CNBC’s Mad Money host Jim Cramer views Amazon (AMZN) stock as a “keeper” after the e-commerce giant recently announced a large round of layoffs. He described Amazon as a company with a strong commitment to profitability and innovation, particularly through artificial intelligence (AI), making it a compelling long-term investment despite short-term market challenges.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cramer believes that Amazon has consistently tried to make more money for shareholders and has not given up on its efforts to improve shareholder returns. Although Amazon does not pay dividends, it has a long-standing practice of reinvesting profits back into the business to fuel growth and expansion.

Amazon’s Job Cuts Reflect Greater Efficiency

Despite previously criticizing Amazon for over-hiring during the COVID-19 pandemic, Cramer acknowledged that recent workforce reductions, expected to total up to 30,000 jobs, are steps toward greater operational efficiency. He noted that advances in AI are key to helping Amazon streamline operations and boost productivity, allowing the company to do more with fewer resources.

Amazon executive Beth Galetti stated that Amazon’s recent layoffs stem from a strategy to reduce bureaucratic layers and increase speed and ownership within the company. She stated that AI represents the most groundbreaking technology since the internet and is a driving force behind such organizational changes aimed at enhancing innovation and customer service.

AMZN Stock Is a Good Long-Term Bet

Cramer noted that Amazon has underperformed the S&P 500 (SPX) index in recent years. Notably, Amazon shares have gained only 4.5% so far this year, while the SPX has surged about 17%.

Nonetheless, he advised investors to hold shares in companies they trust, expressing confidence that Amazon’s stock price will eventually reflect its true value. Cramer compared this belief to his earlier mistake of selling Alphabet (GOOGL) stock too soon, which led to missed gains.

Cramer also highlighted Amazon’s resilience and strong fundamentals, pointing to its successful navigation of the pandemic, growth in European markets, and expansion in Amazon Web Services (AWS). He expects AWS’ growth rate to accelerate when the company reports its third-quarter fiscal 2025 results after the market closes on October 30.

Is Amazon Stock a Buy Ahead of Earnings?

Analysts expect Amazon to report a 10% growth in earnings per share (EPS) to $1.57, with revenue expected to rise about 12% to $178 billion.

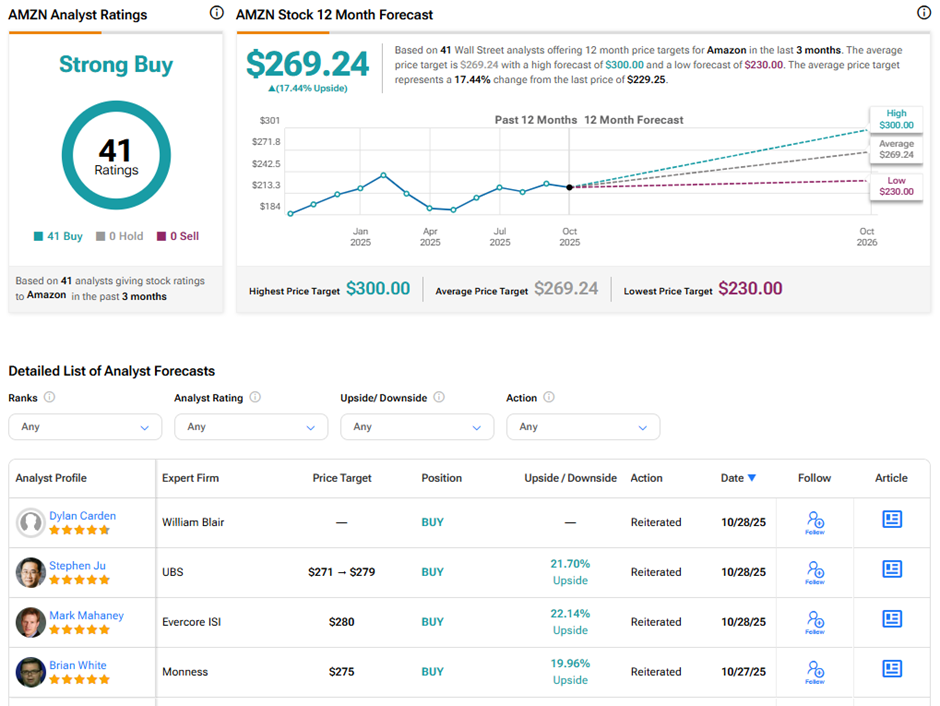

Ahead of the Q3 results, AMZN stock has a Strong Buy consensus rating on TipRanks. This is based on 41 unanimous Buy ratings. The average Amazon price target of $269.24 implies 17.4% upside potential from current levels.