It’s not only those three little pigs who have been shaking their heads at the sturdiness of housebuilders this year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The iShares U.S. Home Construction ETF (ITB), whose holdings include D.R. Horton (DHI) and Lennar Corporation (LEN), has huffed and puffed and blown 3.96% lower in the year to date and 5.34% in the last three months.

That’s left it as one of those U.S. ETFs lurking in the corner compared with those surging tech and finance peers lording it up on the penthouse balcony.

The U.S. housebuilding sector has had its own big bad wolves this year. It has been in the doldrums partly down to mortgage rates hitting historically high levels and making borrowing less affordable for home buyers, weakening consumer confidence over the state of the economy and the jobs market and higher raw material costs for builders partly down to higher tariffs on imports such as lumber.

Price and Inventory Pressure

Higher inventories as new homes remain unsold and existing owners stay put have also led builders to offer more margin-munching incentives to get sales moving.

Indeed, figures from the National Association of Home Builders found that nearly four in 10 builders cut prices in September, while 65% used incentives.

According to the S&P CoreLogic Case-Shiller Home Price Index, which tracks residential real estate prices, that’s impacting house prices. The 6.5% figure year-over-year home price increase for the U.S. in March 2024 has now dwindled down to around 1.5%.

Adding to the gloomy picture is the number of new housing units in private buildings that have received an official building permit from a local authority. They have been falling for over three years now.

But builders are still building despite the demand squeeze.

D.R. Horton said at the end of its 2024 fiscal year it had 29,600 homes in inventory, of which 19,600 were unsold.

David Auld, executive chairman of D.R. Horton, said at its recent Q4 earnings unveiling: “New home demand is still being impacted by ongoing affordability constraints and cautious consumer sentiment, and we expect our sales incentives to remain elevated in fiscal 2026.”

It said homebuilding revenue for the fourth quarter decreased 4% to $8.6 billion, and homes closed decreased 1% to 23,368 homes. Homebuilding pre-tax income decreased 30% to $1.0 billion. Average sales price in the quarter fell 3% from the previous year to $365,600.

Its gross margin on home sales fell to 20% from 21.8% the previous quarter as it offered people larger incentives to buy. It said it was leaning heavily into its promotion of buying down mortgages to 3.99%.

Lennar, in its Q3 results, reported earnings per share of $2, missing estimates. At the same time, sales decreased by 6.3% year-over-year, with revenue hitting $8.81 billion. This also missed analysts’ expectations of $8.97 billion.

Lennar saw new orders jump by 12% to 23,004 homes, while deliveries stayed relatively flat at 21,584 homes. It said the challenging housing market headwinds meant it had to adjust prices in order to match market conditions. Nevertheless, Lennar kept up its pace by using targeted incentives, such as mortgage rate buydowns, which resulted in 4.7 sales per community each month.

Shares Buckle

Its share price has buckled 30% over the last 12 months. D.R. Horton has seen its share price fall 13% over the same period – see below:

The risk is that more bears will come out of the woods to stalk housing stocks as investors do their “window dressing” before the end of the year.

Stephen Kim, analyst at Evercore ISI picked up on the downbeat house party mood in early October when he downgraded six major public builders – D.R. Horton, KB Home (KBH), Meritage (MTH), PulteGroup (PHM), Toll Brothers (TOL) and Tri Pointe Homes (TPH) to In-Line from Outperform.

He said that even though there was a housing deficit in the U.S. it “does not allow the builders to build a lot more houses unless you want home prices to fall.”

He also pointed out that although mortgage rates have come down from around 7% at the start of 2025 to just over 6% today, buyers have remained few and far between.

“The softer-than-expected response to the recent drop in mortgage rates reflects the fact that affordability wasn’t really the main culprit behind this year’s sluggish demand in the first place,” Kim wrote in the report. “We believe the issue has been weak consumer sentiment rather than high rates.”

Stable margins are essential for the stocks to command higher price-to-earnings multiples, Kim added. He is confident though that builders can still command higher valuations in the long run. He believes that “margins must bottom before the stocks can rerate, and we do not believe that this will materialize in the next several months.”

Record Property Equity

Still, lower mortgage rates – which are forecast to drop to around 5.9% by the end of 2026 – could eventually spark buyer interest. An improving economy if tariff impacts begin to ease and both Fed rates and inflation fall could also drive more demand.

Those buyers could be first-timers looking for paint-fresh new homes or those people who have been locked in their homes since the spike in mortgage rates since 2022. They are the owners with their ‘low at the time’ mortgage agreements in their back pockets reluctant to sell up and take on those much higher current rates.

However, it’s those Americans sitting at home with record levels of property equity – around $36 trillion according to Federal Reserve Bank of St Louis figures – which are more likely to spring back into life.

“People who’ve owned their homes for a decade or longer can stomach price cuts if they need to move,” said David Russell, Global Head of Market Strategy at online brokerage TradeStation. “This may drag on prices as transactions increase.”

A recent report from the National Association of Realtors found that only 1 buyer in 5 were first-timers last year – a record low. The average age of that first timer was a relatively seasoned 40, so not too many young families getting onto the property ladder.

In contrast, estate agents are seeing what they describe as familiar faces either upgrading to a new home or getting something smaller with that equity treasure chest.

Good news for builders, right?

Low Rates Paradox

Well, anyone who has ever gone through the process of buying or selling a home should know that the market has its idiosyncrasies. Here is another one.

Because existing homes have not been hitting the market in large numbers this has given newer homes – those builders have toiled and sweated to construct -a bigger market share.

New home sales represented 14.5% of the market in 2024, the highest percentage since 2005. They have historically averaged 10-12% of all home sales.

Which means that if rates continue to go lower and those existing owners sell, -either the well cared for white picket fence properties or the more ramshackle tin cans as doorbell variety – then it will create more sales competition for builders.

” Even if it sounds counterintuitive, lower rates aren’t necessarily good for builders because competition can increase. There’s a paradox of mortgage rates because lower borrowing costs can bring sellers off the sidelines. That can increase the supply of existing homes, threatening the builders’ pricing and market share,” said Russell at TradeStation. “Homebuilders enjoyed a dominant position in recent years because high rates locked existing homes out of the market. That changes as rates fall.”

Homeowners are not holding back when it comes to selling it seems. One of every six U.S. home sellers dropped their asking price in August, up from 15.9% a year earlier. It marks the highest share for that month in records dating back to 2012.

They are doing it because they believe continued economic uncertainty and high inventory numbers means that it is still a buyer’s market in the U.S.

“New home sales are expected to outperform again in 2025, but competition will be growing from existing sellers,” said Danielle Hale, chief economist at Realtor.com.

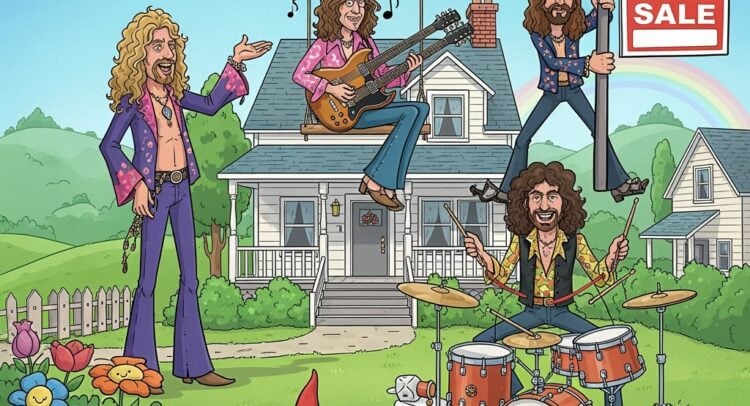

On The Wrong (Jimmy) Page

Also bringing more existing inventory to the market are institutional investors. According to analysis from Parcl Labs, institutional investors are now selling more homes than they buy and have been doing so for six consecutive quarters. These landlords include Invitation Homes (INVH), Progress Residential and FirstKey Homes.

“They’re not exiting the space, just diverting capital into build-to-rent communities. But this shift means less competition for small investors and traditional homebuyers, while also adding more rental supply, which is needed in today’s market where younger adults often opt to rent since they can’t afford to buy a home,” Rick Sharga, founder and CEO of CJ Patrick Co, told CNBC.

It’s all rather unwelcome news for U.S. housebuilders and investors in the sector. Instead of a stairway to heaven as rates fall, they are more likely to be nervously humming another classic from British rockers Led Zeppelin – ‘When the Levee Breaks’ as a flood of property comes onto the market.

“Market position is one of the most important considerations when investing in stocks because companies with falling market share often struggle — regardless of industry,” Russell said. “Pricing matters. Few investors want to invest in sectors where selling prices are under pressure.”