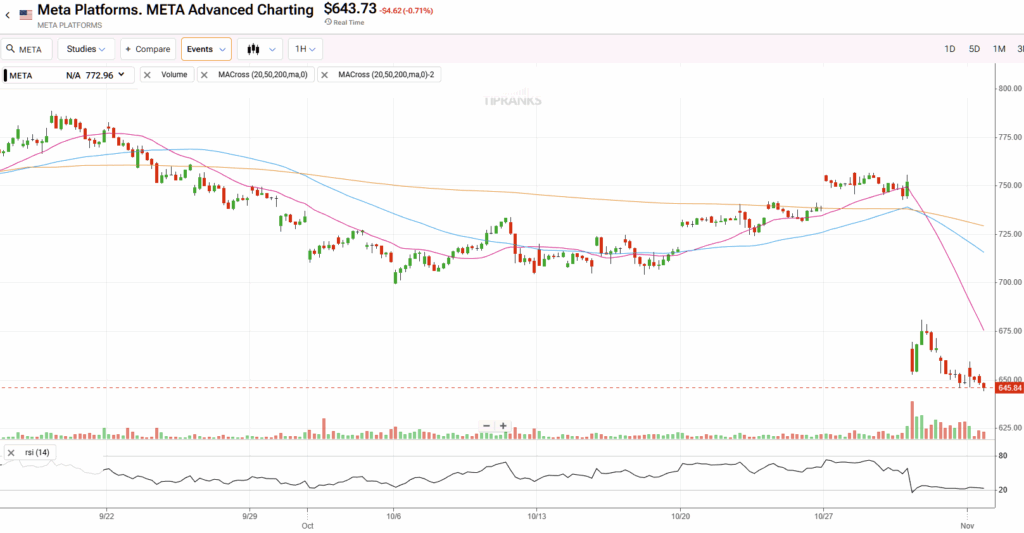

Meta Platforms, Inc. (META), the world’s leading social media platform operator, faced selling pressure last week following the release of its Q3 earnings report. The stock dropped 14% and then slid an additional 3% the following day. While Meta recorded a $16 billion one-time tax charge tied to the new tax law enacted under President Trump, investor and analyst concern centered more on management’s guidance that capital expenditures will accelerate sharply in 2026 versus 2025, driven by expanded investments in AI infrastructure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

These comments drew comparisons to Meta’s massive 2022–2023 spending spree on the metaverse—a venture that ultimately delivered disappointing returns. However, unlike the metaverse push, AI represents a more immediate and scalable opportunity. Although heavy near-term AI spending may weigh on operating margins, I believe Meta is strategically positioned to generate substantial long-term value from these initiatives. In short, I remain Bullish on Meta’s outlook.

Meta Plays The Long Game as Per Usual

My bullish outlook on Meta stems from the belief that the company is positioning itself as a frontrunner in the race toward AI superintelligence—a breakthrough that could unlock vast new growth opportunities over the long term. This strategy aligns with Meta’s history of forward-looking investments in emerging technologies to secure an early competitive advantage. Notable examples include its acquisition of Instagram to capitalize on the influencer economy and its early purchase of WhatsApp before instant messaging became a core focus for other tech giants.

During the Q3 earnings call, CEO Mark Zuckerberg emphasized that Meta’s current objective is to front-load infrastructure investments in preparation for the anticipated rise of AI superintelligence. I view this as a sound strategic move, particularly in light of recent research suggesting that superintelligence may emerge sooner than many expect. Daniel Kokotajlo, a leading AI researcher and head of the AI Futures project (formerly of OpenAI’s governance division), recently projected that AI superintelligence could arrive as early as 2027.

For context, AI superintelligence refers to an advanced form of artificial intelligence that would exceed the capabilities of the most brilliant human minds, potentially revolutionizing every field of scientific inquiry. Its advent could accelerate solutions to some of humanity’s most complex challenges—from medical innovation to climate change.

Meta’s aggressive AI investments aim to weave these superintelligent systems throughout its ecosystem—Facebook, Instagram, and WhatsApp—creating hyper-personalized, adaptive experiences for billions of users. This would not only redefine user engagement but also solidify Meta’s leadership and long-term dominance in the global social media landscape.

Meta’s AI Investments Are Already Paying Off

Another key reason behind my bullish outlook is that Meta’s aggressive AI-related capital expenditures are not only preparing the company for the coming age of AI superintelligence but are also strengthening its core business today. The early returns on these investments are already visible. For example, CFO Susan Li recently disclosed that advertisers using Meta Advantage+, the company’s AI-powered automated campaign creation tool, achieved a 14% lower cost per campaign compared to those not using the suite. By enabling advertisers to achieve the same level of targeting at a significantly lower cost, Meta is reinforcing its competitive edge in digital advertising.

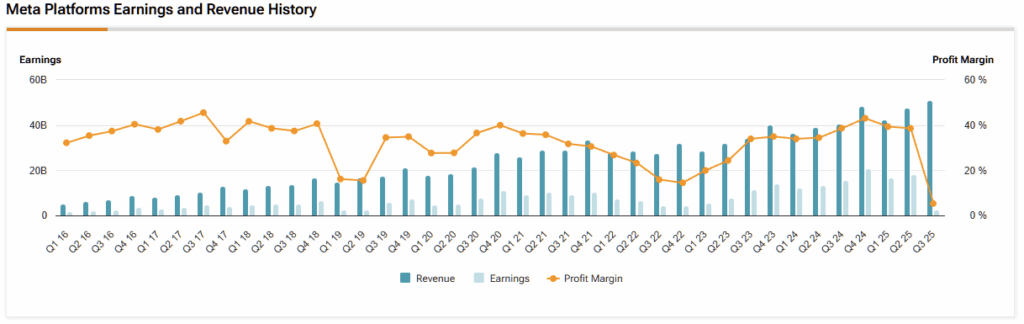

The company’s Q3 results further highlight how AI is enhancing user engagement across platforms. Meta’s AI-driven content recommendation algorithms contributed to a 5% year-over-year increase in time spent on Facebook and a 10% increase on Threads. Since engagement directly correlates with ad revenue potential, these gains bode well for sustained long-term growth. On Instagram, video consumption surged over 30% year-over-year in Q3, pushing Reels’ annual revenue run rate past $50 billion for the first time—a significant milestone.

From a valuation standpoint, META trades at a P/E ratio of 29x, compared to a sector median of 18x, placing it broadly in line with peers such as Alphabet (GOOGL) at 27x and Microsoft (MSFT) at 36x.

Moreover, Meta AI, the company’s suite of consumer-facing AI tools, surpassed one billion monthly active users during the quarter, signaling strong adoption momentum. This growing user base not only reflects Meta’s successful integration of AI into everyday user experiences but also lays the foundation for new avenues of monetization in the years ahead.

Is META Stock a Buy, Sell, or Hold?

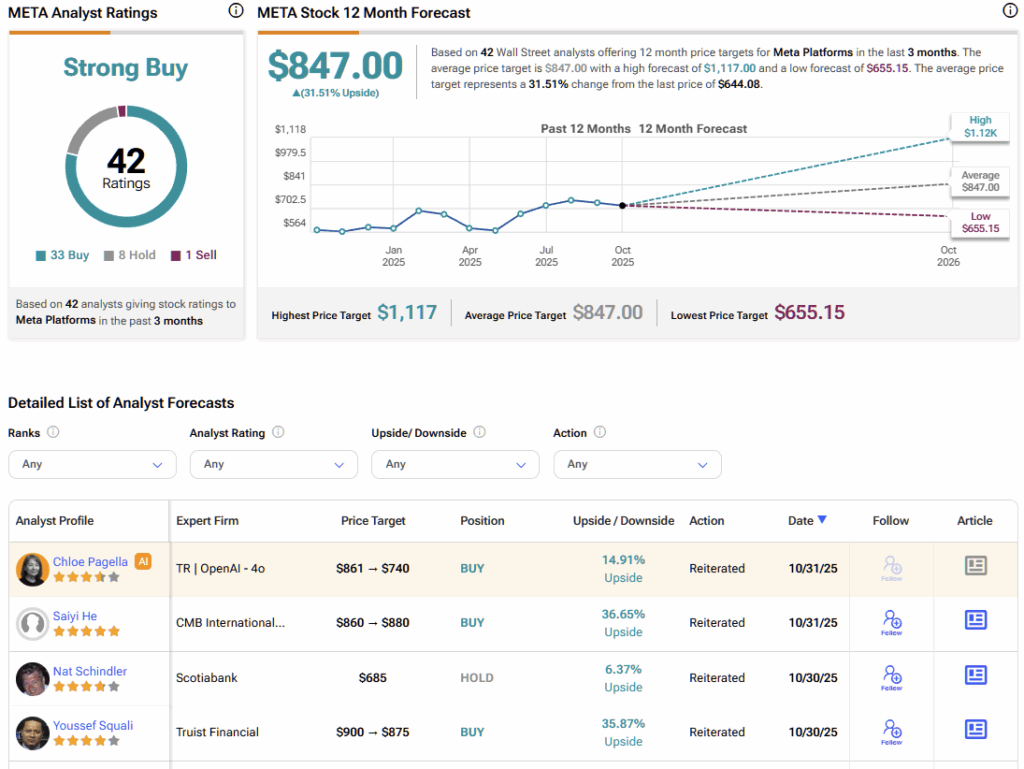

Meta’s Q3 earnings release sparked a flurry of analyst reactions as the company reported a sizable one-time tax charge and projected a sharp increase in capital expenditures for 2026. Jason Helfstein from Oppenheimer downgraded the stock and attached a $696 price target, noting that Meta appears fairly valued given its heavy spending on AI superintelligence initiatives without a clearly defined revenue roadmap.

According to ratings from 42 Wall Street analysts, the average price target for Meta Platforms is $847, suggesting an upside potential of approximately 31% from the current market price over the next 12 months. META stock carries a Strong Buy consensus rating based on 33 Buy, 8 Hold, and one Sell ratings over the past three months.

Meanwhile, Mark Shmulik from Bernstein takes a more balanced stance—acknowledging Meta’s continued growth but drawing parallels between its current AI investments and the company’s prior metaverse spending spree. Reflecting this cautious view, Bernstein trimmed its price target from $900 to $870, which still represents over 15% upside potential from current levels.

In contrast, Thomas Champion from Piper Sandler adopted a more optimistic tone, suggesting that the recent pullback in Meta’s share price offers an attractive entry point for long-term investors. The firm believes Meta’s substantial investments in AI will ultimately translate into meaningful business gains and sustained value creation.

In my view, Meta remains significantly undervalued following its recent pullback. With a forward P/E ratio of just 24, it is currently the most attractively priced stock among the Magnificent Seven. While near-term operating margins may face pressure from elevated AI spending, I believe these investments will reinforce Meta’s long-term leadership in social media and unlock new avenues for growth across emerging market segments.

META’s AI Spend Sparks Investor Jitters as Compelling Outlook Remains

Meta Platforms came under heavy selling pressure last week after the company guided for a sharp acceleration in AI-related capital expenditures for 2026. While investors’ concerns are understandable—given the parallels to Meta’s costly metaverse spending a few years ago—I believe the return profile of its current AI investments is fundamentally different.

Unlike the metaverse initiative, Meta’s AI investments are already generating measurable results and driving tangible improvements in its core business. These advancements position the company to strengthen its dominance in the social media landscape for years to come. With a notably lower valuation relative to its Big Tech peers, I view Meta’s recent pullback as an attractive opportunity for long-term investors.