Bollinger Innovations (BINI) stock plummeted on Friday after the electric vehicle (EV) company provided investors with an update on its listing status. The company confirmed that it will move from the Nasdaq Exchange to trade on the OTC Markets’ OTCID market when trading begins on Monday. It will continue to trade under the BINI stock ticker.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Bollinger Innovations provided a few reasons for its shift to the OTC Markets, including the lower cost to maintain its listing on the exchange. This also comes with fewer regulatory requirements, allowing for better time management related to compliance and reporting, which also reduces the company’s costs.

David Michery, CEO of Bollinger Innovations and Bollinger Motors, said, “Moving to the OTC Markets is a logical and financially prudent step for Bollinger Innovations. It allows us to significantly reduce our administrative burden, directly reinvesting those savings into accelerating our business strategy. We remain fully committed towards our investors as we continue our growth forward.”

Bollinger Innovations Stock Movement Today

Bollinger Innovations stock was down 59.54% in pre-market trading on Friday, following a 14.11% dip yesterday. The shares have dropped 100% year-to-date and over the past 12 months. Today’s news triggered heavy trading, with some 2.2 million shares traded, compared to a three-month daily average of about 1.23 million units. The company also saw 16.53 million shares traded yesterday.

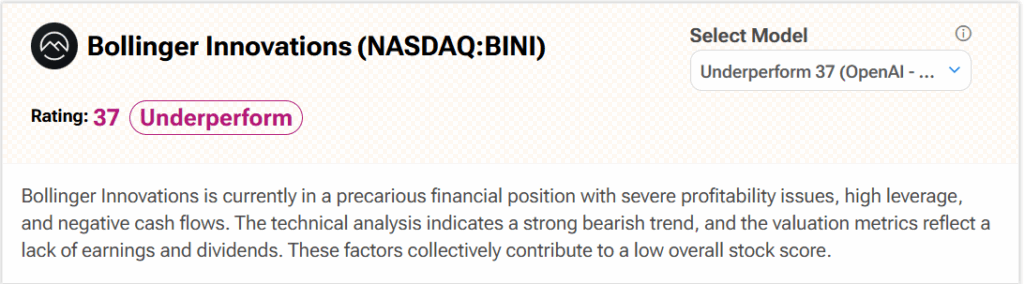

Is Bollinger Innovations Stock a Buy, Sell, or Hold?

Turning to Wall Street, analyst coverage of Bollinger Innovations is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates BINI stock an Underperform (37) with no price target. It cites “a precarious financial position with severe profitability issues, high leverage, and negative cash flows” as reasons for this stance.