One of America’s software titans, Microsoft (MSFT), delivered just about everything investors could have asked for in its Q3 (Q1 2026) earnings call last week—yet the market’s reaction was surprisingly muted. Despite an across-the-board beat—EPS and revenue came in roughly 12% and 3% above expectations, respectively—along with continued strength in Azure and expanding operating margins, investors focused on one key concern: the rise in capital expenditures.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

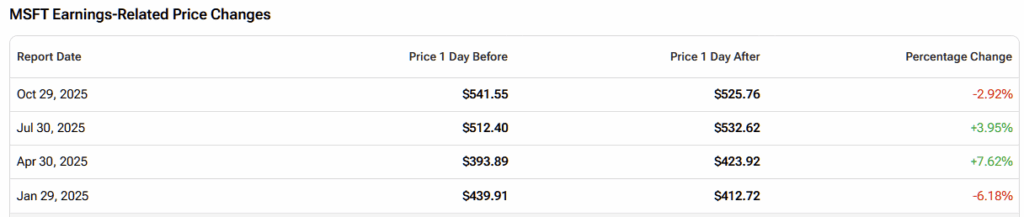

The result was a measured stock selloff post earnings, something that hasn’t happened since January this year.

As a general rule, in an ideal world, you don’t want a company’s growth to rely solely on heavy investment. However, in the context of an unprecedented technological arms race, where demand for AI infrastructure far exceeds supply, a sizable jump in CapEx should be viewed more as a sign of strength than weakness.

What the market currently interprets as a risk that will limit earnings growth, I see as a necessary move to sustain Microsoft’s next growth cycle. Structurally, this doesn’t alter the investment thesis—it reinforces it. So, I view the current pullback in MSFT as a buying opportunity; therefore, a Buy rating remains warranted.

Blowout Results, Tepid Market Response

As Microsoft’s thesis remains closely tied to Azure’s progress—within its primary growth engine, Intelligent Cloud, the short to medium-term stock reaction continues to hinge on the magnitude of advances in this area, along with the performance of the Productivity & Business Processes segment, which remains the most representative in terms of both revenue and operating income.

In this case, Microsoft delivered 39% year-over-year growth for Azure, along with a broad-based beat across virtually all metrics. A major highlight was the consolidated operating margin, which came in at 49% versus 46.6% in the same period last year—exceptionally strong levels for a company in the midst of its most intense capital expenditure cycle in history. So, broadly speaking, there wasn’t much (if any) reason to criticize the results.

Still, that didn’t stop the market from giving Microsoft the cold shoulder, with the stock staying range-bound between $500 and $540 over the past month.

I believe some investors were hoping for Azure growth to reach 40% year-over-year—slightly above the reported figure for fiscal Q4—or were perhaps more concerned about capital expenditures (capex) rising 74% year-over-year to $35 billion, including assets under finance leases. Management also guided that capex growth in fiscal 2026 should moderate compared to fiscal 2025, but that didn’t seem enough to ease short-term sentiment.

Heavy Spending Provides Solid Justification for MSFT

Going deeper into capex, it’s worth noting that from a fundamentals standpoint, it’s generally not ideal—even in a supercycle of AI demand across tech—for a company’s growth to be driven primarily by heavy capital investment. After all, shareholders want to see increasingly solid returns on their capital, not just expansion through spending.

And perhaps that’s one of the perceptions that has limited Microsoft’s potential for a stronger re-rating. Still, hyperscalers and other AI leaders have broadly ramped up their AI-related spending, and the current boom is unprecedented. Amazon (AMZN), for instance, invested around $120 billion over the past twelve months, while Meta Platforms (META) is spending aggressively on “superintelligence”—even warning investors that spending will rise further in 2026. Some view this as reckless, while others see it as the cost of business to stay ahead in the AI arms race.

The good news is that if there’s one company that can afford to play offense in this AI infrastructure cycle, it’s Microsoft. In Q1 alone, operating cash flow came in at $45 billion, up 32% year-over-year. Even after deploying a massive capex schedule, the company still generated roughly $25.7 billion in free cash flow (excluding assets under finance leases)—showing it’s in a comfortable position to keep adding capacity, especially as these investments are increasingly backed by locked-in customer commitments.

In this sense, Microsoft’s commercial remaining performance obligations rose 51% to $398 billion—clear evidence that its capex is at least well justified. While the scale of spending might still leave some uncertainties in the air, it’s certainly not something that undermines the structural strength of the thesis, in my view.

Why Microsoft’s Premium Multiple Still Makes Sense

Another point that tends to be more sensitive for value investors when assessing Microsoft’s thesis is the magnitude of the multiples at which the company trades. Currently, Microsoft trades at a P/E ratio of 36.8x—above its three-year median of 34x but below its peak of 39x reached in mid-2024.

However, Microsoft is arguably one of the lowest-volatility names among Big Tech peers, precisely because of its excellent business model, which gives it a “rare underperformer” status. Because of this, trading at 34x earnings still seems reasonable for a company expected to deliver EPS of around $16 in fiscal 2026, implying a forward P/E of roughly 32x.

That’s assuming Microsoft only meets consensus expectations—but given its consistent track record of beating estimates by about 1.5% to 2%, I expect another modest beat. In that case, the adjusted forward P/E would likely fall between 31x and 31.5x, depending on the size of the beat.

From there, applying a target multiple of 34–35 times to the expected fiscal 2027 EPS of approximately $19 implies a target price in the range of $645 to $665 per share, representing roughly a 20–25% upside over the next 12 months as the market begins to price in FY27 earnings.

Is MSFT a Buy, Hold, or Sell?

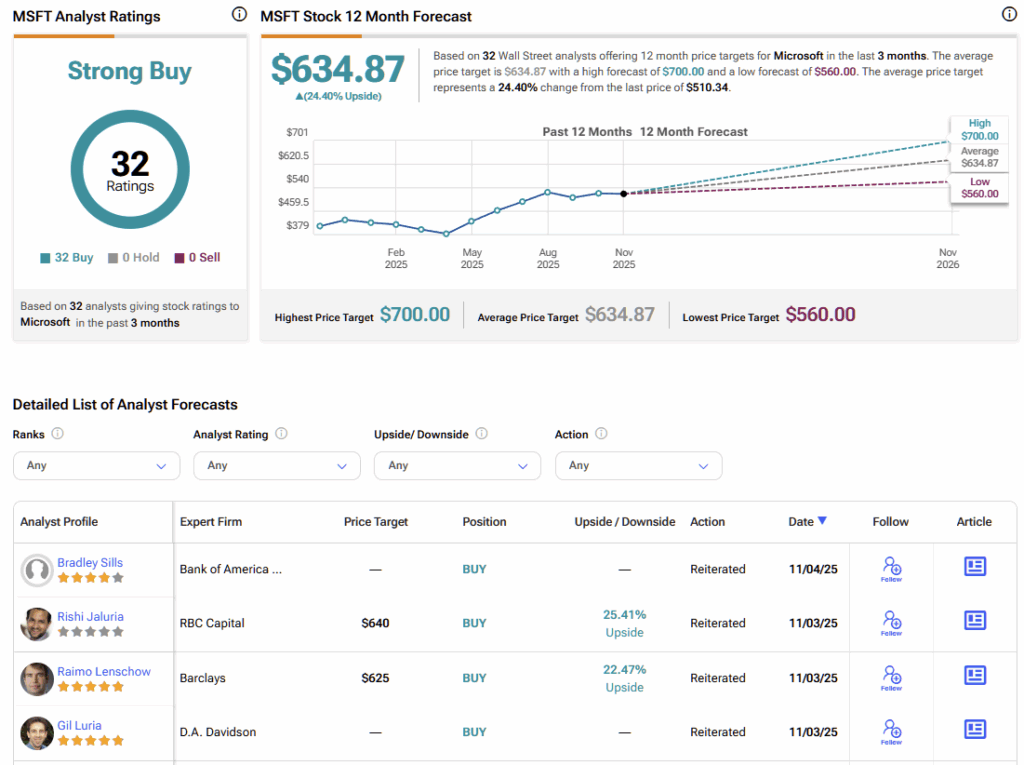

Microsoft is one of those rare stocks that’s nearly impossible to dislike. Over the past three months, all 32 analysts covering $MSFT have rated it a Buy—a unanimous show of confidence. The average stock price target of $634.87 suggests roughly 24% upside from current levels.

Why Microsoft’s Boring Consistency May Be Its Biggest Alpha

It’s not entirely clear why the market didn’t react more explosively in the short term after Microsoft delivered such impressive Q1 results. On the other hand, the fact that there wasn’t a selloff—especially in a market that continues to reward hype and speculation in the AI space—shows investors’ confidence in Microsoft’s fundamentals, yet also highlights how the market continues to take that stability for granted.

In that sense, I view any minor weakness as a buying opportunity, particularly for investors who see Microsoft as a long-term compounder — the way I do.