IREN Limited’s (IREN) shares plunged over 6% on Friday after the Australian data center company reported uneven quarterly results compared to the Wall Street consensus. Yet, the company posted significant year-over-year growth in both revenue and earnings per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

IREN’s first-quarter Fiscal Year 2026 report, released on Thursday, showed that its revenue skyrocketed by 355.4% from $52.76 million a year ago to reach $240.30 million. The Sydney-based neo-cloud firm also earned $1.07 per share during the quarter — a significant jump from a loss of 27 cents per share in the same period last year.

IREN Turns Loss to Profit

However, while IREN’s EPS beat Wall Street’s consensus forecast of 15 cents per share, its revenue came in below analysts’ expectations of $241.40 million — a difference of over $1 million.

With the mixed results, IREN’s shares embarked on a downward trajectory. This comes as investors appeared to ignore the fact that IREN turned its net loss of $51.7 million from the same quarter last year into about $385 million in profit.

Analysts and IREN CEO Upbeat on $9.7B Microsoft Deal

The company’s $9.7 billion deal with tech giant Microsoft (MSFT) — announced earlier this week — also appears unable to save the day.

Under the deal with Microsoft, IREN will supply Microsoft with access to Nvidia’s (NVDA) GB300 graphics processing units (GPUs) to power the tech company’s next-generation AI cloud infrastructure. The company, formerly focused on Bitcoin mining, is expected to roll out the GPUs in phases across its 750-megawatt campus in Childress, Texas.

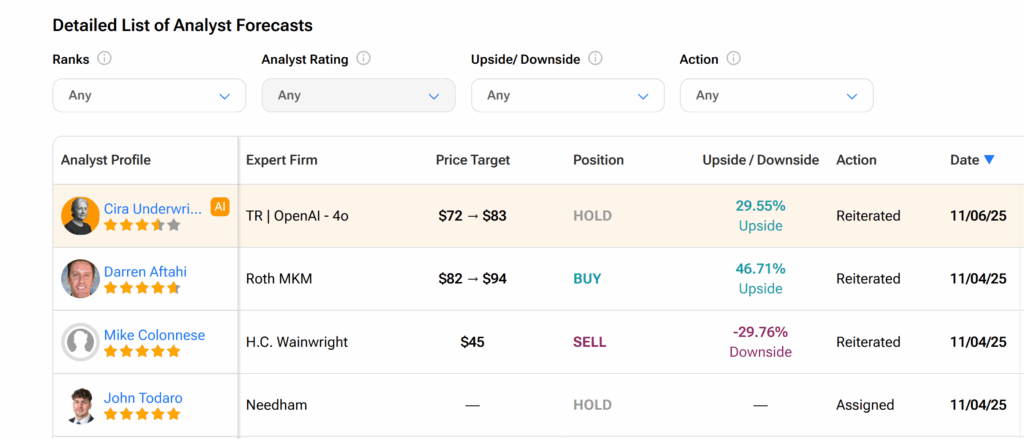

Cantor Fitzgerald analyst Brett Knoblauch, who trimmed his IREN price target by 4% to $136 per share after the release of the results, believes that more large-scale deals will come IREN’s way in the near future. Roth MKM analyst Darren Aftahi previously echoed a similar sentiment, noting that the first major deal for IREN has “more legs to it” and is the best “brand validator.”

“IREN (IREN) continues to execute with discipline, delivering record results this quarter and meaningful progress in our AI Cloud expansion,” noted Daniel Roberts, IREN’s co-founder and co-CEO, who expects the Microsoft deal to contribute to the company’s target of raking in $3.4 billion in annual revenue by the end of 2026.

Is IREN Stock a Good Buy?

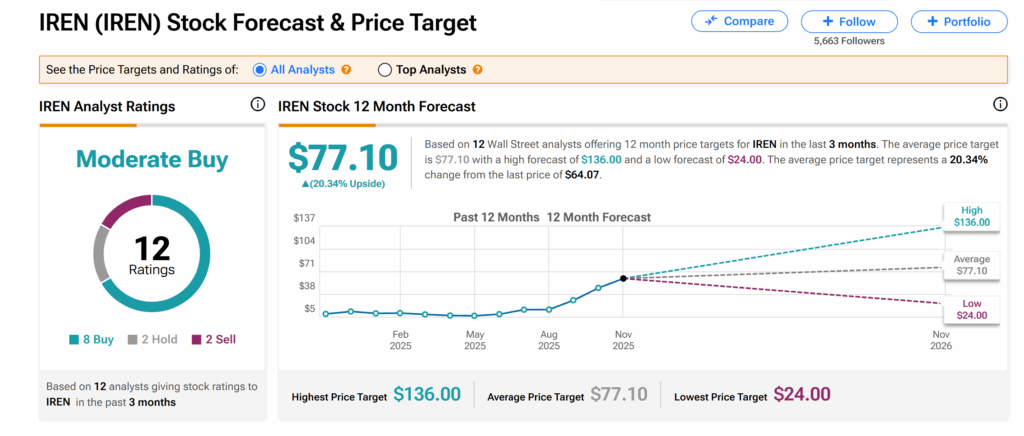

Across Wall Street, IREN Limited’s shares currently hold a Moderate Buy consensus rating, TipRanks data shows. This is based on eight Buys, two Holds, and two Sells issued by analysts over the past three months.

At $77.10, the average IREN price target indicates more than 20% upside potential from the current trading level.