General Motors’ (GM) stock recently hit a 52-week high, a notable milestone for the Detroit automaker. The rally comes as investors flock to traditional gas-powered carmakers, anticipating stronger demand if federal EV tax credits expire on September 30. Additionally, a potential rollback of emissions rules by the Trump administration could further improve the company’s outlook. GM stock climbed to an intraday high of $61.95 on Friday before closing at $61.24, up 1.07% for the day. Likewise, Ford (F) shares also hit a 52-week high on Friday, climbing 3.36%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Year-to-date, GM stock has gained around 15%. If the Trump administration moves forward with relaxing these rules, automakers would face less pressure to invest heavily in EV technology, making it cheaper to produce and sell traditional gas-powered vehicles. Investors see these potential changes as a boost for companies like General Motors, which continue to sell large volumes of conventional cars and trucks.

Automakers Support EPA Plan to Scrap Emissions Rules

Recently, a group representing most major automakers, including GM and Ford, urged the Trump administration to ease strict vehicle-emission rules that require automakers to produce more electric vehicles. The group also expressed support for the EPA’s plan to repeal the rule that classifies greenhouse gases as a threat to human health. This rule is significant because it gives the EPA the authority to regulate vehicle emissions, meaning its repeal could substantially weaken emissions standards.

On the other hand, EV leader Tesla (TSLA) has urged the Trump administration to maintain the existing emissions standards, criticizing the proposal to roll back the vehicle-emission rules.

Top Analyst Raises Price Target in GM Stock

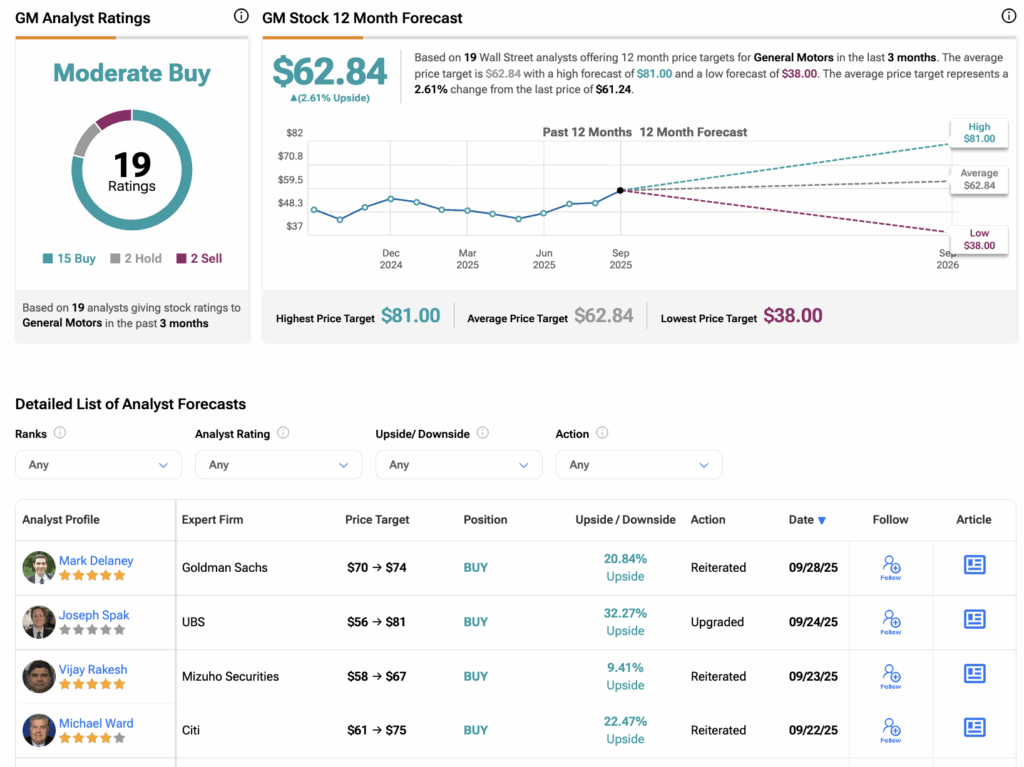

Yesterday, five-star-rated analyst Mark Delaney at Goldman Sachs raised his price target on GM from $70 to $74 while keeping his Buy rating.

Delaney raised his 2025 U.S. auto sales forecast to 16.2 million vehicles from 15.75 million and its 2026 forecast to 16.0 million from 15.5 million. This increase is based on strong year-to-date sales, Goldman’s indicators showing improving vehicle demand, and stable pricing in response to tariffs.

Is GM a Good Stock to Buy?

Turning to Wall Street, GM stock has a Moderate Buy consensus recommendation on TipRanks, based on 15 Buys, two Holds, and two Sells assigned in the last three months. The average price target for GM is $62.84, suggesting an upside potential of 2.6% from its current price.