At its Investor Day on June 9, PPG Industries Inc. (NYSE: PPG) highlighted the importance of buyouts, especially of Tikkurila, for its operations and talked about its environmental, social, and governance (ESG) targets.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Shares of the company fell 6.5% to close at $115.9 on Friday. The stock, however, rose 1.1% in the extended trading session.

PPG Industries is a manufacturer and global supplier of paints, coatings, and specialty materials.

Inside the Headlines

The company noted that the Tikkurila buyout (completed in June 2021) has enhanced its portfolio of painting and coatings, distribution network, and technological capabilities.

Also, the buyout has boosted PPG’s cross-selling capabilities and its presence in multiple countries, including Sweden, Finland, Poland, and the Baltics.

It is worth noting that Tikkurila’s architectural coatings account for 85% of PPG’s total revenues, and industrial coatings contribute the remaining 15%.

From this buyout, PPG anticipates realizing costs synergies of $45 million, with $30 million expected in 2022 alone.

For Tikkurila and four other buyouts, including Ennis-Flint, VersaFlex, Worwag, and Cetelon, PPG’s COO, Tim Knavish, said, “Acquisitions are a key to PPG’s long-term growth strategy and continue to create value for the company. We are pleased with the integration pace of our five most recent acquisitions.”

Meanwhile, the company has reiterated its goal to slash emissions of greenhouse gases (GHG) by 15% by 2025. The company has already achieved a reduction of 9.7% in GHG emissions.

Further, PPG achieved a 37.5% reduction in waste intensity last year against its goal of 25% by 2025. For the reduction in energy consumption, PPG targets a 15% fall by 2025. It was able to register a decline of only 0.5% until last year.

Lastly, the use of energy from renewable resources grew 24% till last year, as compared with its goal of 25% by 2025.

Stock Rating

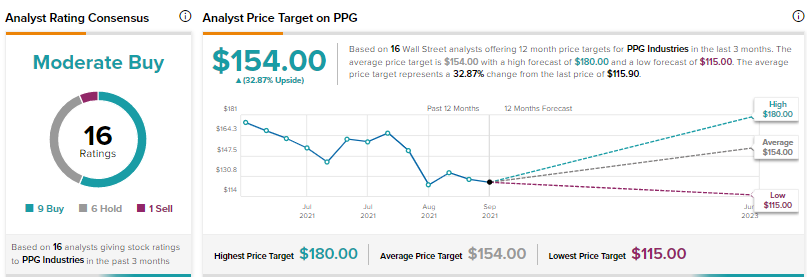

As per TipRanks, PPG has a Moderate Buy consensus rating based on nine Buys, six Holds, and one Sell. PPG’s average price target of $154 mirrors 32.87% upside from current levels. Over the past year, shares of this $27.4-billion company have declined 33.9%.

Three days ago, Stephen Richardson of Evercore ISI reiterated a Buy rating on PPG with a price target of $170 (46.68% upside potential).

Bloggers’ Stance

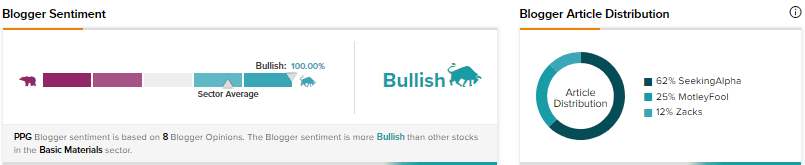

The Financial bloggers on TipRanks are 100% Bullish on PPG, compared with the sector average of 74%.

Conclusion

PPG’s inorganic actions have strengthened its growth prospects and reflect its commitment to return more value to its shareholders. Also, the progress of the company’s ESG program mirrors its desire to be a socially and environmentally responsible company.

Read full Disclosure