Investment firm Citigroup (C) has raised its forecast for AI-related infrastructure spending by major tech companies. Indeed, it now expects the total to surpass $2.8 trillion by 2029, up from $2.3 trillion previously. This increase comes as big players like Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) continue to invest heavily in data centers to support AI growth. In addition, Citi now expects AI-related capital spending by hyperscalers to reach $490 billion by the end of 2026, which is up from its earlier estimate of $420 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Citi analysts believe that this extra spending will show up in upcoming earnings reports, where companies are likely to give guidance based on expected future demand, even if that demand hasn’t fully materialized yet. It is also worth noting that in order to meet growing AI computing needs, the world will need 55 gigawatts of new power by 2030, which translates to about $2.8 trillion in spending.

In fact, building just 1 gigawatt of AI compute capacity costs around $50 billion. As a result, big tech firms are now borrowing money to help cover costs instead of relying only on profits. However, this borrowing is starting to affect free cash flow and is raising questions among investors about how long this level of spending can continue. Still, Citi stated that companies like Eli Lilly (LLY) are already showing the value of AI through real-world deployments, which proves that the investment is paying off.

Which AI Stock Is the Better Buy?

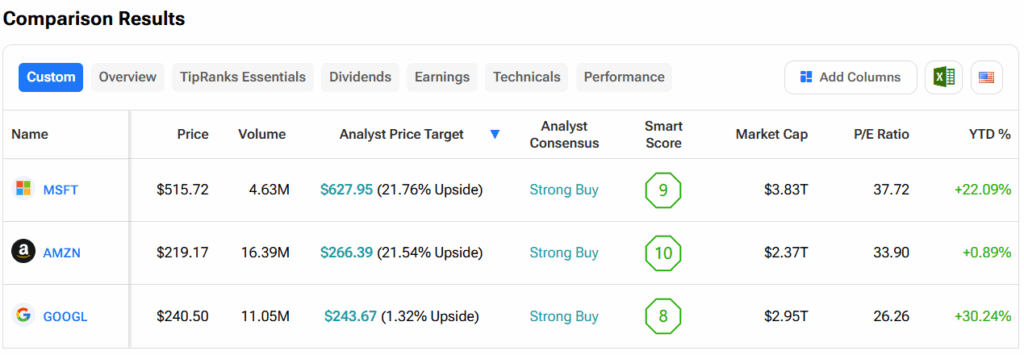

Turning to Wall Street, out of the AI stocks mentioned above, analysts think that MSFT stock has the most room to run. In fact, MSFT’s average price target of $627.95 per share implies more than 21% upside potential. On the other hand, analysts expect the least from GOOGL stock, as its average price target of $243.67 equates to a gain of 1.3%.