Shares of Chewy (NYSE:CHWY) went public in 2019 and were trading at all-time highs in 2021 as the COVID-19 pandemic acted as a massive tailwind for e-commerce stocks. Today, Chewy stock trades 85% below all-time highs, trailing the broader markets by a wide margin. Nevertheless, I think Chewy stock can recover in 2024 and deliver outsized gains for shareholders. I remain bullish on Chewy due to its leadership position, improving profit margins and recession-resistant business.

An Overview of Chewy

Chewy, valued at $7.76 billion, is an online pet retailer launched in 2011. It aims to combine the personalized service of a physical retail store with the convenience and speed of e-commerce.

Over the years, Chewy has increased its portfolio of products, currently offering a selection of more than 110,000 items, including its line-up of private brands.

How Did Chewy Perform in Q3 of Fiscal 2024?

Chewy reported revenue of $2.74 billion in Q3 of Fiscal 2024 (ended in October), an increase of 8% year over year. The company stated that it continues to capture more market share, as the broader industry has seen growth in the low single digits in recent months, coinciding with pet inflation reverting to historical averages.

Chewy’s focus on improving the bottom line allowed it to end Q3 with an adjusted EBITDA (earnings below interest, tax, depreciation, and amortization) margin of 3%. It reported record gross margins of 28.5%, reflecting the strength of its product mix, strong customer engagement levels, tightly managed promotional spending, and strong logistics performance.

Chewy stated that revenue growth was driven by strong demand during Black Friday weekend, the most important holiday shopping week of the year, as traffic and sales exceeded expectations across categories.

Chewy Is Positioned to Grow

Chewy remains well poised to drive improved active customer trends as the macro environment and pet household formation trends recover. For instance, Chewy demonstrated its ability to grow wallet share among customers as net sales per active customer, or NSPAC, rose 14% year-over-year to $540 in Q3.

Chewy’s customer engagement remained strong amid an uncertain macro backdrop. Similar to other retail companies such as Walmart (NYSE:WMT) and Costco (NASDAQ:COST), Chewy should experience strong demand across market cycles, as pet owners are unlikely to reduce spending significantly. Moreover, its mix of Non-Discretionary Consumables and Health, combined with its Autoship subscription service, results in stable and recurring sales.

Autoship is a subscription service offered by Chewy. Here, customers sign up for products such as pet food and medication that are delivered at regular intervals, resulting in recurring orders and cash flow. The loyalty and spending resiliency of Autoship customers remain a key driver of sales for Chewy, even as it expands its subscribers over time.

Autoship customer sales outpaced revenue growth in Q3 and were up 13%, accounting for 76% of net sales. Non-Discretionary Consumables and Health categories collectively represented 85% of net sales in Q3.

Chewy emphasized that pharmacy products continue to grow at a premium and surpassed $1 billion in the last 12 months, making it the largest pet pharmacy in the U.S.

Chewy Is Expanding

While Chewy has established a presence in the U.S., it is looking to enter other markets. In September 2023, the company launched in Canada, bringing its value proposition to millions of pet parents north of the border. Chewy maintained strong initial customer demand in Canada, and Autoship sign-up rates are robust.

Chewy recently announced it will enter the veterinary practice business, which includes emergency and routine care as well as pet surgery. The pet retailer will open its first practice in Florida, unlocking another revenue stream for the company.

Chewy’s expansion into vet care will be a long-drawn process. However, it offers Chewy another channel to sell its products to pet owners.

Is CHWY Stock a Buy, According to Analysts?

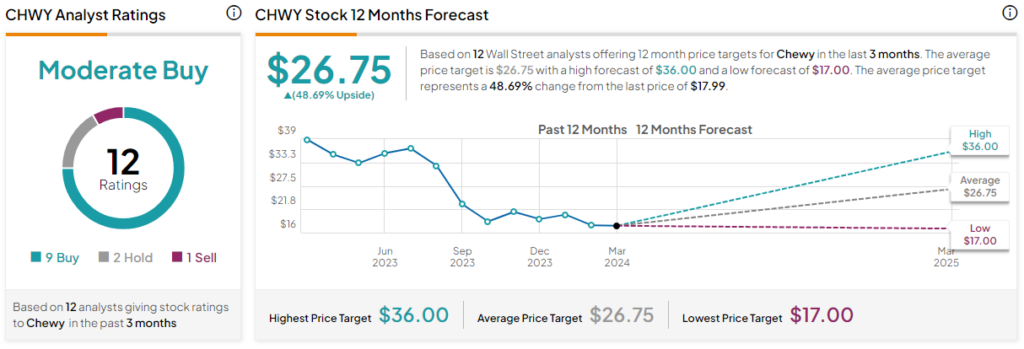

Out of the 12 analyst ratings given to Chewy stock, nine are Buys, two are Holds, and one is Sell, indicating a Moderate Buy consensus rating. The average Chewy stock price target is $26.75, indicating an upside potential of 48.7% from current levels.

Chewy stock trades at a massive discount to consensus price target estimates due to its attractive valuation relative to its growth potential. Analysts expect Chewy to report adjusted earnings of $0.57 per share in Fiscal 2024 (which ended in January) and $0.68 per share in Fiscal 2025.

So, CHWY stock is priced at 31.9 times 2024 earnings and 26.5 times 2025 earnings. Comparatively, the sector median earnings multiple is lower at 15.7x. However, growth stocks like Chewy command a premium valuation due to a widening earnings base.

The Takeaway

Chewy’s improving profit margins and earnings profile have not translated to share price appreciation. Moreover, Chewy is still in the early stages of a compelling growth cycle surrounding the global pet landscape. Its reasonable valuation and widening revenue streams make it look like a top stock to watch right now.