IREN Limited (IREN) surged 23% in pre-market trading after revealing a major five-year deal with Microsoft (MSFT) worth approximately $9.7 billion. Under the agreement, IREN will provide access to Nvidia (NVDA) GB300 GPUs, which will power Microsoft’s next-generation AI cloud infrastructure.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The contract includes a 20% prepayment, giving IREN a strong upfront cash boost and clear revenue visibility through 2030. The GPUs will be rolled out in phases across IREN’s 750-megawatt Childress, Texas campus, which is being expanded with new liquid-cooled data centers designed to handle 200 megawatts of critical IT load.

IREN also signed a related $5.8 billion deal with Dell Technologies (DELL) to purchase GPUs and other key equipment for the buildout. The deployments are expected to continue through 2026, as the company scales up its infrastructure to meet growing AI demand.

Microsoft Agreement Ushers In a Turning Point for IREN

This deal marks one of the largest commercial GPU infrastructure agreements to date and puts IREN among the top-tier players in AI cloud services. Microsoft President of Business Development Jonathan Tinter said the partnership is about building “cutting-edge AI infrastructure” and combining Microsoft’s software capabilities with IREN’s scalable power and data center expertise.

For IREN, it’s a validation moment. Co-founder and Co-CEO Daniel Roberts called the agreement a “milestone partnership” that proves IREN’s platform can deliver reliable, large-scale GPU capacity for hyperscale clients.

The collaboration is also part of Microsoft’s broader AI expansion strategy. The company has been securing GPU supply lines and partnering with hardware providers as demand for AI computing continues to soar across its Azure ecosystem.

Funding and Execution Challenges Ahead

While the contract gives IREN strong long-term revenue visibility, it also brings near-term financial challenges. The $5.8 billion in capital spending tied to GPU and equipment purchases will require significant funding. IREN said it plans to finance the costs through a mix of existing cash, customer prepayments, operating cash flow, and new financing initiatives.

Execution will be critical. The company must ensure timely GPU deliveries, on-schedule data center construction, and smooth scaling of its AI infrastructure. Any supply chain bottlenecks or financing delays could impact deployment timelines through 2026.

Still, analysts see the deal as a transformative step. The structure of the agreement, combining guaranteed demand from Microsoft with secured power capacity at Childress, gives IREN a clear path toward sustained growth and profitability in a sector that is expanding faster than ever.

IREN Doubles Down on AI Infrastructure

The Microsoft partnership also positions IREN to compete directly with larger cloud and infrastructure providers. Its vertically integrated model, spanning power generation, data center operations, and GPU deployment, offers an edge in cost and efficiency.

The company already has 3 gigawatts of secured power capacity across North America, much of it tied to renewable sources. This positions IREN as a key supplier in the growing push for sustainable AI infrastructure.

As Roberts put it, “We’re building the backbone for the next generation of AI.”

Is IREN a Good Stock to Buy?

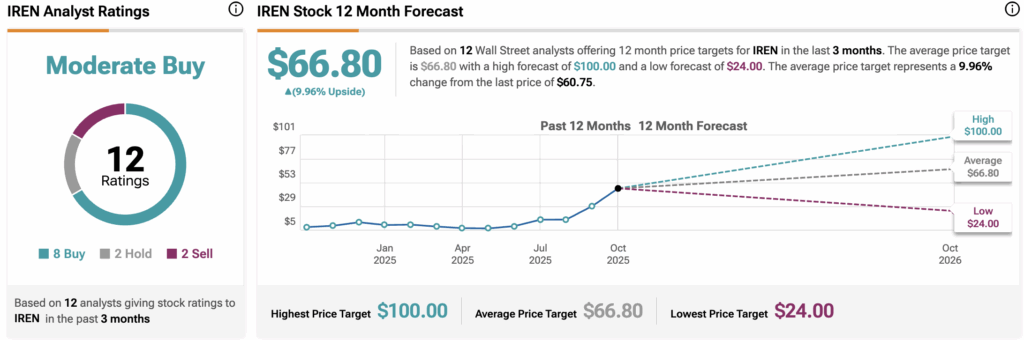

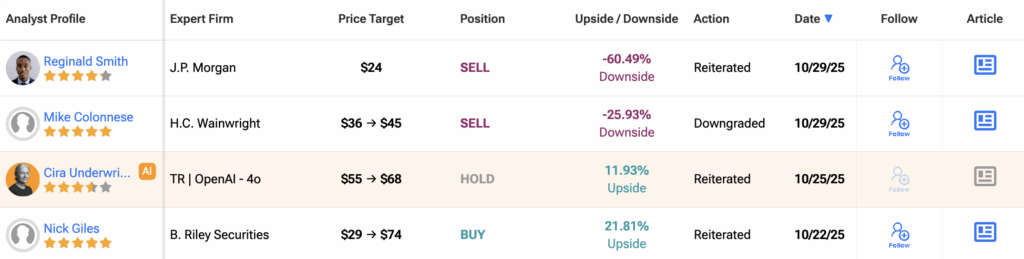

Wall Street remains moderately bullish on IREN stock. Out of 12 analysts, eight rate the stock a Buy, two suggest a Hold, and two recommend a Sell. This gives it an overall “Moderate Buy” consensus. The average 12-month IREN price target stands at $66.80, implying nearly a 10% upside from the last close.