SHF Holdings (SHFS) stock rocketed higher on Wednesday after the banking, lending, and financial services company announced a stock purchase agreement. This agreement is with CREO Investments LLC and allows the company to sell up to $150 million worth of SHFS stock to the investor.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Under the terms of the stock purchase agreement, SHF Holdings has the right to direct CREO Investments LLC to purchase shares of SHFS for the agreed-upon VWAP Purchase Price. The agreement states that the price of SHFS stock must be at least $1 per share, and that CREO Investments LLC will pay the lesser of 90% of the lowest sale price of the Common Stock on the applicable VWAP Purchase Date and the volume-weighted average price during the applicable VWAP Purchase Period.

To go along with this stock purchase agreement, SHF Holdings has also agreed to file a registration rights agreement with CREO Investments LLC with the SEC. This will allow for the resale of shares issued to CREO Investments LLC.

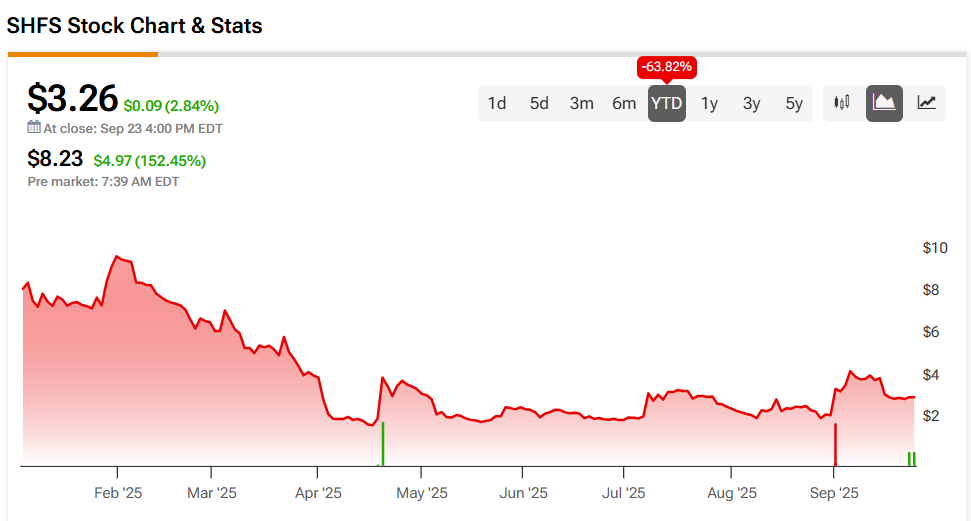

SHF Holdings Stock Movement Today

SHF Holdings stock was up 152.45% on Wednesday, following a 2.84% rally yesterday. However, the shares have fallen 6.82% year-to-date and 70.09% over the past 12 months. With today’s news came heavy trading of SHFS stock, as some 7 million shares changed hands, compared to a three-month daily average of about 1.55 million units.

Is SHF Holdings Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of SHF Holdings is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates SHFS stock a Neutral (49) with a $3.50 price target. It cites “poor financial performance, characterized by declining revenues and high leverage” as reasons for this rating.