If you really want to get familiar with the ins and outs of a company, there’s no better way than breaking bread with top executives. While this opportunity might be out of reach for the average person, it’s a real possibility for a Wall Street analyst.

That’s exactly what Bernstein’s Stacy Rasgon did to gain insights into the latest happenings at Advanced Micro Devices (NASDAQ:AMD). Rasgon, a 5-star analyst rated in the top 3% of the Street’s stock pros, recently hosted a client dinner with AMD’s CTO Mark Papermaster and Head of IR Mitch Haw. Unsurprisingly, the conversation largely centered around AI.

Mr. Papermaster indicated that AMD has made inference a top priority and contends that they are on equal footing with Nvidia in terms of silicon capabilities, while also making strides in software development. AMD is actively investing in its Heterogeneous-Compute Interface Portability (HIP) to streamline the transition of models from Nvidia’s CUDA-based infrastructure to AMD’s ROCm-based infrastructure.

The company is also confident that its GPUs will provide hyperscalers with a better Total Cost of Ownership (TCO), although Rasgon says that remains to be seen. Additionally, AMD’s software team is committed to ensuring that there will be no decline in the effectiveness of the models.

Although Mr. Papermaster refrained from commenting on the general demand for CPU servers, he is optimistic regarding the potential for AMD to gain market share in the enterprise server CPU segment given a “renewed focus” and bigger investments in direct sales initiatives. The chip giant also has a bullish stance on AI PCs and thinks the next Windows version should create opportunities for the expansion of AI applications.

“Overall,” Rasgon summed up, “we believe AMD still is playing catch up, but can at least articulate a strategy on how they want and plan to gain some share in the inference space. The argument remains though as to whether AMD’s presence will be material, or more along the lines of a second-source in an attempt to keep their larger peer honest (though perhaps even the latter could be considered enough for now).”

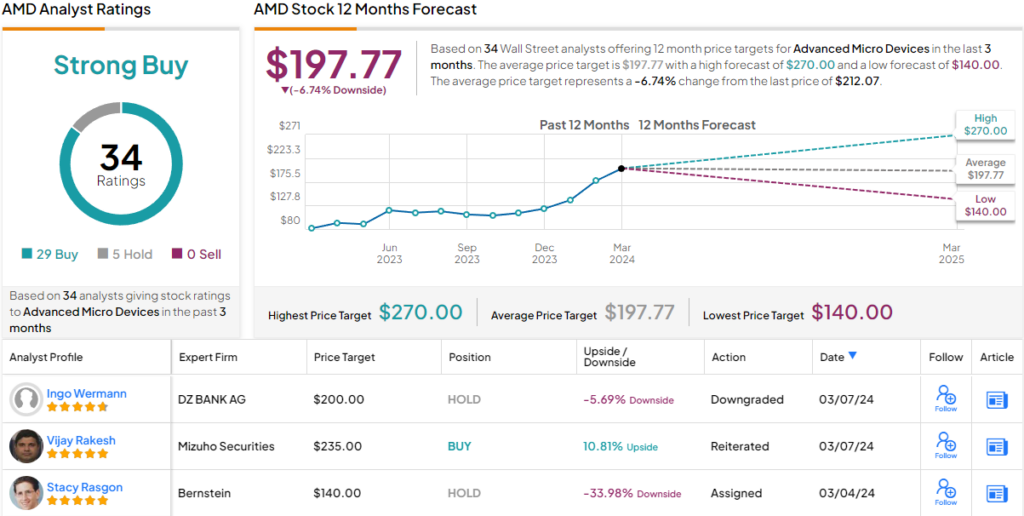

To this end, Rasgon currently remains on the sidelines with a Market Perform (i.e., Neutral) rating while his $140 price target is actually the Street’s most bearish and indicates shares are overvalued by ~34%. (To watch Rasgon’s track record, click here)

That said, most of Rasgon’s colleagues are of a bullish bent. The stock claims a Strong Buy consensus rating, based on a mix of 29 Buys and 5 Holds. However, many also think the shares have soared enough for now as the $197.77 average target points to ~7% downside in the months ahead. It remains to be seen whether the analysts will adjust their price targets upward to align with their Buy ratings. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.