Advanced Micro Devices (AMD) plunged from roughly $220 per share in March 2024 to a multiyear low of ~$76 in April—just around Liberation Day. Remarkably, the stock has since retraced its entire decline, climbing back above $220 in less than six months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While part of this surge reflects the broader rebound in U.S. equities, AMD’s underlying fundamentals have also strengthened. The company’s Data Center segment continues to post robust growth across both AI accelerators and server CPUs, providing a solid backbone for performance. Expectations for the upcoming MI350 and MI400 series have risen as well, supported by meaningful improvements in efficiency per watt and cost per trained model—driving upward revisions in revenue and earnings projections.

The real catalyst arrived in early October, when AMD announced a multi-year partnership with OpenAI, sparking renewed optimism about its long-term growth trajectory.

Recent quarters have underscored that prior market projections were too conservative. However, with valuation multiples now approaching historical peaks, much of that optimism appears priced in. Balancing strong execution against elevated expectations, I view AMD as fairly valued at current levels and maintain a Hold stance.

Next-Gen GPUs and OpenAI Fuel AMD’s Rally

Large-cap tech stocks are going through a revolutionary period fueled by the ongoing AI boom, and even the so-called laggards in this technological race can leap back into the lead peloton almost overnight. Take AMD, for example: on October 6, the company announced a major multi-year deal with OpenAI to supply GPUs, and the stock surged nearly 40% in just three trading sessions. Welcome to the AI stock era.

Part of the agreement also includes a warrant for OpenAI to buy 160 million AMD shares at just $0.01 each. If OpenAI exercises the warrant in full, Sam Altman’s company could end up owning roughly 10% of AMD for a negligible cost—equivalent to tens of billions of dollars at today’s multiples.

The arrangement benefits both sides. For AMD, it guarantees a multi-year anchor customer for its next-generation GPUs, like the MI450, with the deal expected to add around $100 billion in revenue over four years. It also sends a strong market signal that AMD can finally go head-to-head with Nvidia (NVDA). For OpenAI, it means securing six gigawatts of machines, starting with the MI450, which will be delivered from the second half of next year and spread over several years.

The practical effect has been a significant upward revision of AMD’s long-term revenue forecasts, particularly from 2027 onward. Six months ago, the market projected AMD’s five-year revenue CAGR at 16.6%. Before the partnership announcement, it had already climbed to 18.5%. Now, after the deal, analysts are projecting a five-year CAGR of 22.6%. It’s no surprise, then, that AMD’s stock has seen such a massive re-rating.

The GPU Scarcity Environment

But once again, the magic words “demand is better than expected” were warmly welcomed, especially by AI-led companies still benefiting from the asymmetry of explosive demand and limited supply.

This time, those words didn’t come from AMD or Nvidia, but from one of their biggest customers: the hyperscaler Microsoft (MSFT). The software giant recently announced that its data center crunch will last longer than previously expected. This means that demand for cloud computing is outpacing the company’s ability to expand capacity, despite massive multi-billion-dollar investments in cloud infrastructure. Clearly, this shortage is a direct reflection of surging demand for AI computing power, particularly for running and training large language models.

So where does AMD fit into this story? GPUs are the most vital component powering AI data centers. While Nvidia currently dominates this market by an insanely wide margin, AMD is one of the few credible alternatives for hyperscalers like Microsoft. AMD’s MI-series accelerators (e.g., Instinct MI300X) are being adopted in AI clusters, and Microsoft has recently announced partnerships to deploy these chips in its data centers. In other words, AMD is now directly in the same growth channel that’s creating shortages at Microsoft. And ultimately, when demand outstrips supply, pricing power emerges—and margins typically improve.

Unsurprisingly, this has also led to upward revisions in long-term EPS. Just a month ago, the five-year EPS CAGR was projected at 26.9%. Today, it’s estimated at 29.2% over the same period.

Has the Market Already Counted the Gains?

As AMD shares rebounded from their lowest forward P/E multiples in April this year (around 20x) to now about 55x, some might argue that these upward revisions have already priced in most of the upside, meaning the stock is at least fairly valued relative to these emerging catalysts.

In my view, even though AMD is still trading below its all-time forward earnings multiple of over 63x reached in early 2024, being close to these levels now puts the thesis in a position where overdelivering becomes crucial, leaving virtually no margin for error.

In about three weeks (early November), AMD is scheduled to report Q3 earnings. The company is guiding for revenues of $8.7 billion at the midpoint, while analysts expect slightly above that at $8.73 billion. While partnerships and industry-wide updates on GPU demand are strong long-term structural bullish signals, there are some delicate points to watch in the short term. For instance, in the CPU segment, AMD could face renewed competition from Intel (INTC), now partnering with Nvidia, which may try to reclaim market share that AMD has gained in recent years.

Even more concerning is the pressure on margins. In Q2, AMD was hit by strict U.S. export restrictions, resulting in a GAAP gross margin of 40%—a sharp drop from 49% in the same period last year. This directly impacted the data center segment, which posted an operating loss of $155 million, compared to a $740 million operating profit a year earlier.

Given these headwinds, there’s a relatively high probability that short- to mid-term results could temper AMD’s momentum, especially now that the stock is trading at elevated multiples that appear to already reflect much, if not all, of the implied long-term upside.

Is AMD a Buy, Hold, or Sell?

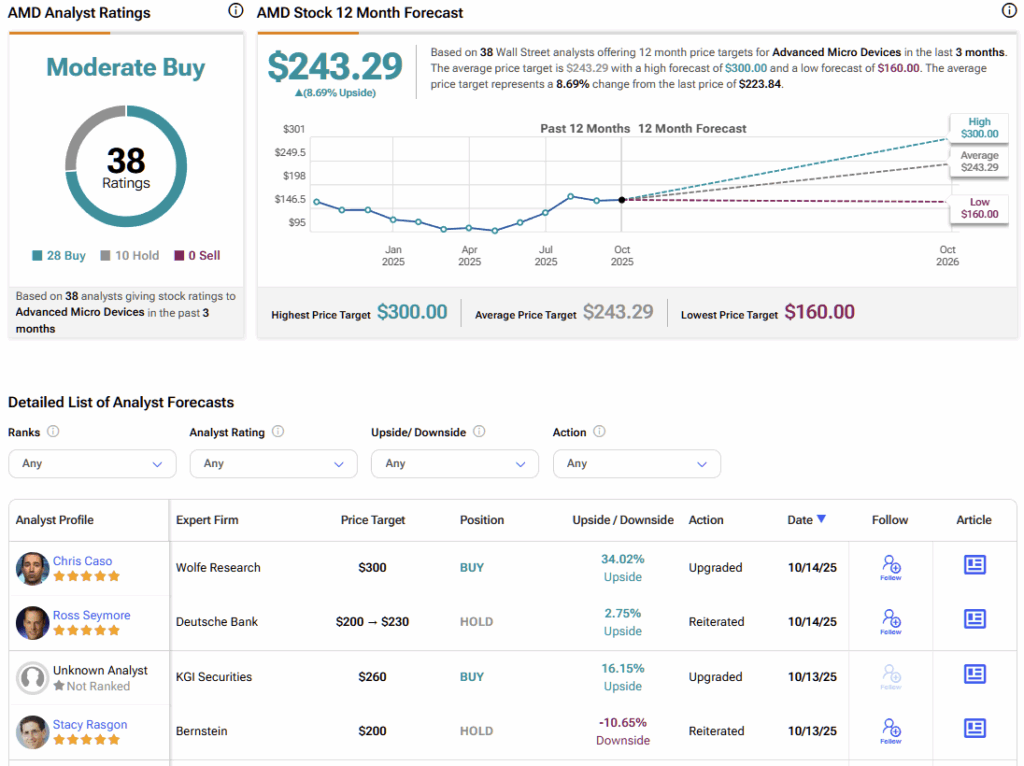

Wall Street consensus on AMD stock is generally bullish, though there’s still room for some skepticism. Of the 38 analysts covering the stock, 28 are bullish, while the remaining 10 are neutral with no bears in sight. AMD’s average price target stands at $243.29, implying roughly 8% upside from the current share price over the coming 12 months.

AMD’s Rally Comes with Strings Attached

If there’s one company that can realistically go “head-to-head” with Nvidia today, it’s AMD. Recent catalysts—like the OpenAI agreement and the ongoing tailwinds from AI demand/supply dynamics—have made future top- and bottom-line growth more predictable. However, the massive rally over the past six months seems to have already priced in the perception of a narrowing gap in the GPU market with Nvidia.

That said, I would rate AMD as a Hold. The stock’s current multiples feel risky given a couple of potentially unstable quarters ahead. AMD is now firmly in “overdeliver-or-bust mode,” and the chance of the price retreating to mid-2024 levels may be higher than that of a sustained, significant upside—at least until new evidence proves otherwise.