Palantir (PLTR) received attention on Wednesday after HSBC raised its price target following the AI software company’s recent quarterly earnings report. Five-star analyst Stephen Bersey noted in a client update that Palantir’s U.S. commercial segment continues to grow at an impressive pace. Specifically, he projected that this segment’s revenue will rise at a compound annual growth rate of 59.3% between 2025 and 2029 to reach $9.3 billion by the end of that period.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bersey highlighted that revenue in the U.S. commercial segment jumped 122% year-over-year to $397 million in Q3 2025, which was up from 92.5% growth in Q2. He also pointed out that Palantir signed new contracts worth $1.31 billion in Q3, a sharp rise from $843 million in Q2. As a result, these numbers suggest that the company’s revenue run rate could keep climbing. However, he warned that reports from across the industry show that many internal AI projects are yielding disappointing returns on invested capital, which could eventually slow down the pace of new deals, though this isn’t specific to Palantir.

Despite these concerns, Bersey maintained a Hold rating on the stock and raised his price target from $181 to $197. The cautious rating, combined with the higher target, suggests that there is both optimism about Palantir’s growth potential and awareness of the risks associated with enterprise AI investments. And although the company’s recent surge in commercial contracts demonstrates that business momentum is still strong, whether that momentum is sustainable remains a key question for investors. Nevertheless, shares slipped in today’s trading.

Is PLTR Stock a Good Buy?

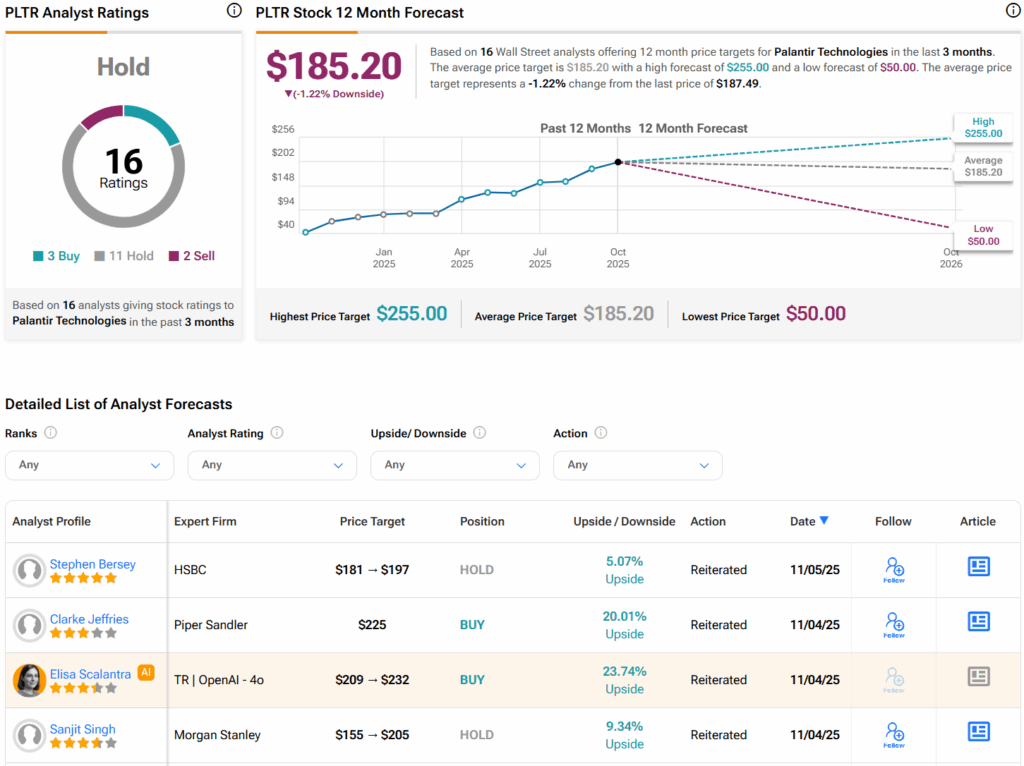

Overall, analysts have a Hold consensus rating on PLTR stock based on three Buys, 11 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average PLTR price target of $185.20 per share implies that shares are trading near fair value.