Tech giant Microsoft (MSFT) is basically the gold standard in many offices. Microsoft 365 offers up the standard slate of tools from Excel to Word and beyond. But with some recent issues about availability—and thus, reliability—a major competitor is rising to take advantage of Microsoft’s failures: Alphabet (GOOGL). And worse yet, Alphabet has a serious proposition for Microsoft users. This left investors on the back foot, and sent shares slipping fractionally in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Basically, Alphabet is setting up its counter-marketing on one central premise: it is only a matter of time until 365 fails, again. It refers to Microsoft’s 365 outages as “…frequent and severe,” and is encouraging users to keep Google tools like Gmail and Google Meet on hand to back up Outlook and Microsoft Teams “…when and for how long, not if…” they fail.

Alphabet explained further, noting, “Workspace, with support from our partners, will sync emails, calendars, chat, and more with Microsoft 365, so customer data is right where organizations need it, without requiring migration. This can protect against disruptions to the core business and impacts to customers.” Alphabet is also rolling out a “Work Transformation Set” that offers a replacement to Microsoft 365 for those who want out for good.

Choking on the Price Tag

That was bad news enough for anyone, but it got worse, as the price on the next Xbox may have leaked out online. And this time, the price tag might be a real disaster, not just to gamers, but to Microsoft’s own bottom line.

Reports suggest that the next Xbox will come with a four-figure price tag. The report noted, “I don’t see Xbox Magnus as likely being a direct competitor to the next-gen PlayStation console anymore. This is due to how much more Magnus will cost to make compared to the PS6. Compared to PC gaming systems, it will be much more favorable. I definitely think it will cost more than $800. But don’t think it needs to cost more than $1,200.”

Is Microsoft a Buy, Hold or Sell?

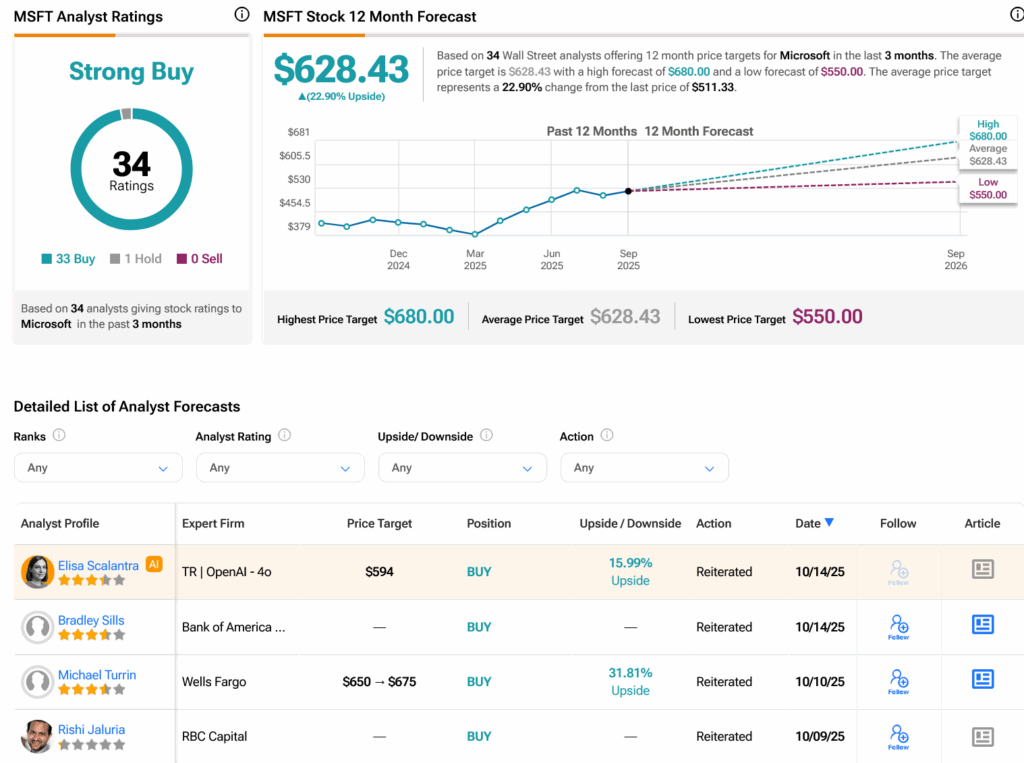

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 33 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 23.21% rally in its share price over the past year, the average MSFT price target of $628.43 per share implies 22.9% upside potential.