first half of 2026.

According to Subin’s calculations, over 2025-2026, the 787 program should account for more than 25% of total operating cash flow for BCA with that figure possibly rising to 30%+ over time. This potential increase factors in improvements in pricing power, a shift in the product mix towards the larger -10 variant, and the potential for further production increases to between 12 and 14 aircraft per month.

“That next production phase would be key as that could be worth $450-900m in annual operating cash generation, per our estimates, excluding the tailwind from operating leverage,” Subin further said.

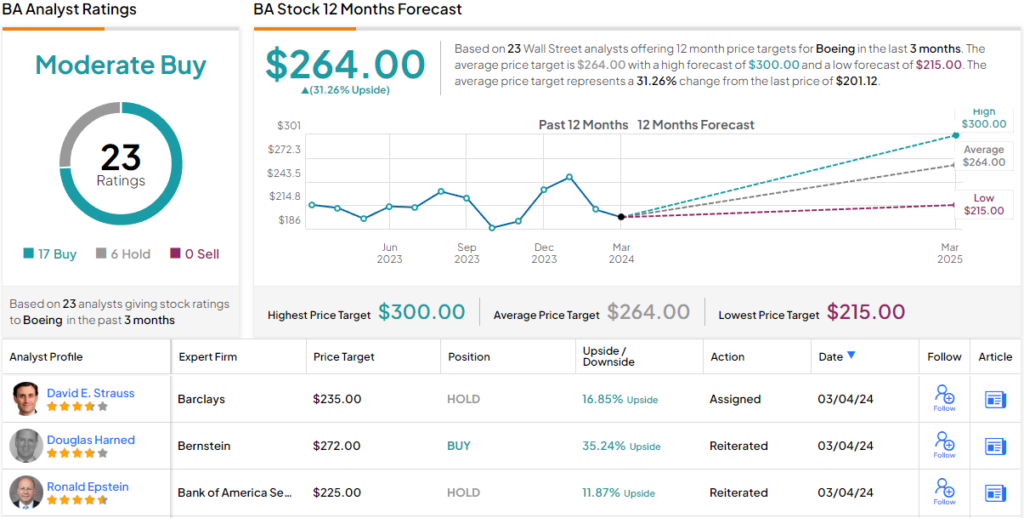

Bottom line, Subin rates BA shares a Buy, along with a $280 price target, suggesting the stock will climb 39% higher over the coming months. (To watch Subin’s track record, click here)

All in all, 23 analysts have chimed in with BA reviews and these break down into 17 Buys and 6 Holds, all for a Moderate Buy consensus rating. The forecast predicts a 31% return over the next 12 months, with an average target price of $264. (See Boeing stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.