The world’s richest man is set to become even richer. Elon Musk has once again rewritten the playbook for corporate compensation — and for Tesla (TSLA) shareholders, the stakes could hardly be higher. At Tesla’s annual general meeting in Texas this week, investors approved a record-breaking $1 trillion pay package for the world’s richest man, with 75% of votes cast in favor.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The vote not only reaffirmed Musk’s control over the EV maker but also tied the eye-watering reward to a decade-long series of ambitious performance milestones that are set to reshape Tesla’s future. Namely, TSLA is seeking to transition away from EV production to embrace robotics as its new lodestar.

The approval came after months of controversy, although the markets had been expecting it. Critics, including Norway’s trillion-dollar sovereign wealth fund, argued that the package rewards “unchecked power” and dilutes existing shareholders. Yet, most investors chose to back the billionaire whose leadership turned Tesla into a $1.5 trillion company — more valuable than all other Western carmakers combined. For many, the logic was simple: Tesla’s success is inseparable from Musk.

What the Vote Means

The package gives Musk the opportunity to boost his ownership by 12%, ultimately giving him control of almost 25% of Tesla’s stock if all targets are met. Notably, Musk purchased $1 billion worth of TSLA stock in September this year. To unlock his trillion-dollar payoff, Musk must expand TSLA’s market cap from $1.5 trillion to $8.5 trillion and increase earnings 24-fold to $400 billion over the next decade.

Musk has emphasized that his focus will be on scaling Tesla’s next-generation ventures in AI, robotics, and autonomous driving, while forgoing any salary or cash bonuses through 2035. According to the terms of his proposal, Musk’s compensation will be solely through performance-based stock options.

The pay package, coming at a time of austerity for many people, inevitably raises questions about equality. However, viewed through the lens of performance-based compensation, Musk could reasonably argue that his payout is proportional to the value he aims to create. If his innovations and technological breakthroughs were to drive Tesla’s valuation to $8.5 trillion and annual earnings to $400 billion, then a $1 trillion reward might not seem disproportionate after all.

At the meeting, Musk celebrated his endowment with his trademark mix of pomp and spectacle: techno music, neon lights, and two Optimus humanoid robots dancing beside him. He painted a picture of an AI-driven future where Tesla robots “perform surgery better than humans” and “eliminate poverty.” Possibly as an inside tip, or maybe simply some PR bluster, Musk urged investors to “hang on to your Tesla stock,” hinting that the company’s next chapter — from robotaxis to humanoid robots — could dwarf the EV business.

The Good for Shareholders

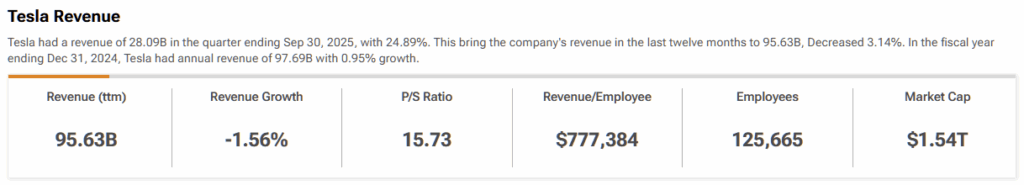

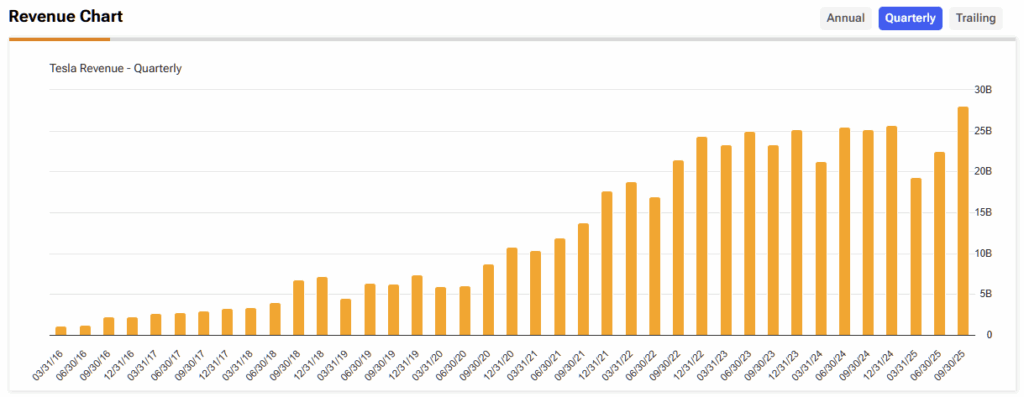

For bullish investors, Musk’s victory signals stability and vision. Tesla’s Q3 2025 results already show record revenues, deliveries, and $4 billion in free cash flow, underscoring the company’s strong fundamentals despite the various distractions it has faced this year. Expansion in Full Self-Driving (FSD) and robotaxi operations promises new recurring revenue streams, while demand for Megapack energy storage and AI-powered Megablock systems links Tesla to the booming data center and AI infrastructure markets.

If Musk’s ambitions for AI and robotics bear fruit, the payoff will be historic. Products like the Optimus robot and the company’s push toward in-house chip manufacturing could create entirely new business lines — a reason why some see the trillion-dollar award as a calculated bet on Tesla’s next frontier rather than an indulgence.

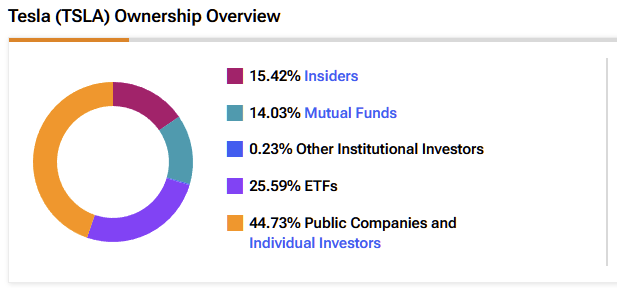

Who Owns Tesla?

Tesla’s ownership structure comprises institutional, retail, and individual investors, with ~40% of the company’s stock currently owned by institutional investors, 15% by insiders, and 45% by public companies and retail investors.

The Risks and the Road Ahead

Although TSLA shareholders are rubbing their hands with glee, the deal is not without peril. The dilution of shareholder value, coupled with what some refer to as “key person risk,” raises valid concerns. Tesla’s heavy reliance on Musk — who also leads SpaceX and xAI — means the company’s fortunes remain inextricably linked to one individual’s vision. Meanwhile, FSD adoption remains limited to just 12% of Tesla’s fleet, and regulatory roadblocks continue to slow the rollout in key markets, such as China and Europe. Rising tariffs and legal costs have also weighed on margins.

Furthermore — and perhaps most significantly — Musk’s growing involvement in politics has stirred controversy and tension this year. His divided focus between U.S. policy debates and Tesla’s operations has not only weighed on the stock but also underscored the very “key person risk” investors fear. In essence, Musk has become both Tesla’s greatest asset and its most inherent vulnerability. While Tesla remains an American powerhouse in technology and manufacturing, its future now appears tied as much to political dynamics as to its market innovations.

In the Trumpian era, Tesla’s future is tied to Musk’s relationship with Donald Trump as much as it is to the company’s sales of EVs and robots.

Ultimately, Musk’s trillion-dollar package is both a reward and a wager. It rewards past performance but wagers that the same man who revolutionized electric vehicles can now do the same for artificial intelligence, robotics, and energy. For shareholders, that means a wild — but potentially lucrative — ride ahead.