Jane Fraser, the CEO of banking giant Citigroup (C), said that while artificial intelligence is changing industries fast, the excitement surrounding it might be exaggerated. Speaking with CNBC at Citigroup’s Tech Leadership Summit, Fraser noted, “There is a lot of hype in tech at the moment in the AI space. And some of it is earned, and some of it is exuberant.” Her comments come as tech stocks have declined this week, leading many to question whether AI investments can truly deliver the results investors expect.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Fraser explained that AI currently benefits large, established companies that can afford to invest heavily and move quickly, suggesting that smaller players may struggle to keep up. She described the speed of change in the AI industry as “unprecedented,” saying that companies now measure competitive advantages “in weeks, not even in months and years.” Although she believes investing in computing capacity will pay off in the long run, she warned that the AI boom will create both winners and losers as industries adjust to the technology’s impact.

At Citigroup, Fraser said AI tools are already improving efficiency across the company. About 180,000 employees use AI to help write performance reviews and credit memos, which has boosted productivity and improved customer service. She added that while large financial institutions are well-positioned to benefit from AI, smaller companies without strict credit standards could face challenges. For Citigroup, Fraser said AI is only “the tip of the iceberg” when it comes to transforming how the bank operates and grows in the future.

Is Citigroup Stock a Good Buy?

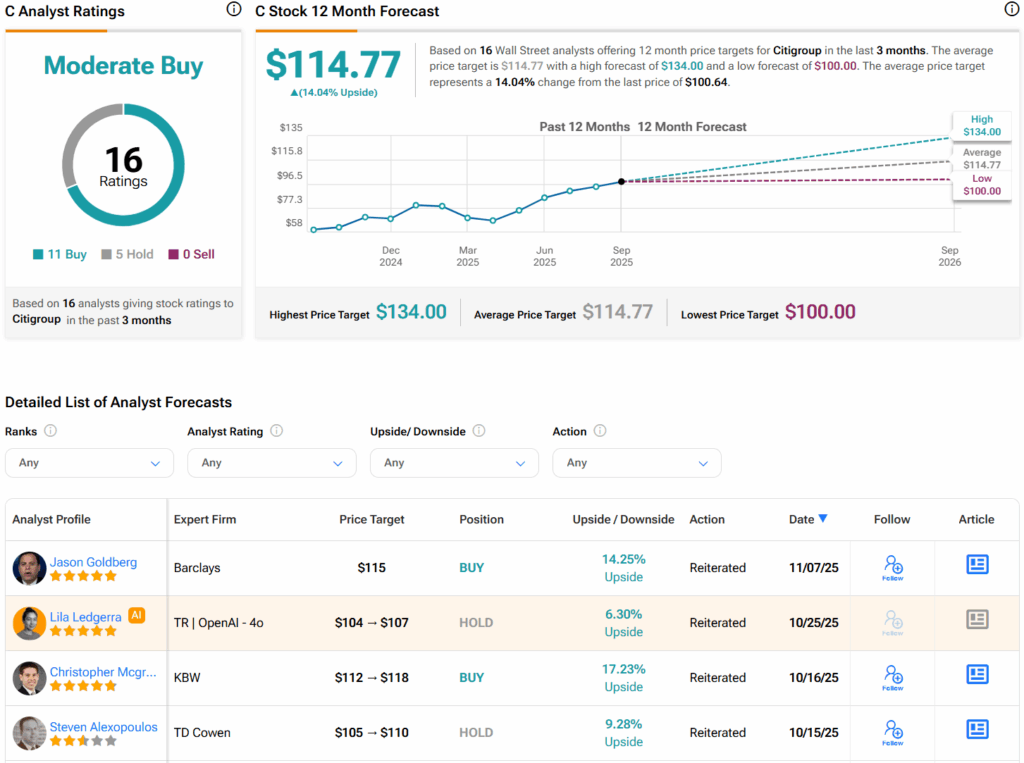

Turning to Wall Street, analysts have a Moderate Buy consensus rating on Citigroup stock based on 11 Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average Citigroup stock price target of $114.77 per share implies 14% upside potential.