Joby Aviation (JOBY) stock dropped about 9% in after-hours trading on Tuesday after the electric air-taxi company said it plans to sell $500 million in common stock. Joby also gave underwriters a 30-day option to buy up to $75 million more shares at the same price. The decline reflects market worries about share dilution, since the new offering will increase the number of outstanding shares and reduce the ownership stake of existing investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Despite the pullback, Joby stock is still up 233% over the past year and 133% year to date, supported by strong investor optimism around electric air mobility.

Joby Raises Cash to Fund Growth Plans

Joby said the funds will help support its expansion as it works to launch its electric air-taxi service. As part of its broader growth push, the company recently announced plans to make Blade Air Mobility’s (BLDE) helicopter and seaplane services available on the Uber (UBER) app as early as 2026.

However, the company is still in the testing and certification phase with U.S. regulators, and large-scale aircraft production remains costly. Nevertheless, regulators have been moving faster since President Donald Trump called for quicker reviews of air taxis and other new aircraft in June.

It’s worth noting that Joby is still reporting losses, and it may take a few more years before the company begins generating consistent revenue. In its latest Q2 earnings call, the company posted a loss of $0.41 per share, wider than the $0.19 loss analysts expected.

Is JOBY a Good Stock to Buy?

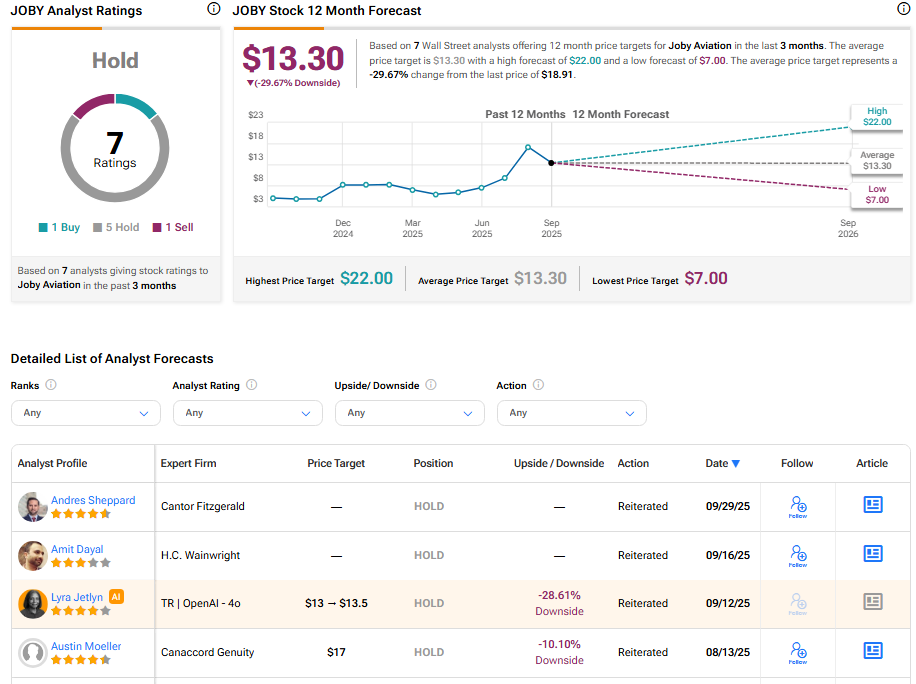

On TipRanks, JOBY stock has received a Hold rating based on one Buy, five Hold, and one Sell recommendations. The average JOBY stock price target is $13.30, implying a 29.67% downside from the current price.