Palantir Technologies (PLTR) has been a popular name in the AI and data analytics space, but its stock is under pressure as investors sell off shares. Despite delivering a solid Q3 performance earlier this week, the company saw its stock retreat as investors took profits and weighed concerns over high valuations. Notably, PLTR stock is down around 15% since the release of Q3 results on November 3.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

For context, Palantir reported earnings per share (EPS) of $0.21, surpassing the consensus estimate of $0.17. Its Q3 revenue reached $1.18 billion, exceeding analysts’ expectations of $1.09 billion.

Investors Pull Back From PLTR

PLTR stock dropped after earnings, as high expectations and a premium valuation left little room for error. Coinciding with its earnings report, renowned investor and hedge fund manager Michael Burry disclosed a bearish bet against Palantir, resulting in a sharp sell-off in PLTR. In a quarterly filing, Burry’s Scion Asset Management revealed it holds put options on 5 million Palantir shares.

Meanwhile, Palantir’s stock was also hit amid a broader tech sell-off, as investors weighed macroeconomic news and high valuations in AI stocks. The decline underscores the tension between strong earnings and cautious market sentiment in the AI-driven growth sector.

What’s Next for Palantir?

Despite the recent pullback, PLTR shares are still up more than 130%, driven by strong demand for AI solutions and lucrative government contracts. The stock, however, remains about 15.5% below its all-time high of $207.18.

Looking ahead, many investors believe the company can turn its advanced AI technologies into practical solutions for government and enterprise clients, making the recent pullback a potential buying opportunity.

Wall Street Reactions

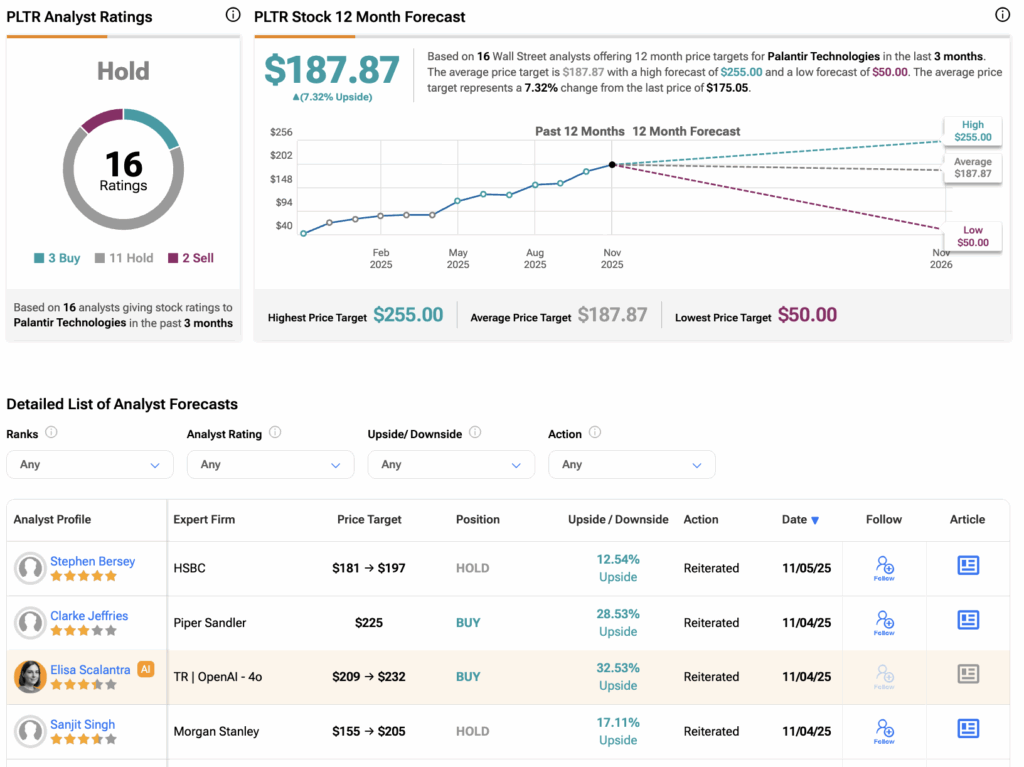

On Wall Street, analysts’ reactions to PLTR stock were mixed. While several raised their price targets, the majority maintained Hold ratings.

For instance, HSBC’s five-star analyst Stephen Bersey raised his price target on PLTR from $181 to $197 with a Hold rating. He highlighted that the company’s U.S. commercial segment is growing rapidly, projecting revenue to increase at a 59.3% annual rate from 2025 to 2029, reaching $9.3 billion by the end of that period.

Meanwhile, DA Davidson’s top-rated analyst Gil Luria raised his price target from $170 to $215. Luria called Palantir “the best story in all of software,” praising its strong U.S. demand for AI solutions, leadership in applied AI, and expanding customer base.

Is PLTR a Good Stock to Buy Now?

According to TipRanks consensus, PLTR stock has a Hold rating, based on three Buys, 11 Holds, and two Sells assigned in the last three months. The average Palantir share price target is $187.87, which implies a downside of over 7% from current levels.