Electric vehicle (EV) company Bollinger Innovations (BINI) stock continued to fall on Thursday, with insider trading acting as the catalyst for today’s movement. A filing with the Securities and Exchange Commission (SEC) revealed that Winvest Investment Fund Management Corp. bought and sold shares of BINI stock on October 10. This is noteworthy, as Winvest Investment Fund Management Corp. is a 10% stakeholder in Bollinger Innovations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Winvest Investment Fund Management Corp. bought 27,900 shares of Bollinger Innovations for a total of $14,787. It then turned around and sold 29,589 shares for a total of $19,824. While only reported today, this activity came before a major change for BINI stock last week. The company announced late in the week that it would switch from the Nasdaq Exchange to the OTC Markets’ OTCID market. This change went into effect on Monday.

Bollinger Innovations Stock Movement Today

Bollinger Innovations stock was down again on Thursday, extending a week of losses. The shares were trading for about 14 cents before the opening bell, compared to $1.35 five days ago. This represents an 89.6% decrease over the past five days. Investors will also note that the stock has suffered significant drops year-to-date and over the past 12 months, wiping out a huge portion of the company’s value.

With all of the recent negative movement around BINI stock, and no sign of recovery, investors are advised to be careful when considering a stake in the EV company.

Is Bollinger Innovations Stock a Buy, Sell, or Hold?

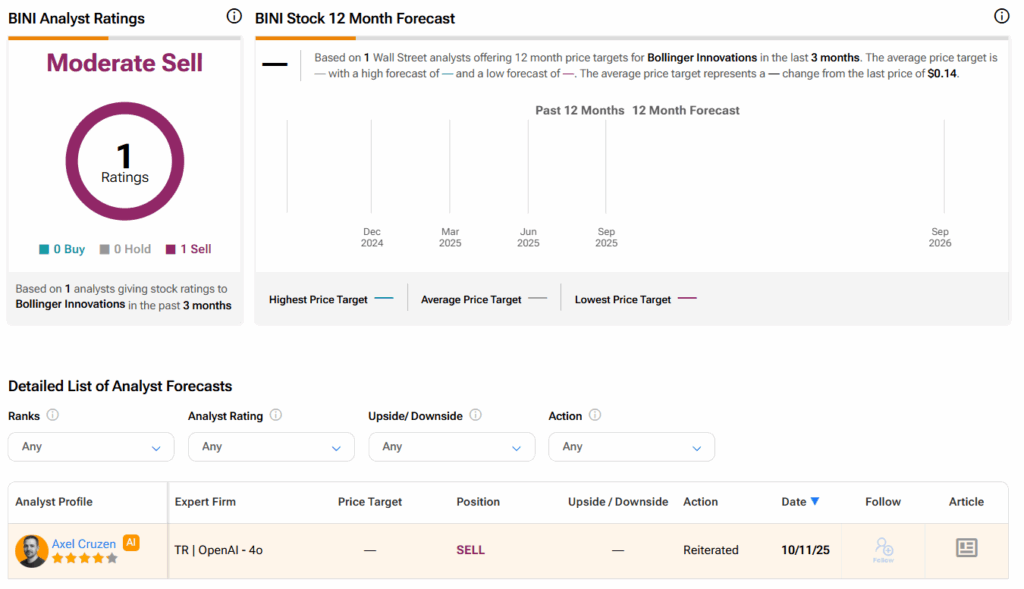

Turning to Wall Street, the analysts’ consensus rating for Bollinger Innovations is Moderate Sell, based on a single Sell rating over the past three months. Investors will note there currently isn’t an average price target for BINI stock.