Etsy (ETSY) operates an online marketplace that primarily sells craft items. It recently completed the acquisition of London-based fashion resale app Depop for $1.63 billion, and Brazil-focused craft marketplace Elo7 for $217 million in primarily cash transactions.

Let’s take a look at Etsy’s latest financial performance and risk factors.

Etsy’s Q2 Financial Results and Q3 Guidance

The company reported second-quarter revenue of $528.9 million, representing a 23.4% year-over-year increase. EPS of $0.68 decreased 9.33% year-over-year. Etsy ended Q2 with $2.5 billion in cash.

“Etsy’s second quarter 2021 performance is quite remarkable when viewed in context of how dramatically the world changed during the year-ago period…We’re seeing measurable results from deepened investments in our ‘Right to Win’ strategy, which provides a clear roadmap for product and marketing investments to make it easier to shop on Etsy, build top of mind awareness, and solidify buyer trust,” commented Etsy CEO Josh Silverman.

For Q3, the company anticipates revenue in the range of $500 – $525 million, suggesting 13.5% year-over-year growth at the midpoint of the guidance. (See Etsy stock charts on TipRanks).

Etsy’s Risk Factors

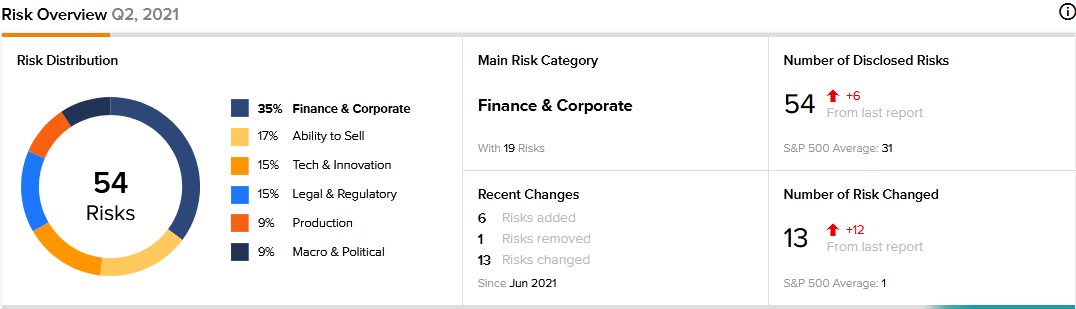

The new TipRanks Risk Factors tool shows 54 risk factors for Etsy. Since June, the company has revised its risk profile to introduce six new risk factors, all related to the recent acquisitions. The company is counting on the acquisitions of Depop and Elo7 to expand its market opportunities.

However, Etsy cautions that the integration of Depop and Elo7 may strain its resources and adversely impact its financial position, and that the benefits of the acquisitions might be less than anticipated.

The company also tells investors that its due diligence concerning the acquisitions may not have revealed everything it needed to know. Therefore, it cautions that should surprise liabilities be discovered, it could incur significant unexpected expenses.

Etsy has moved fast to expand Elo7’s market, opening offices in Mexico and India. But the company tells investors it may encounter new challenges in these markets that could adversely affect Elo7’s operations and financial performance.

Finance and Corporate is Etsy’s top risk category, accounting for 35% of its total risks. But that is still below the sector average at 36%. Etsy’s shares have gained about 6% since the beginning of 2021.

Analysts’ Take

Following Etsy’s Q2 report, Wedbush analyst Ygal Arounian reiterated a Buy rating on Etsy stock but lowered his price target to $195 from $204. Arounian’s new price target suggests 3.47% upside potential. The analyst noted that Etsy issued soft revenue guidance for Q3.

Consensus among analysts is a Strong Buy based on 11 Buys and 3 Holds. The average Etsy price target of $215.85 implies 14.53% upside potential to current levels.

Related News:

Sysco Fiscal Q4 Results Beat Estimates; Raises EPS Guidance

Paymentus Tops Q2 Expectations; Announces Payveris Acquisition

TransDigm Fiscal Q3 Earnings Beats Estimates