Sotherly Hotels (SOHO) stock rallied on Monday after the real estate investment trust (REIT) announced an acquisition agreement with a joint venture led and sponsored by affiliates of Kemmons Wilson Hospitality Partners, LP, alongside Ascendant Capital Partners LP. These two will use the joint venture entity KW Kingfisher LLC to acquire all outstanding shares of SOHO stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Under the terms of this deal, KW Kingfisher LLC will pay $2.25 per share in cash for Sotherly Hotels stock. This represents a 152.7% premium to the closing price of SOHO stock on Friday and a 126.4% premium to its volume-weighted average share price over the previous 30 days.

Sotherly Hotels Chairman Andrew Sims stated, “This transaction is a testament to the high-quality portfolio that Sotherly has built over the past 20+ years as a publicly traded company and we are confident this will pave a path towards future success for our hotels and the associates and guests that enjoy them every day.”

Sotherly Hotels Stock Movement Today

Sotherly Hotels stock was up 141.49% in pre-market trading on Monday, following a 3.42% fall on Friday. The stock has decreased 4.27% year-to-date and 35.95% over the past 12 months.

Today’s news brought with it heavy trading of SOHO stock, as more than 6.3 million shares changed hands as of this writing, compared to a three-month daily average of about 336,000 units.

Is Sotherly Hotels Stock a Buy, Sell, or Hold?

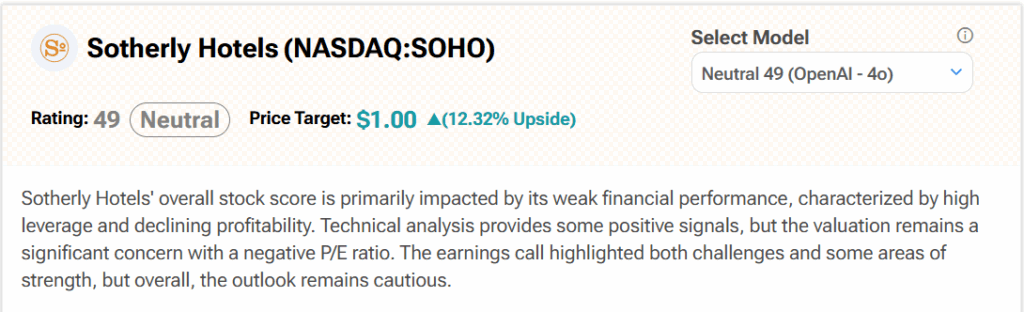

Turning to Wall Street, analyst coverage of Sotherly Hotels is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates SOHO stock a Neutral (49) with a $1 price target. It cites “weak financial performance, characterized by high leverage and declining profitability” as reasons for this stance.