Billionaire investor Paul Tudor Jones believes that the market could be headed for a dramatic surge before this bull run ends. Speaking on CNBC, he said that all the conditions are in place for what he called a potential “blow-off” rally. Indeed, he compared today’s setup to the lead-up to the dotcom bubble in 1999, but with even more explosive potential. He’s especially uneasy about the kind of financial arrangements that are popping up in the AI space, such as circular deals and vendor financing, which remind him of patterns that occurred in past market crashes.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It is also worth noting that the Nasdaq (QQQ) has soared 45% from its April low to new record highs due to massive investments in AI from major tech companies. While this is similar to the tech rally of the late ’90s, Jones noted one key difference: today’s fiscal and monetary backdrop is far more aggressive. In fact, unlike 1999, when the U.S. had a budget surplus and the Fed was preparing to raise rates, the government is now running a 6% deficit, and the Fed has already started easing.

As a result, Jones said that this mix of loose fiscal and monetary policy is something we haven’t seen since the early 1950s and could pour fuel on an already hot market. Nevertheless, despite his worries, Jones isn’t calling for a crash just yet. Instead, he believes the market has room to rise. However, he warned that the final stages of a bull market often deliver the biggest gains, followed by a sharp reversal. This means that investors will need to react quickly in order to benefit. Interestingly, to position himself for this final push, Jones said he’s holding a mix of gold, crypto, and high-flying tech stocks.

Is QQQ Stock a Good Buy?

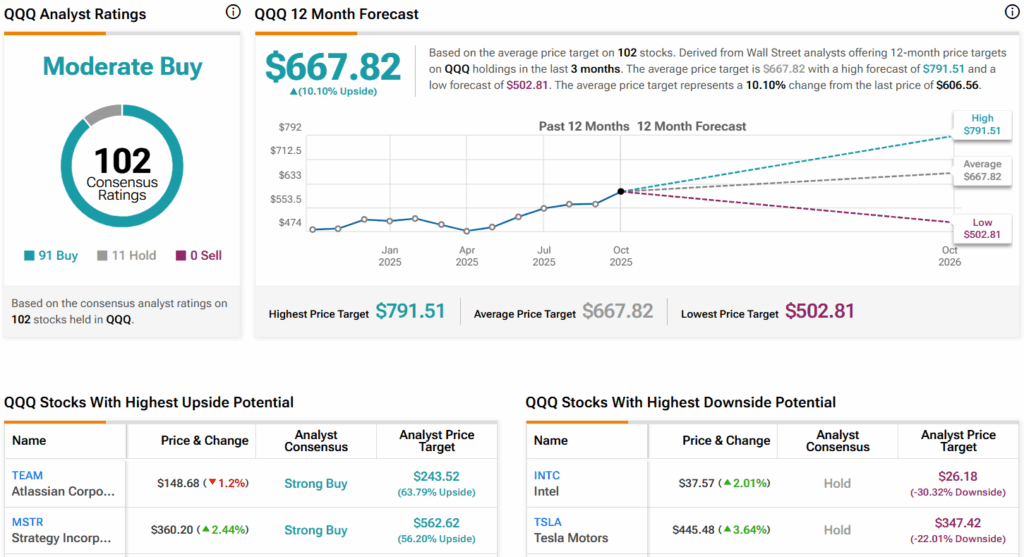

Turning to Wall Street, analysts have a Moderate Buy consensus rating on QQQ based on 91 Buys, 11 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average QQQ price target of $667.82 per share implies 10.1% upside potential.