Shares of consumer health company Kenvue (KVUE) have plunged following the Trump administration’s announcement that Tylenol use during pregnancy may be associated with a higher risk of autism. Although the announcement was made on September 22, the stock has continued to slide. The allegations had been circulating for months, but their renewed attention has contributed to a 25% decline in Kenvue’s share price over the past six months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The potential link is a serious matter, and I don’t think it’s a bad idea to take a closer look at the long-term impact of many of the drugs we use today.

From an investment perspective, however, the selloff in Kenvue stock appears overdone and presents an appealing entry point for investors seeking exposure to a company with a broad portfolio of trusted brands, an attractive valuation, and a robust dividend yield exceeding 5%. Moreover, Wall Street analysts project that Kenvue shares could climb more than 30% over the next 12 months.

What is Kenvue?

As a brief introduction for readers unfamiliar with the Kenvue name, the company was formed when Johnson & Johnson (JNJ) spun off its consumer health segment in 2023, making Kenvue a publicly traded, pure-play consumer health company.

While the Kenvue name is fairly new, the names associated with its brand of portfolios are longstanding and widely recognized as household names. Beyond Tylenol, Kenvue also owns well-known brands including BAND-AID, Listerine, Motrin, Zyrtec, Benadryl, Nicorette, and Aveeno.

Why Tylenol’s Impact on Share Price May Be Overblown

As stated above, I am not downplaying the seriousness of the allegations levied against Tylenol or saying it shouldn’t be investigated further. For its part, the company has vigorously defended itself from the allegations, stating that Tylenol “is the safest pain reliever option for pregnant women as needed throughout their entire pregnancy” and that “rigorous research, endorsed by leading medical professionals and global health regulators, confirms there is no credible evidence linking acetaminophen (the active ingredient in Tylenol) to autism.”

Many public health experts have also expressed that there is no evidence of a causal link between autism and acetaminophen (the active ingredient in Tylenol). Meanwhile, the FDA, America’s prime regulator of medicines, was more measured than Trump in its comments, clarifying that “a causal relationship has not been established,” in a letter to doctors, and that the topic is “an ongoing area of scientific debate.”

Even if the administration’s claims prove accurate, the market’s reaction to Kenvue’s stock appears excessive. Although Kenvue does not disclose revenue by individual product, analysts at BNP Paribas (BNPQY) estimate that Tylenol contributes roughly 10% of total sales. While that portion is notable, a 25% drop in share value tied largely to a product representing just 10% of revenue seems clearly disproportionate.

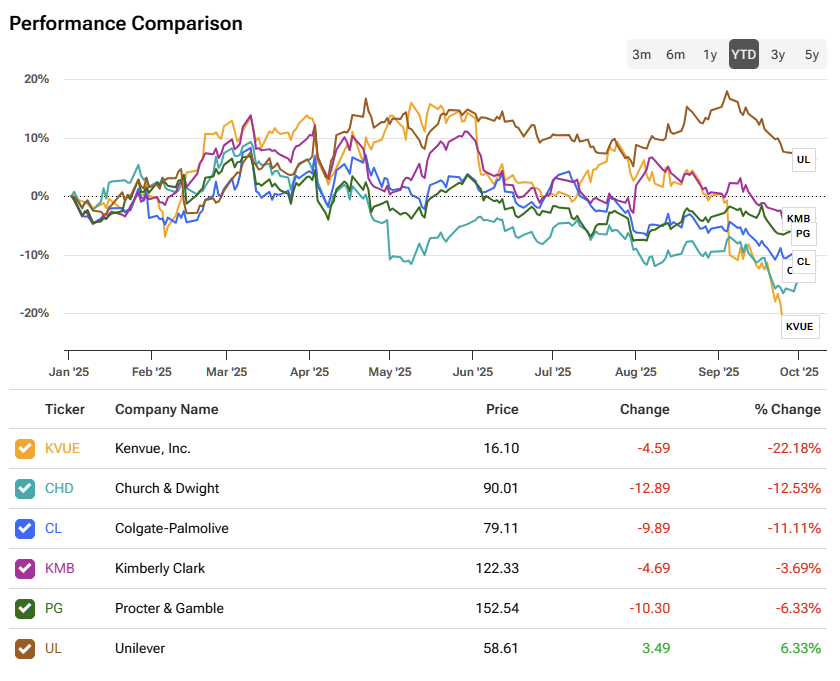

Taken together, when compared to its peers, KVUE stock has suffered the most year-to-date.

Additionally, this does not mean that all, or even most, Tylenol sales are going away — the warning is only relevant to pregnant women, who represent a small portion of Tylenol’s users at any given time. As Novare Capital Management’s James Harlow told Reuters, “This issue only involves pregnant mothers, which is a smaller subset of consumers – therefore the actual impact on Kenvue’s financials was likely always going to be modest.”

There is always the potential that the allegations could lead to lawsuits, but we are likely a long way off from this becoming a serious risk, and analysts from Citigroup (C) contend that they see “limited judicial risk,” following Trump’s bombshell a couple of weeks back. However, there may still be an impact on Tylenol consumption due to negative headlines.

Notably, there is already some precedent on Tylenol’s side effects. A Federal Judge has previously rejected a lawsuit making claims that Tylenol use during pregnancy caused autism and ADHD based on a lack of scientific evidence, but the families involved in the suit are appealing the decision.

Lastly, as stated above, Kenvue has a strong, diversified portfolio of other household brands beyond Tylenol, so I believe the company is well-positioned to weather the storm even if Tylenol sales take a meaningful hit.

KVUE’s Dividend Support in an Expensive Market

After the selloff, KVUE stock trades at an inexpensive valuation of just 15.3x 2025 earnings estimates. This valuation represents a significant discount to the broader market, as the S&P 500 is trading for nearly 23x forward earnings. For investors seeking bargains at a time when the market is trading at a historically elevated level, Kenvue presents an appealing option. If we include the dividend aspect, the stock becomes more attractive.

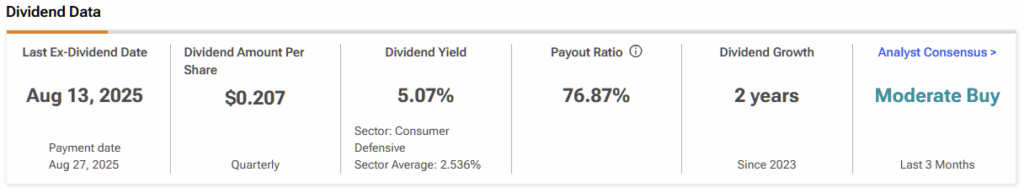

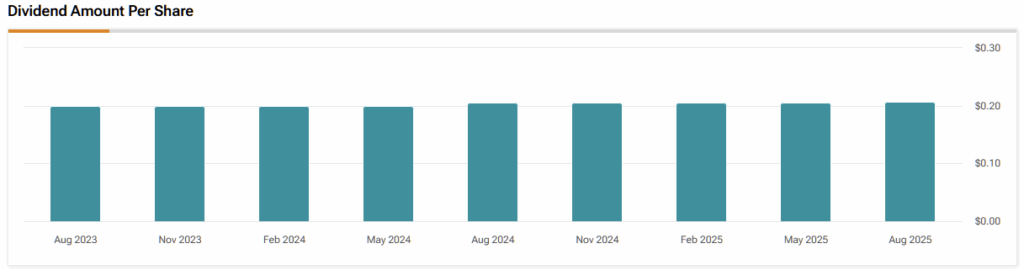

Kenvue stands out as an attractive dividend stock, offering a yield of 5.07%—roughly four times higher than the S&P 500’s current yield of 1.3% and double the sector average of 2.5%.

Since Kenvue only went public in 2023, it lacks a long track record of dividend payments. However, it’s important to note that its former parent company, Johnson & Johnson, is a Dividend King, having raised its dividend for an impressive 62 consecutive years.

What is the Price Target for Kenvue?

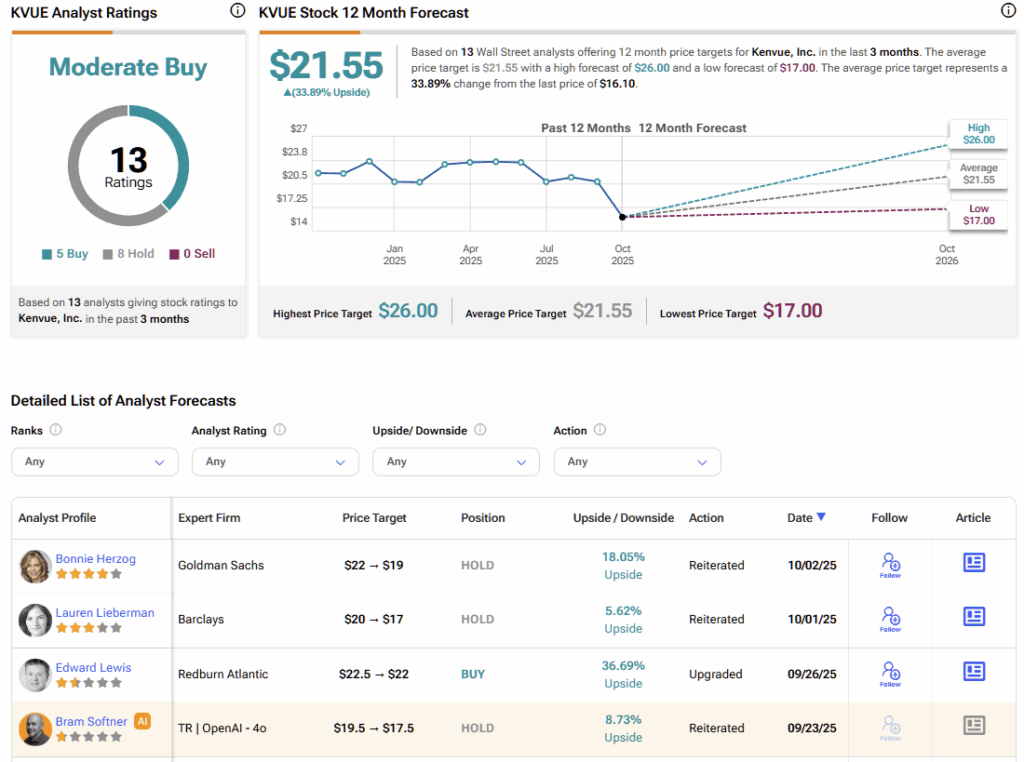

Turning to Wall Street, KVUE earns a Moderate Buy consensus rating based on five Buys, eight Holds, and zero Sell ratings assigned in the past three months. The average KVUE stock price target of $21.55 implies almost 34% upside potential.

Kenvue’s Selloff Creates Buy-the-Dip Opportunity Amid Tylenol Concern

While the claims about Tylenol are a serious matter, the selloff in shares of Kenvue appears to be an overreaction. Not all Tylenol users are pregnant women, so it’s not as if Tylenol sales are going to somehow dry up overnight.

Additionally, Tylenol is just one of Kenvue’s many iconic brands, contributing to a well-diversified revenue base that can help cushion any potential impact from declining sales of a single product. As such, I view the current selloff as a compelling opportunity for risk-tolerant investors. I remain confidently Bullish on Kenvue stock, anticipating a rebound by year-end as the market refocuses on the company’s strong brand portfolio, attractive valuation, and generous dividend yield—while also recognizing that Trump’s all-sweeping policy statements often prove less consequential than initially feared.