Robinhood’s (HOOD) stock dipped more than 10% during extended trading on April 28, after the company reported Q1 2022 results that missed Wall Street’s expectations. TipRanks’ Website Traffic tool hinted at these disappointing results.

An online brokerage, Robinhood operates a platform that allows people to trade stocks, options, cryptocurrencies, and other assets. The platform is popular with retail investors.

Robinhood does not charge its customers a trading fee. Instead, it makes money primarily from order flow payments. Therefore, the volume of orders that customers generate has a big impact on the company’s earnings. Visits to its website generally reflect the amount of customers Robinhood has.

Q1 Numbers at a Glance

Revenue fell 43% year-over-year to $299 million, missing the consensus estimate of $355.78 million. The loss per share of $0.45 improved from a loss per share of $6.26 in the same quarter the previous year, but still missed the consensus estimate of $0.36 loss per share.

What Went Wrong for Robinhood?

Robinhood’s results were weighed down by a slowdown in activity on its platform. For example, the company had fewer monthly active users at 15.9 million versus 17.7 million a year ago. Amid the market uncertainties, Robinhood customers with modest balances are cutting back on trading, the management explained during the earnings call.

What is Next for Robinhood from Here?

Robinhood believes the current weakness is temporary and that the future is bright. While the challenging economic times have pressed customers with modest accounts, larger customers have remained active. In a bid to attract more customers and stimulate activity on its platform, Robinhood is introducing more products and features and expanding abroad.

The broker has recently added support for additional cryptocurrencies, including the much-requested Shiba Inu. It has also introduced a digital wallet that gives customers more control of their crypto assets as they can now transfer them in and out of the Robinhood platform. Robinhood’s expansion of extended trading time is another important move that could attract more people interested in operating on the platform.

Robinhood has agreed to acquire UK-based Ziglu as part of its international expansion efforts. Ziglu offers various financial services, including crypto trading and money transfers.

Robinhood CFO, Jason Warnick, said, “We’re building a really strong foundation for future growth.”

Robinhood CEO, Vlad Tenev, commented, “Looking ahead, we have a suite of new products and services slated for release that we believe will excite and delight our customers.”

Wall Street’s Take

Mizuho Securities analyst Dan Dolev recently maintained a Buy rating on Robinhood stock with a price target of $19, which indicates 88.3% upside potential.

The stock has a Hold consensus rating based on four Buys, four Holds, and three Sells. The average Robinhood price target of $15.91 implies 57.7% upside potential to current levels.

Website Traffic

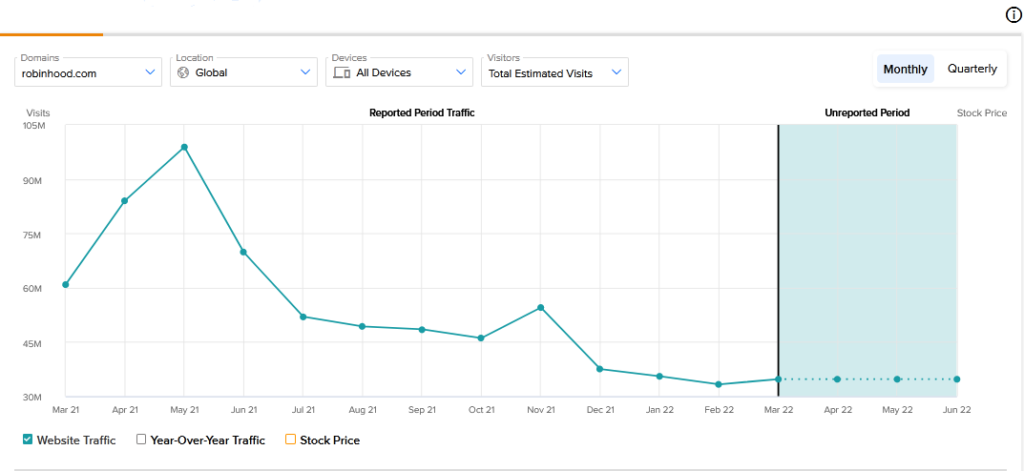

During Q1, Robinhood’s Website Traffic Tool recorded a 55% year-over-year drop in total visits. Website traffic trend can help investors assess customer interest in a company’s products or services, which can in turn help in gauging the company’s likely performance.

In Robinhood’s case, the traffic decline correctly predicted the company’s weak earnings results. Ahead of earnings, investors could see that HOOD likely had a drop in monthly users.

Learn more about the Website Traffic tool in this video by Youtube sensation Tom Nash.

Key Takeaway for Investors

Although Robinhood’s Q1 loss was surprisingly larger than what Wall Street had expected, the company actually managed to sharply narrow its loss from the same quarter last year. The recently announced staff layoff could open more opportunities for the company to cut its costs to further narrow its loss. However, there are still more potential headwinds that could slow Robinhood. For example, the Fed’s rate hikes and balance sheet reduction could further squeeze Robinhood’s modest accounts and keep platform activity low.

Investors who keep an eye on ongoing website traffic trends at HOOD will know what to expect from its next earnings report.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Why Did Apple Shares Drop Despite Q2 Beat?

ServiceNow Shares Up 8% on Q1 Beat

How Did Rivian Impact Amazon’s Poor Q1 Result?